Welcome to this week’s Crypto Market Weekly Outlook, post #384, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

Bitcoin (BTC): Trading at $105,895, holding steady as ETF inflows persist and whale activity continues to support the mid‑$105K range.

Ethereum (ETH): At $2,514.52, marking a slight drop, as the market consolidates ahead of the imminent Cancun‑Deneb upgrade.

Solana (SOL): At $150.44, stabilizing amid mixed sentiment around regulatory oversight and ongoing DeFi/NFT use cases.

Dogecoin (DOGE): At $0.1843, under pressure as retail enthusiasm cools, with meme‑coin momentum retreating.

Key Developments This Week

Bitcoin remains firm around $105K after retreating from resistance levels, suggesting investor confidence is holding as macro volatility stabilizes.

Ethereum holds above $2,500, signaling cautious optimism as traders await remarks on the upgrade and L2 adoption.

Solana is gaining some traction from new validator tools and an uptick in DeFi community activity, though regulatory overhang still lingers.

Dogecoin’s performance reflects reduced retail appetite, though occasional social media-driven spikes still emerge.

Emerging Projects to Watch

DePIN Energy Network (ENERG): Decentralizing local energy trading via tokenized microgrid credits.

zkDAO (ZKDAO): Privacy-first governance layer built on zero-knowledge proofs.

YieldFusion (YFUS): Cross-chain yield aggregator optimizing stablecoin returns across L2 ecosystems.

CollectiCare (CCARE): NFT-based healthcare credential registry for patient data security and verification.

Investor Insights

Bitcoin: Biased toward continued accumulation; watch for dips below $105K for potential entry.

Ethereum: Near-term consolidation, long-term upside tied to upgrade execution and adoption of L2 protocols.

Solana: Resilient but navigating mixed signals—key levels around $145–155 to monitor.

Dogecoin: Caution advised; high volatility remains but retail-driven catalysts may reappear.

Looking Ahead

Expect annualized volatility around the upgrade week; closely monitor L2 network metrics and developer commentary.

Be on alert for comments from UK regulators and U.S. agencies that might impact memecoins or staking frameworks.

Watch macro cues like CPI, Fed comments, and global equity volatility—they have strong historical correlations with crypto sentiment.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

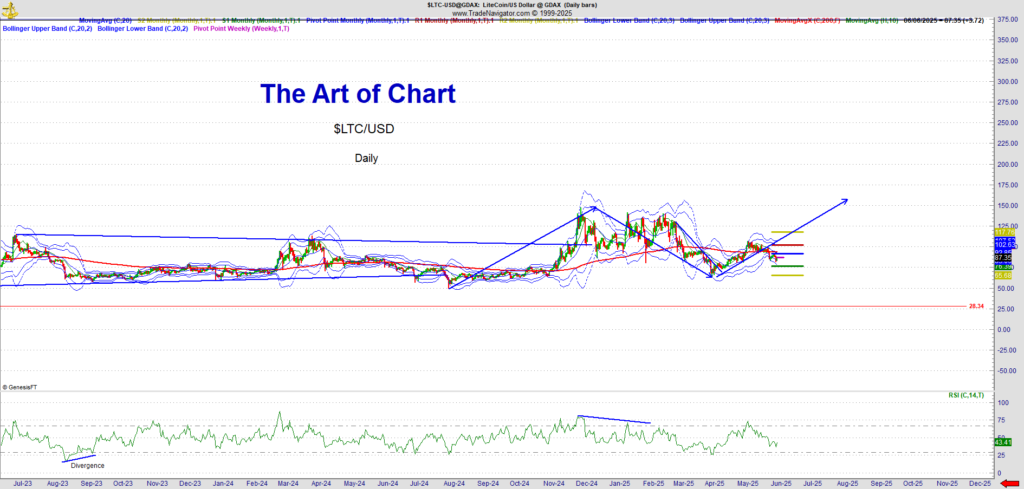

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

08th Jun 2025

08th Jun 2025