Welcome to this week’s edition of The Weekly Call, your trusted source for high-quality commodity setups and trading strategies. Since October 2016, our approach has delivered an impressive 777% return, and we continue to share the insights and methodologies that drive these results with this post #491. This week, we’ll explore the latest market trends, actionable trade setups, and global economic factors influencing commodities like sugar, coffee, live cattle, and gold.

U.S. Markets (Friday, January 23 close)

S&P 500 (SPY): Closed near 6,910, higher on the week as markets continued a steady, low-volatility grind upward.

Nasdaq Composite (QQQ): Around 23,950, leading again as AI-linked and mega-cap technology stocks extended gains.

Dow Jones Industrial Average (DIA): Approximately 48,400, modestly higher, supported by industrials and selective financial strength.

Global Markets

FTSE 100 (UK): Slightly higher, supported by energy and defensive sectors as rate expectations stabilized.

DAX (Germany): Higher on continued optimism around easing inflation and ECB rate-cut expectations later in 2026.

Nikkei 225 (Japan): Continued higher, aided by yen weakness and sustained foreign inflows into Japanese equities.

Shanghai Composite (China): Mixed; targeted stimulus headlines provided support, but property and consumer confidence remain ongoing headwinds.

Commodities Snapshot (Friday close)

Gold: Around $2,145/oz, firm as investors balanced risk-on equity flows with longer-term hedging demand.

Silver: Near $26.50/oz, holding recent strength on improving industrial demand expectations.

Copper: Approximately $4.25/lb, steady to higher as global growth sentiment stabilized.

Crude Oil (WTI): Around $79/barrel, supported by geopolitical risk and steady global demand signals.

Natural Gas: Near $3.10/MMBtu, firm on colder weather forecasts and tightening storage expectations.

Cryptocurrency Market (Friday close)

Bitcoin (BTC): ≈ $50,600, continuing a steady uptrend as ETF inflows and constructive risk sentiment persisted.

Ethereum (ETH): ≈ $2,680, pushing higher on sustained Layer-2 activity and staking participation.

Solana (SOL): ≈ $132, outperforming as developer activity and consumer-app momentum remained strong.

XRP (XRP): ≈ $0.72, firmer as regulatory uncertainty continued to ease.

BNB (BNB): ≈ $360, trending higher with consistent on-chain usage.

Cardano (ADA): ≈ $0.66, gradually improving following recent consolidation.

Dogecoin (DOGE): ≈ $0.12, modestly higher as speculative appetite remained constructive.

Key Market Drivers

Low-Volatility Risk-On Environment: Markets continued to grind higher with shallow pullbacks, reflecting steady inflows and disciplined positioning.

Fed Narrative Holds: Recent data reinforced expectations for gradual, later-year rate cuts rather than abrupt policy shifts.

AI & Mega-Cap Leadership: Technology and AI-related stocks remained the primary drivers of equity index performance.

Global Rate-Cut Expectations: Softer inflation trends in Europe and parts of Asia supported global equity sentiment.

Crypto ETF Support: Continued spot Bitcoin ETF inflows provided a durable bid under BTC and supported broader crypto confidence.

Emerging Crypto Projects & Ecosystem News

AI + Crypto Theme Strengthens: Projects focused on decentralized compute, AI inference, and data marketplaces continued gaining traction as a core 2026 narrative.

Real-World Asset Tokenization: Tokenized treasuries, credit, and funds remained a focal point for institutional crypto adoption discussions.

Ethereum Scaling Momentum: Layer-2 networks maintained strong throughput and user growth, reinforcing Ethereum’s infrastructure role.

Solana Consumer Expansion: New payments, gaming, and social applications launched, supporting SOL’s continued relative strength.

Regulatory Backdrop Remains Calm: Fewer enforcement headlines reduced headline risk and supported improved sentiment across digital assets.

Outlook for the Week Ahead

Macro Calendar: Markets will watch inflation data, employment indicators, and Fed commentary for confirmation of the current growth and rate narrative.

Equities: Trend remains constructive, though consolidation would be healthy after several strong weeks.

Crypto Levels to Watch:

BTC: Support $49,000–$49,500, resistance $52,000–$54,000.

ETH: Support $2,600, resistance $2,800–$2,900.

SOL: Support $125–$128, resistance $140.

Sentiment: Risk appetite remains healthy but sensitive to inflation surprises or shifts in Fed messaging.

Strategy Note: Stay aligned with leaders, respect extended conditions, and use pullbacks as opportunities rather than chasing strength.

Stay tuned as global market conditions continue to evolve, trade smart and trade safe!

As always, stay informed and adjust your strategies based on the evolving market conditions. All trades are posted on our Private Twitter Feed for subscribers and are included in the track record posted below under Completed Trades. I am currently trading 15 lots given the account balance and will adjust as necessary based on market developments.

Trading futures contracts and commodity options involves substantial risk of loss, and may not be appropriate for all investors. Past performance is no guarantee of future results. Please see our Disclaimer for more information.

The trades below are discussed on the Daily Update: – Click Here for a FREE Trial

Sugar

Coffee

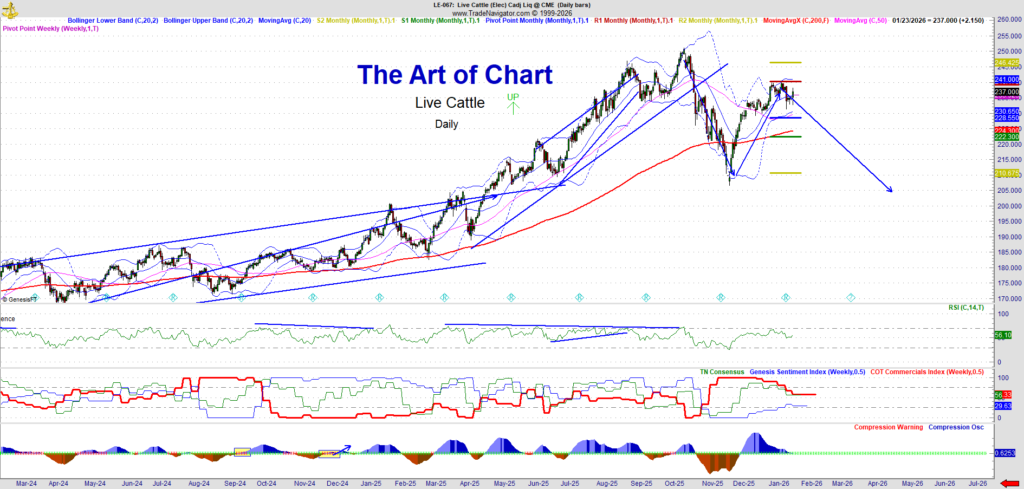

Live Cattle

Gold (GC)

Come see what we are trading – Try our 30 day FREE trial – Click Here

COMPLETED TRADES

Track Record of Completed Trades

The purpose of this blog is to demonstrate how to swing trade futures using our methodology to select high-quality setups and manage the trade with our risk management approach. This track record is based on entries and exits as posted in this blog. I am currently using 15 lots for the Striker trades which is based on this account being over $375,000. Each lot for auto trading at Striker requires $25,000 per lot. See the videos below for more information.

Track Record January 2022 thru December 2022 Click Here.

Track Record January 2021 thru December 2021 Click Here.

Track Record January 2020 thru December 2020 Click Here.

Track Record January 2019 thru December 2019 Click Here.

Track Record January 2018 thru December 2018 Click Here.

Track Record October 2016 – December 2017 Click Here.

*** Trading futures contracts and futures options involves substantial risk of loss, and may not be appropriate for all investors. By reading this web site, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced on this web site and associated documents and emails are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.. See our disclaimer here.

Completed trade in Cattle as of November 28th

We expect subscribers to have captured 60% of the swing in live cattle which is over $14,500 in profit using a margin of only $5,115. A great example of using leverage in futures.

Completed Trade in Coffee as of December 12th

The total swing was $37.00 and we expect subscribers to have captured 60% of a wing or $22 in coffee for a profit of over $25,500 using a margin of $8,850. A great example of using leverage in futures. See the video below for the review of the trade.

Completed Trade in Natural Gas as of January 2nd

We were stopped out of out last 1/3 position as weather-related news created a gap down on January 2nd and a possible flat with support at 3.196. This concludes our trade with natural gas; we exit with 550 ticks on 2/3s of a position with $8,500 in profit.

Completed Trade in Coffee as of January 19th

We exited the coffee trade on January 19th with $17 or over $15,000 in profit using a margin of $8,850. A great example of using leverage in futures.

Completed Trade in Gold as of February 8th

We exited the gold trade on February 8th with over $14,000 in profit. We entered on January 3rd and held the trade into the high window. We will re-enter gold in a few weeks after a backtest.

25th Jan 2026

25th Jan 2026