The purpose of this article is to outline the types of options strategies that we plan to use in the new service. We plan to start the first posts of the new service next week. The video below provide a good overview and the rest of the article provides more in depth examples. You may want to refer back to this post some time in the future.

We should note that, while we will often use a strategy that is familiar to most option traders, such as a butterfly, vertical spread, calendar spread, etc., we will often change the structure to reduce the cost basis of the strategy in order to increase the probability of making a profit. One of our goals in this option education service is to help the subscriber realize that options offer the most flexibility of any financial product and can be used profitably in all market conditions. Even if you are an experienced option trader we hope you will open your mind to seeing these strategies in a different light and use them in ways you never thought of previously. And for those subscribers who are new to options, we will do our best to provide you with a framework to understand how these strategies work best. Having said that, we won’t be providing a ‘basic’ options class, there are plenty of good sources of basic option info available on the internet including The Options Playbook which covers all types of option strategies. Let’s look at some of our favorite strategies.

Probably the most common option strategy is also the most basic. Many option traders, especially new traders, will simply buy a put or a call to make a bet on the price movement of an underlying stock or ETF.

Buying a call option is certainly less capital intensive than buying a stock and it has the feature of defined risk built into it (you can only lose what you paid to buy the call) but that feature comes at a high price. The extrinsic premium you pay to buy a call will decay over time and will diminish until it becomes zero. If you bought a call that is out of the money and you paid $8.95 for it, you have paid $8.95 of extrinsic value. All options have zero extrinsic value at expiration. In this example, you need AAPL to move $8.95 in the money above the $125 strike just to break even on your trade. The time decay of long calls and puts is a huge drag on your option trading performance. So how do you minimize that drag?

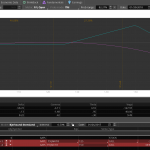

That’s easy, you just sell something against that asset that you purchased. In the above example I bought the 125 strike call for $8.95. If I sell another call that is in the same expiration cycle but further out of the money I have created call debit spread. Here I sold 1 of the $150 strike calls for $1.96 so now the cost basis in the position is $6.99 instead of $8.95. That means my risk in the trade has decreased by 22%. As you will soon discover, if you don’t already know, consistently reducing your position cost basis with increase your profits over the long run.

Taking it one step further, what if I sold more than one call? In this example, I sell 3 of the $150 strike calls. Now I have reduced the cost basis of the position all the way down to $3.22. This strategy is called a front ratio or just a ratio spread. Now, call front ratio spreads have undefined risk to the upside (which is a nice way of saying unlimited risk to the upside) so we use very specific rules when we trade ratio spreads. We often use call ratio spreads in our long term option portfolio as a stock replacement strategy but they also work quite well for a move lower in an underlying. Just remember that, just like selling straddles, strangles or naked options, you can find yourself in large draw down situations if you don’t follow good risk management procedures. We will cover all of that more in depth in the future.

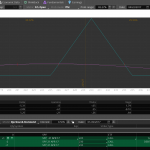

But for now, lets get to the next favorite strategy that is closely related to the ratio spread; the standard butterfly spread or the broken wing butterfly (aka the skip strike or split strike butterfly). Typically the standard butterfly is used when you think an underlying stock or ETF is stuck in a range and you want to profit from that. If Stan or Jack thinks a diagonal or triangle is forming on a chart, you might choose a butterfly spread. Another great way to use a butterfly is to place it out of the money, sometimes well out of the money, and let the price of the underlying move into the range of the spread. That method in using butterfly spreads can often result in returns of 5-10 times your risk on a position. More about that strategy to come.

The broken wing butterfly is very similar in design to the call front ratio spread described above but with the purchase of a protective, further out of the money call to define your upside risk and reduce your margin requirement on the position. That protective call can allow you to use this strategy even on underlying stocks that are potential takeover candidates or any instrument which can have explosive upside where we won’t use the call ratio spread. The probability of profit is much higher on the broken wing butterfly than it is on the standard butterfly.

The option education service will also utilize various time spreads. The 2 different time spreads we will use are calendar spreads and diagonal spreads. Time spreads are similar to butterfly spreads in that you typically want the underlying to be relatively caught in a range but they are exceptional ways to profit from an increase in the implied volatility of the underlying instrument. Because of that they are a great compliment to our long term ratio spreads because they can hedge short term spikes in volatility. They can be positioned around the current price of the underlying or they work very well if they are placed

below the money if a price chart analysis projects a move lower. Since most non-commodity stocks and ETFs see an increase in implied volatility on a move lower, the below the money time spread can take advantage of both the price movement and the option Greek known as Vega (volatility).

So this is just a partial list of the strategies that we will utilize in the option education service but it covers most of the basics. There is no better way to learn than following along with specific examples and we will be providing many examples of option positions in the future. We hope you will join us for the ride!

09th Feb 2017

09th Feb 2017

I’m going to be utilizing the butterfly or BWB rather than the ratio spread. One question I have is how do you know what strikes to use for the wings. I was wondering if u could address that issue when the options ervice is started next week. Thanks

That’s a great question Marcie. Stan and I will be recording a webinar this weekend where we will be discussing a couple of specific option positions for the coming weeks/months including the Broken Wing Butterfly(BWB). I will make sure to discuss how I choose the 3 option strikes that comprise the body and the wings of the BWB. I will always construct my option positions by selecting each leg from the options chain and never by just selecting the strategy from a drop down box. Doing that forces me to fit the strategy to Stan and Jack’s price and time projections. It is extremely important to really understand how option positions come together to form a strategy. Once you understand that you will be able to ‘customize’ positions in the future to better profit from your expectations of price and time.