Welcome to this week’s edition of The Weekly Call, your trusted source for high-quality commodity setups and trading strategies. Since October 2016, our approach has delivered an impressive 777% return, and we continue to share the insights and methodologies that drive these results with this post #483. This week, we’ll explore the latest market trends, actionable trade setups, and global economic factors influencing commodities like sugar, coffee, live cattle, and gold.

U.S. Markets (Friday, December 12 Close)

S&P 500 (SPY): Closed near $681.8, down roughly 1.1% on Friday and slightly negative on the week as markets digested the Fed cut and a more divided policy outlook.

Nasdaq 100 (QQQ): Ended around $613.6, down about 1.9% Friday and under pressure for the week as crowded AI and mega-cap tech positions unwound.

Dow Jones Industrial Average (DIA): Finished near $485.4, essentially flat on the week, continuing to act as the relative safe haven within U.S. equities.

Big picture: The Fed cut rates as expected, but markets are now reassessing how much easing actually comes in 2026.

Global Markets

FTSE 100 (UK): Lower on the week, pressured by global risk-off sentiment and softer growth expectations.

DAX (Germany): Slightly weaker, though still holding longer-term uptrend structure despite sluggish industrial data.

Nikkei 225 (Japan): Higher on the week, supported by yen weakness and exporter strength even as BOJ tightening speculation persists.

Shanghai Composite (China): Modestly higher, as investors continue to price in incremental policy support rather than large stimulus.

Commodities Snapshot (Friday Close)

Gold: Around $4,275/oz, rising on the week as investors hedge policy uncertainty and slowing growth risks.

Silver: Near $63/oz, extending its outsized rally and remaining one of the strongest performers across asset classes.

Copper: Around $5.28/lb, pulling back late week but still near cycle highs driven by AI, electrification, and grid-build demand.

Crude Oil (WTI): Near $57.5/bbl, drifting lower as oversupply concerns outweigh geopolitical risk.

Natural Gas: Around $4.10/MMBtu, volatile as weather forecasts and storage dynamics continue to swing sentiment.

Cryptocurrency Market (Friday Close)

Bitcoin (BTC): Around $90,300, down on the week as crypto tracked tech-led risk-off flows following the Fed decision.

Ethereum (ETH): Near $3,085, underperforming BTC and still struggling to regain upside momentum.

Solana (SOL): Around $132, consolidating after sharp swings earlier this month.

XRP: Near $2.01, relatively stable compared with other large-cap alts.

BNB: Around $880, holding up better than most majors.

Cardano (ADA): Around $0.41, weak and liquidity-sensitive.

Dogecoin (DOGE): Near $0.14, fading as meme-driven flows cool.

Crypto tone: Risk appetite has shifted from momentum chasing to capital preservation and volatility management.

Key Market Drivers This Week

1. Fed Cut, But Less Confidence in the Path Forward

The Fed delivered the expected 25 bp cut, but internal disagreement and cautious forward guidance reduced enthusiasm. Markets are now debating whether 2026 brings gradual easing or a stop-and-wait approach.

2. AI / Tech Crowding Unwinds

Mega-cap tech and AI-linked names saw notable de-risking. As those positions unwound, pressure spilled into the Nasdaq and into crypto, particularly BTC and ETH.

3. Metals Continue to Signal Late-Cycle Dynamics

Gold and silver strength contrasts sharply with equity hesitation. Copper remains structurally strong despite short-term pullbacks, reinforcing the theme of infrastructure demand + constrained supply.

4. Crypto Increasingly Trades as a Macro Proxy

BTC and ETH are moving in tighter correlation with tech and liquidity conditions. When Nasdaq weakens, crypto now reacts faster and with higher beta.

Emerging Crypto Projects / Themes to Watch

Bitcoin Hyper (HYPER): Gaining attention within the growing “Bitcoin Layer-2” narrative, aiming to bring smart-contract scalability to BTC.

Remittix (RTX): Continues to draw interest as a PayFi / global payments infrastructure play, benefiting from renewed focus on real-world utility.

AI-Driven Blockchain Projects: Select early-stage AI + crypto projects remain active as investors position for a 2026 convergence theme.

(These remain speculative and should be sized accordingly.)

Investor Insights

Equities

The market remains near highs, but leadership is narrowing.

A failure for QQQ to stabilize risks dragging the broader tape lower despite Dow resilience.

Crypto

BTC: Key range remains $88K–$95K. A break either way likely defines the next multi-week move.

ETH: Needs to hold $3,000 to avoid deeper underperformance versus BTC.

High-beta alts: Vulnerable if risk-off persists, but likely to snap sharply if macro sentiment improves.

Outlook for the Week Ahead

Macro Focus: Retail sales, housing data, and follow-up Fed commentary will shape rate expectations quickly.

Volatility Risk: Thin year-end liquidity can exaggerate moves in both equities and crypto.

Market Bias: Near-term consolidation favored unless data clearly supports further easing.

Crypto Strategy: Expect range-bound trading with selective opportunities around project-specific catalysts.

Stay tuned as global market conditions continue to evolve, trade smart and trade safe!

As always, stay informed and adjust your strategies based on the evolving market conditions. All trades are posted on our Private Twitter Feed for subscribers and are included in the track record posted below under Completed Trades. I am currently trading 15 lots given the account balance and will adjust as necessary based on market developments.

Trading futures contracts and commodity options involves substantial risk of loss, and may not be appropriate for all investors. Past performance is no guarantee of future results. Please see our Disclaimer for more information.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Sugar

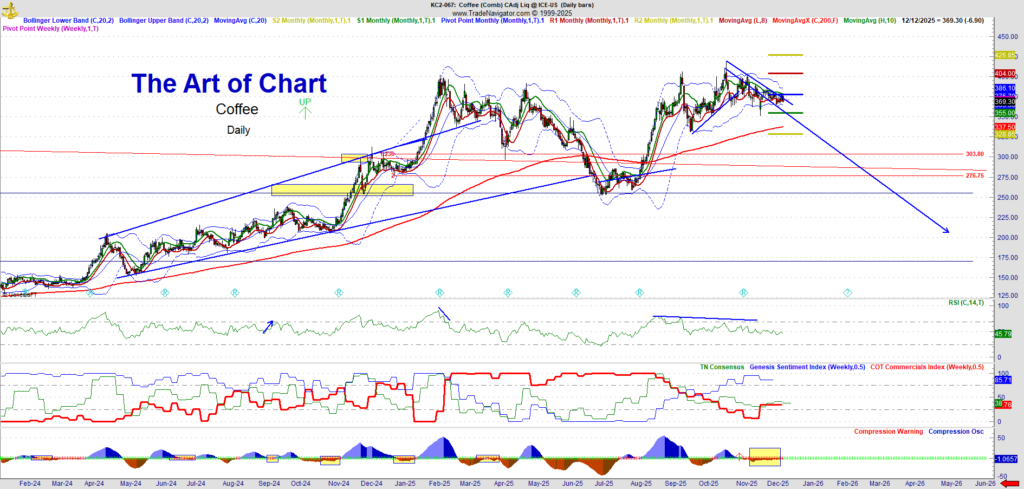

Coffee

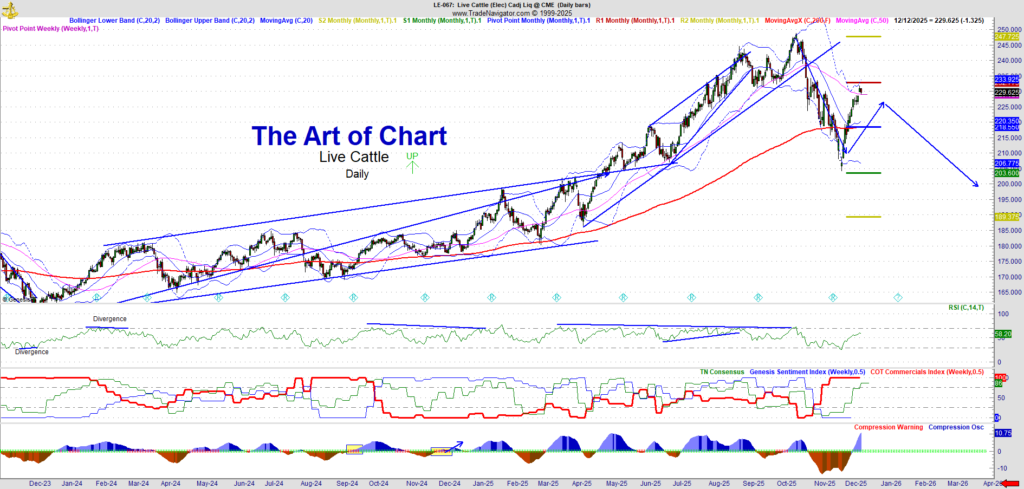

Live Cattle

Gold (GC)

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am currently using 15 lots for the Striker trades which is based on this account being over $375,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2022 thru December 2022 Click Here.

Track Record January 2021 thru December 2021 Click Here.

Track Record January 2020 thru December 2020 Click Here.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

13th Dec 2025

13th Dec 2025