Welcome to this week’s Crypto Market Weekly Outlook, post #385, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

Market Overview

Bitcoin (BTC): Trading around $105,209, holding steady despite recent geopolitical uncertainty and mixed macro data.

Ethereum (ETH): Near $2,537.88, slightly firming ahead of the Cancun-Deneb upgrade.

Solana (SOL): At $152.44, supported by a rebound in DeFi and increasing staking activity.

Dogecoin (DOGE): At $0.1739, maintaining around current levels after recent meme-coin rotation.

Key Developments This Week

Geopolitical & Macro Resilience

Bitcoin and Ethereum remained firm despite Mideast tensions and U.S. inflation surprises, reflecting steady institutional and whale accumulation.EU MiCA Licenses Advance

Leading exchanges like Gemini, OKX, and Coinbase are moving ahead with operating licenses under EU’s crypto rules, improving global market access and legal clarity.Bitcoin ETF Inflows

ETF inflows hit over $1.3 billion last week, helping sustain crypto prices amid broader market retests.U.S. Legislative Progress

Crypto-related bills (CLARITY and GENIUS) have moved through key House committees, while the U.S. Senate moves forward on a new CFTC chief—boosting regulatory confidence.EU Memecoin Controversy

A “$Trump” memecoin dinner stirred ethics concerns in Washington, highlighting evolving political influence in crypto.

Emerging Projects & Themes

DePIN Growth: Decentralized physical infrastructure tokens—such as those powering IoT, energy grids, and GPU rentals—are gaining momentum as real-world asset support grows.

LayerEdge (EDGEN), XYZVerse (XYZ), Unilabs (UNIL): Utility and meme hybrids attracting attention for staking, real-world use cases, and community-driven activity.

Investor Insights

Bitcoin & Ethereum: Benefiting from ETF inflows, legislative clarity, and global tensions balancing risk sentiment.

Solana: Remains strong due to DeFi/NFT demand despite ongoing regulatory overhang.

Dogecoin: Continue caution; next catalysts may be social media events or adoption in payments.

Looking Ahead

U.S. Inflation, Fed Minutes: These will be pivotal for yield curves and risk appetite.

Ethereum Upgrade: Upcoming Cancun-Deneb deployment may provide directional clarity for ETH & L2 tokens.

MiCA Rollout: Monitoring EU license rollouts as they open new institutional pathways.

DePIN Expansion: Watch tokens tied to infrastructure growth in energy, IoT, and compute.

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

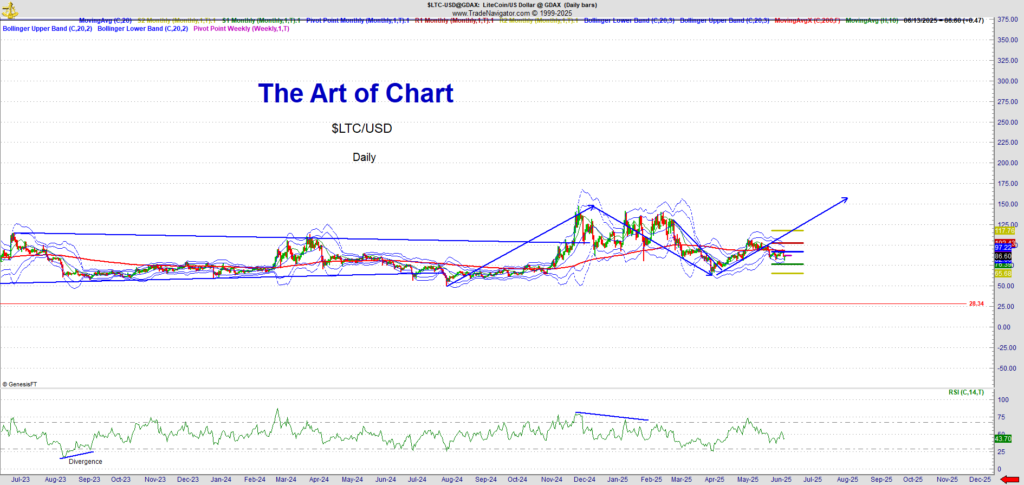

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

15th Jun 2025

15th Jun 2025