I plan to cover just three cryptos every week in this post: Bitcoin, Litecoin, and Ethereum. These instruments provide trading opportunities with out sized gains. I hope the analysis presented here helps you profit in these instruments.

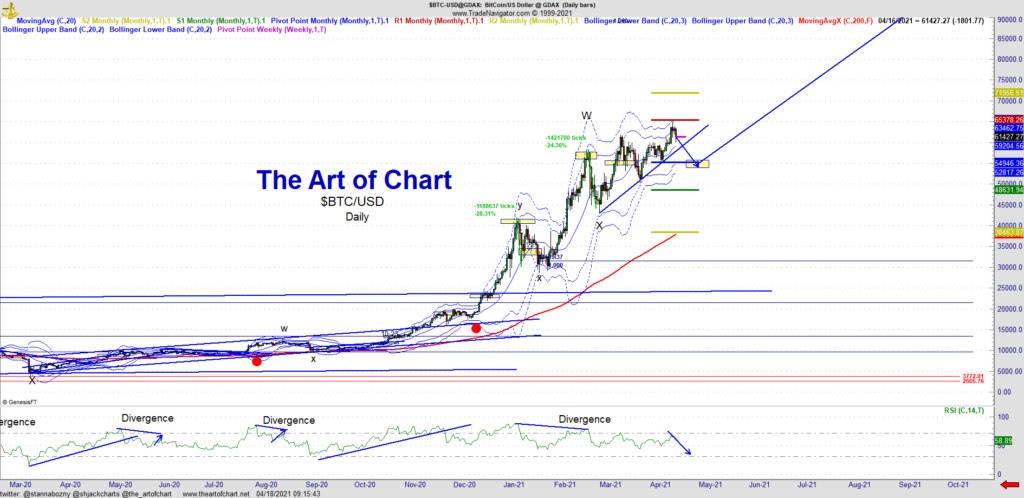

BTCUSD — I am patterning the recent advance with the advances on LTC and ETH. It appears that the X wave on the other two cryptos are in which means that BTC wave X is likely done. We will see a retest of the 2nd SD BB bands and when seen this is a spot to buy cryptos. We are now in wave 1 of Y and likely will see more upside so focus on buying pull backs into the 2nd SD band.

ETHUSD – Big advance here in ETH which indicates this is not a wave B – I was considering a running flat which is a bullish structure but this is clearly breaking up. Focus on buying pull backs into the 2nd SD band. ETH is very expected here and we should see a pull back this week.

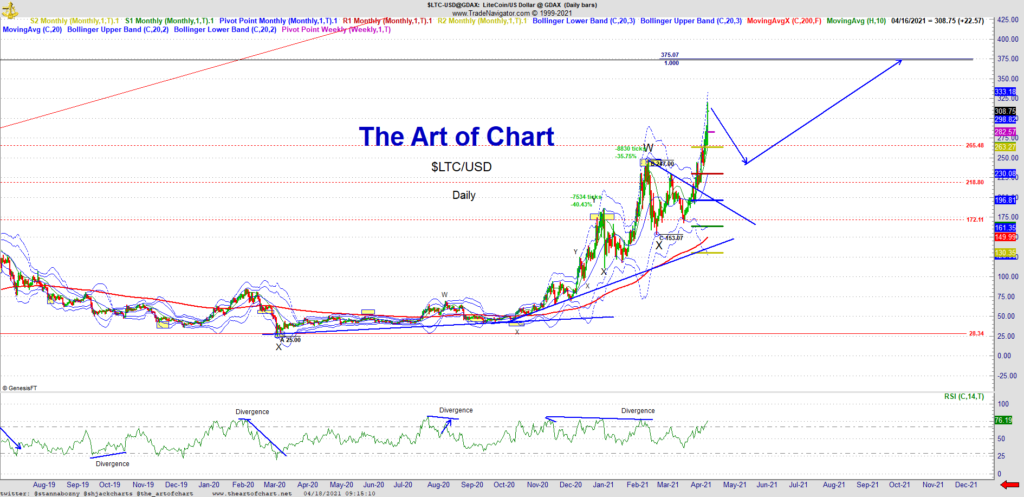

LTCUSD – Quite a strong impulse and this is mostly driven the the lower lows seen on the USD. Likely this continued to the upside into 375 or so. I am watching for a buy near the top of wave W. We are in wave Y so more upside is expected after a pull back.

Across all three Cryptos we have broken up and invalidated wave B. While a running flat is a bullish retracenment pattern, this is not the case here. We have broken up so look for the 2nd SD band as support and look to accumulate Cryptos here into their next major high later this year in September. These pairs will continue their bullish run as the USD continues to fall throughout the year. I remain bullish Crypto’s. Trade Smart and Trade Safe.

18th Apr 2021

18th Apr 2021