Welcome to this week’s Crypto Market Weekly Outlook, post #345, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Bitcoin (BTCUSD)

Recent Developments: Bitcoin has remained resilient amid mixed economic and regulatory news, continuing its sideways movement after briefly dipping below key support levels. Recent economic data from the U.S., including jobs reports and GDP figures, have influenced market sentiment, while speculation surrounding Bitcoin ETFs is creating a cautious, wait-and-see atmosphere. Bitcoin’s market dominance continues to hold strong despite these headwinds, as traders are closely monitoring institutional activities.

Outlook: Looking ahead, Bitcoin remains sensitive to both macroeconomic data and regulatory news, particularly around ETF approvals in the U.S. If Bitcoin can break key resistance levels, it could move higher, targeting previous highs. If the ETF delay continues, Bitcoin may struggle to find momentum, with downside risks likely if it fails to maintain its current support.

Ethereum (ETHUSD)

Recent Developments: Ethereum has faced its own challenges but continues to show strength in the DeFi and NFT spaces. Updates around Ethereum’s layer-2 scaling solutions like Optimism and Arbitrum have spurred investor interest, as these technologies aim to reduce transaction costs and increase processing speeds. However, broader market sentiment remains cautious due to macroeconomic uncertainties and the regulatory landscape.

Outlook: Ethereum’s price is closely tied to developments in its ecosystem, particularly in layer-2 scaling and potential Ethereum ETF approvals. A breakout above key resistance levels could trigger a rally, while failure to maintain current momentum could lead to short-term corrections. Investors are also watching Ethereum’s network updates, which could influence its price trajectory in the long term.

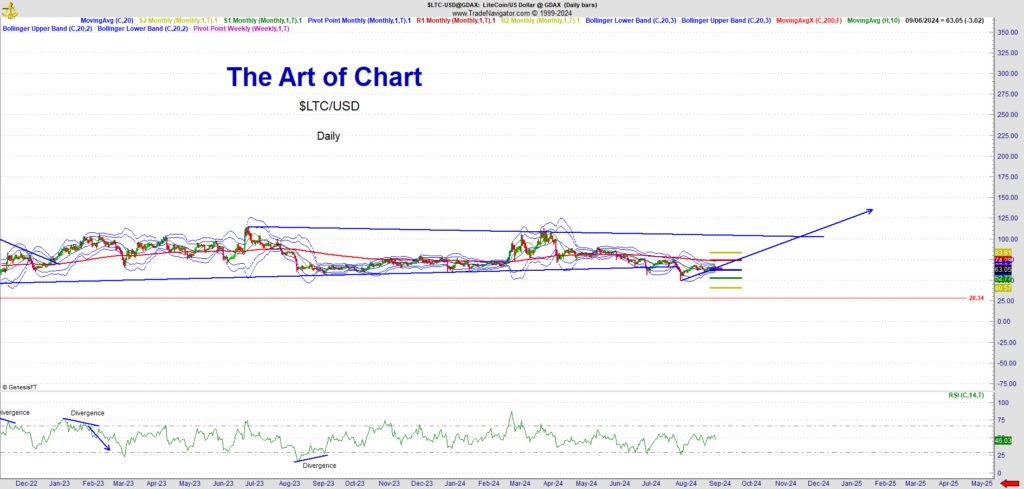

Litecoin (LTCUSD)

Recent Developments: Litecoin has remained relatively stable over the past week, with less volatility compared to other major cryptocurrencies. The coin’s utility for faster transactions and lower fees continues to attract long-term holders. Despite its lower trading volume, Litecoin is being watched closely for signs of an upcoming breakout or correction.

Outlook: Litecoin is facing resistance at key technical levels, and a breakout could lead to higher highs. However, given its stable nature, traders see Litecoin as a solid choice for portfolio diversification in the current turbulent market conditions.

Solana (SOLUSD)

Recent Developments: Solana continues to strengthen its position in the blockchain ecosystem with its high transaction speeds and low costs, making it a favorite among developers for DeFi and NFT projects. Last week saw further developments in Solana’s infrastructure, which has attracted significant attention from institutional investors. However, network stability remains a concern following high-profile outages earlier in the year.

Outlook: Solana is on the verge of testing key resistance levels. If the network can maintain stability and build on its recent infrastructure improvements, the price may move higher, retesting previous highs. However, caution is advised, as Solana has shown vulnerability to sharp price movements in response to technical issues.

Regulatory Landscape and Market Sentiment

News from Last Week: The SEC delayed its decision on Bitcoin ETFs again, increasing market anticipation but also keeping traders cautious. On the global front, regulatory discussions at the G20 summit continued to focus on crypto frameworks, with no immediate decisions but clear acknowledgment of the need for comprehensive regulation. These delays in regulatory clarity continue to weigh on the market, but optimism remains high for eventual ETF approvals.

Blockchain Ecosystem Developments

The Ethereum ecosystem continues to benefit from layer-2 scaling solutions, with projects like Optimism and Arbitrum attracting increasing adoption. Solana has also made strides in improving its infrastructure, signaling growth potential. In addition, new protocols in decentralized finance (DeFi) are expanding the use cases for smart contracts across multiple blockchains.

What to Watch This Week

- Economic Data Releases: U.S. inflation and jobs data will be critical in shaping investor sentiment in the crypto space.

- Regulatory News: Keep an eye on further developments from the SEC regarding Bitcoin ETFs and other regulatory news from major financial bodies.

- Technological Developments: Watch for updates in Ethereum’s scaling solutions and network improvements in Solana, as these could significantly influence price action.

The crypto market remains in a state of cautious optimism. Institutional inflows, regulatory developments, and technological innovations are expected to drive market trends in the near future.

Stay tuned for further updates, and as always, Trade Smart and Trade Safe.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous three weeks this post has included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns. Stay turned for our service that we will be offering to support investors using these advanced tools.

08th Sep 2024

08th Sep 2024