Welcome to this week’s Crypto Market Weekly Outlook, post #388, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

Bitcoin (BTC): Trading around $108,857, buoyed by sustained ETF inflows and investor confidence.

Ethereum (ETH): At $2,562, gaining from stablecoin activity and growing anticipation around the Cancun‑Deneb upgrade.

Solana (SOL): Near $151.46, supported by steady DeFi usage and developer engagement.

Dogecoin (DOGE): Around $0.1736, showing modest recovery as meme‑coin sentiment returns.

Key Developments This Week

ETF Capital Continues: Strong Bitcoin ETF flows kept BTC elevated despite broader market uncertainty.

Ethereum Momentum: ETH outperforms on stablecoin demand and upgrade excitement, hinting at renewed interest.

Altcoin Resurgence: Lower BTC volatility encouraged investors to explore Layer‑2 and meme‑coin opportunities.

Regulatory Signals: EU MiCA licensing progresses; the U.S. sees enhanced scrutiny of crypto infrastructure, especially crypto ATMs.

Security Concerns: Recent hacking incident at a major Asian exchange reminds investors about exchange and custodial risks.

Emerging Projects to Watch

Lagrange (LA): ZK‑rollup Layer‑2 recently launched on Binance Alpha, generating developer interest.

Solaxy (SOLX): High-growth Solana‑based scaling solution active during presale.

MIND of Pepe (MIND): AI‑enhanced meme token gaining traction post‑presale.

Bondex (BDXN): Web3 professional network token aiming to decentralize career ecosystems.

Investor Insights

BTC & ETH: Bitcoin remains range-bound with institutional support. Ethereum displays potential upside tied to upgrades and stablecoin growth.

Solana: Maintains momentum, though price is tied closely to DeFi fundamentals.

Dogecoin: Watch for social‑media catalysts, as current volatility aligns with meme‑coin patterns.

Looking Ahead

Macroeconomic Signals: Upcoming Fed minutes and CPI data may shift overall risk sentiment.

Crypto Infrastructure: Watch for regulatory updates on ETFs, stablecoins, and custody frameworks.

Ethereum Upgrade Timing: Confirmation around Cancun‑Deneb will likely influence ETH markets and Layer‑2 traction.

Security Landscape: Continued focus on exchange safety and custodial measures remains critical.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

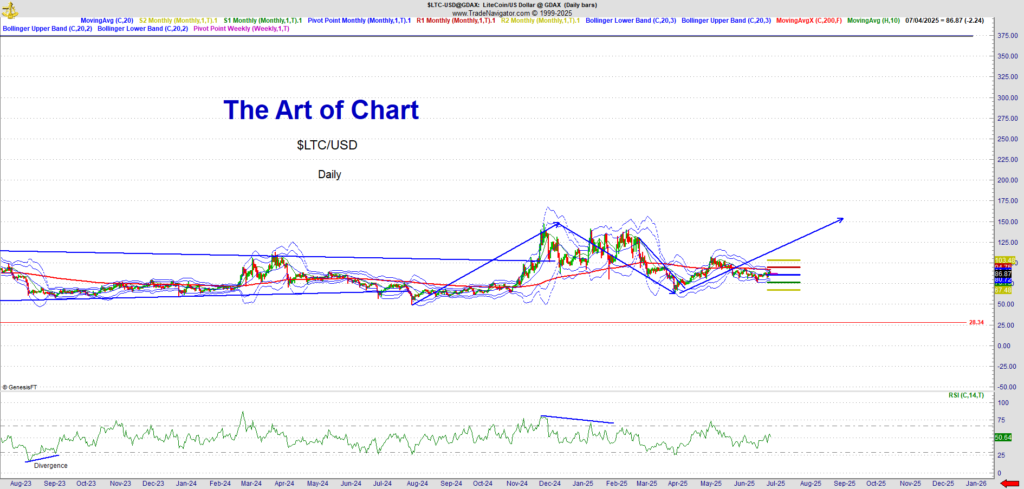

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

06th Jul 2025

06th Jul 2025