I plan to cover just three cryptos every week in this post: Bitcoin, Litecoin, and Ethereum. These instruments provide trading opportunities with out sized gains. I hope the analysis presented here helps you profit in these instruments.

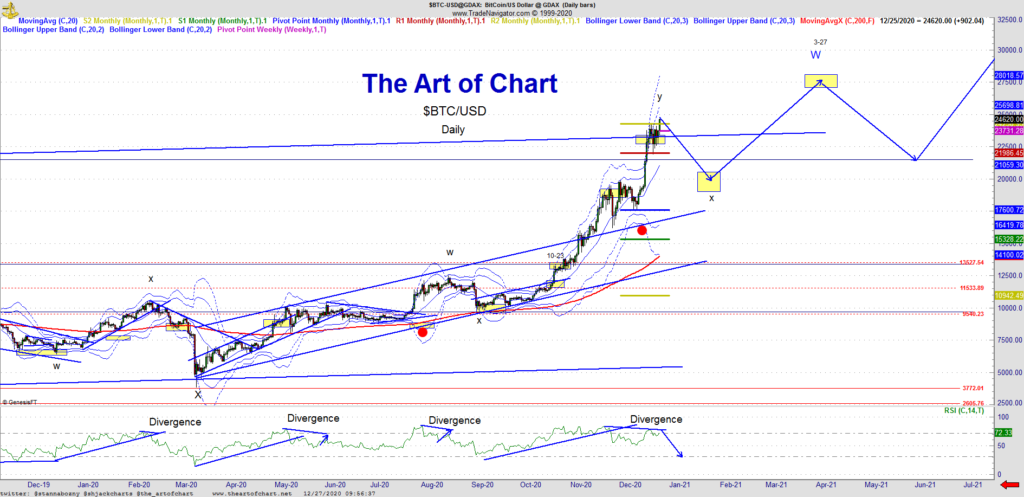

BTCUSD — BTC has made the higher high as mentioned last week and we have a short setup. This means take profits and wait to add size lower. The key here is the negative D on RSI with a consolidation and minor higher high. This will trigger a pullback and still higher highs into our March window. I remain bullish into March of next year and would advise taking profits and slimming positions down to trailer side here.

ETHUSD – A minor higher high here too and not quite at the R1 which can still be seen. A nice short setup which means slim down positions and wait to add size lower. Look for a retest of the monthly pivot at 535 then higher highs into March. I remain bullish into March, more upside to come after a pull back/ consolidation completes.

LTCUSD – Wave Y may be complete here with neg. D setup on RSI and likely we see a pull back and higher highs as discussed. I have extended the target to the 100% fib here as we have the time to get there. Watch for 104-105 as a support area. I am still expecting a higher high into March as discussed.

Crypto’s have all made a minor higher high last week and have set neg D on RSI – more consolidation this week and next and another big move higher expected. Take some profit here and hold a small position and add size lower. I remain bullish Crypto’s into March of next year. Trade Smart and Trade Safe.

27th Dec 2020

27th Dec 2020