Welcome to this week’s Crypto Market Weekly Outlook, post #352, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

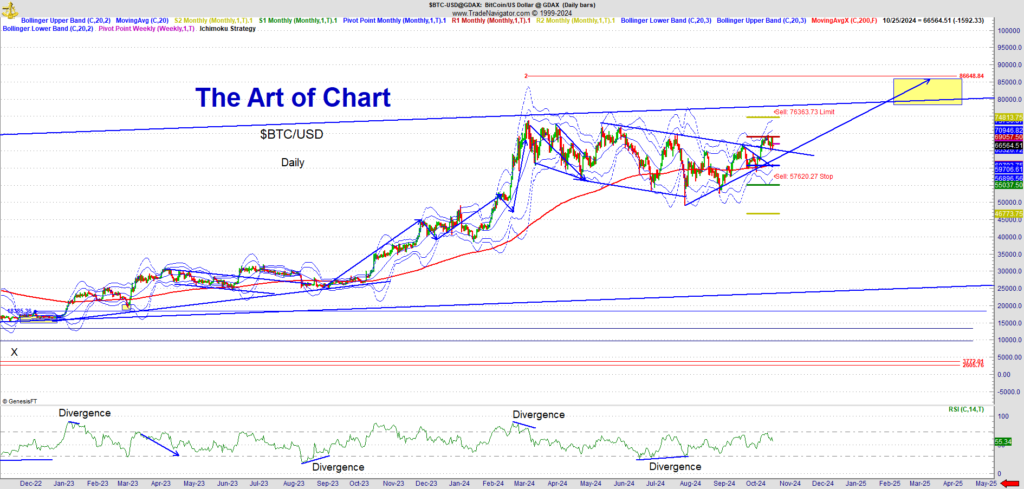

Bitcoin (BTCUSD)

Recent Developments: Bitcoin has displayed resilience amid a volatile market environment, remaining steady despite global macroeconomic uncertainties. Geopolitical tensions in the Middle East and ongoing discussions about digital currency regulations in major economies are impacting investor sentiment. Recent U.S. GDP growth data indicated a strong economy, which could potentially lead to future rate hikes, indirectly affecting Bitcoin’s appeal as an alternative investment. Additionally, the market awaits further updates on ETF approvals, as the SEC continues to review applications for Bitcoin spot ETFs.

Outlook: Bitcoin is likely to experience increased volatility in the coming weeks as investors assess macroeconomic and geopolitical events. Breakouts above current resistance levels could drive BTC toward new highs, though further delays or unfavorable ETF decisions could weigh on momentum. Key support and resistance levels are expected to guide short-term price action, with a bullish push contingent upon positive regulatory developments and continued institutional interest.

Ethereum (ETHUSD)

Recent Developments: Ethereum has remained range-bound, benefiting from steady activity in the DeFi and NFT ecosystems. Upgrades in Ethereum’s layer-2 protocols, specifically Optimism and Arbitrum, have continued to draw developers and users alike. However, the market is cautious, given that rising gas fees and scaling challenges persist, highlighting the need for more robust layer-2 solutions. Additionally, Ethereum’s recent deployment of staking updates is gradually improving investor confidence by addressing long-term security and staking participation issues.

Outlook: Ethereum’s price movement will likely depend on the broader crypto market’s direction, especially Bitcoin’s trajectory. Developments in Ethereum’s layer-2 scaling and potential ETF approvals could attract more institutional attention. Key support levels remain essential for maintaining momentum, with a bullish breakout possible if network upgrades positively impact scalability and transaction costs.

Litecoin (LTCUSD)

Recent Developments: Litecoin has seen modest gains amid Bitcoin’s stability, with reduced volatility making it a favored choice for risk-averse investors. Litecoin’s usage for low-fee transactions remains a strong selling point, and recent updates to its network aim to further reduce transaction costs. Although overshadowed by larger assets, Litecoin’s integration into traditional financial systems and partnerships with payment providers have given it a reliable base.

Outlook: Litecoin remains a stable asset for portfolio diversification, particularly as it approaches key technical levels. Its future performance may hinge on broader crypto market trends, particularly if investor interest shifts to less volatile digital assets during periods of high market uncertainty.

Solana (SOLUSD)

Recent Developments: Solana continues to lead in high-speed blockchain applications, with ongoing growth in DeFi and NFT platforms despite facing sporadic network issues earlier this year. The launch of Solana’s new development tools and recent updates to improve stability have helped solidify its reputation as an efficient blockchain for developers. However, Solana’s rapid price movements and network outages have made it a more volatile investment.

Outlook: Solana’s price trajectory will depend on continued network stability and successful onboarding of new projects in DeFi and NFTs. While its low transaction costs make it a favorite among developers, the network must address stability to maintain investor confidence. Key support levels remain critical to sustaining momentum, and breaking key resistance could propel SOL toward previous highs.

Regulatory Landscape and Market Sentiment

Recent News: The U.S. SEC has delayed its decision on several crypto ETFs, maintaining a cautious approach that has kept investors on edge. Internationally, regulatory discussions at the G20 summit highlighted the need for clearer frameworks, as member nations seek to establish consistent regulations for digital assets. These regulatory developments, while not yet finalized, signal a movement toward more structured oversight in the sector.

Blockchain Ecosystem Developments

Ethereum Layer-2 Solutions: Ethereum’s Optimism and Arbitrum are seeing increased usage as users seek efficient alternatives to the main Ethereum network. This week, Arbitrum announced plans to further decentralize its governance, aiming to increase user involvement in network upgrades, which could bolster confidence in layer-2 scalability.

Solana Ecosystem: Solana continues to attract developers for DeFi and NFT projects, particularly with its recently enhanced tools for ecosystem development. However, the network’s previous outages are still a concern for some institutional investors, emphasizing the need for consistent performance as it competes with Ethereum in the NFT space.

What to Watch This Week

- Macroeconomic Data: Upcoming U.S. inflation data and any Fed commentary on interest rates could influence market sentiment.

- Regulatory News: Keep an eye on SEC decisions regarding ETF approvals and further G20 regulatory updates, which may impact market volatility.

- Blockchain Innovations: New developments in Ethereum layer-2 scaling and Solana’s infrastructure could affect price trajectories in the coming weeks.

The crypto market remains cautiously optimistic, with institutional inflows, regulatory developments, and ecosystem innovations expected to drive market trends in the near future.

Stay tuned for further updates, and as always, Trade Smart and Trade Safe!

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

27th Oct 2024

27th Oct 2024