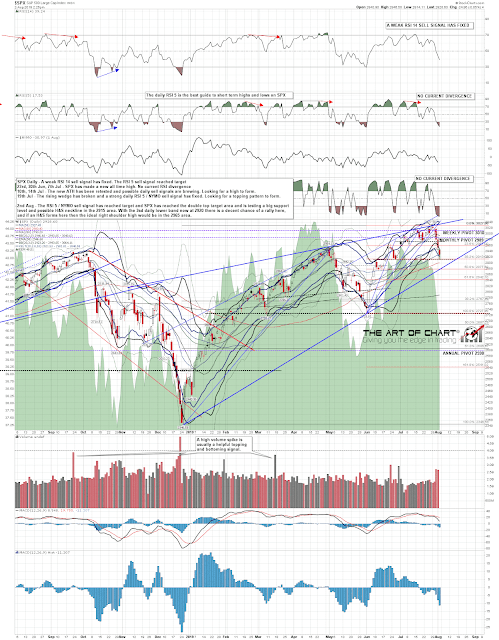

SPX delivered some wild moves this week, helped along by the White House Staff’s ongoing failure to gain control of the President’s twitter account, but at the end of the week SPX has reached the obvious first target at a test of the 2915 support area, and there is a short term inflection point here. This is the retest of the late June low, just above a big open gap from 2889.67, and is a possible H&S neckline area. If SPX was to rally from here the ideal right shoulder high would be in the 2964 area, and that would set up a possible H&S that on a sustained break down would look for the 2800 area, with obvious serious support on the way at rising wedge support, currently in the 2870 area.

Support for a rally here also comes in the form of today’s break below the 3sd daily lower band, which generally delivers a decent bounce short term, subject to further unexpected tweets over the weekend of course.

SPX daily chart:

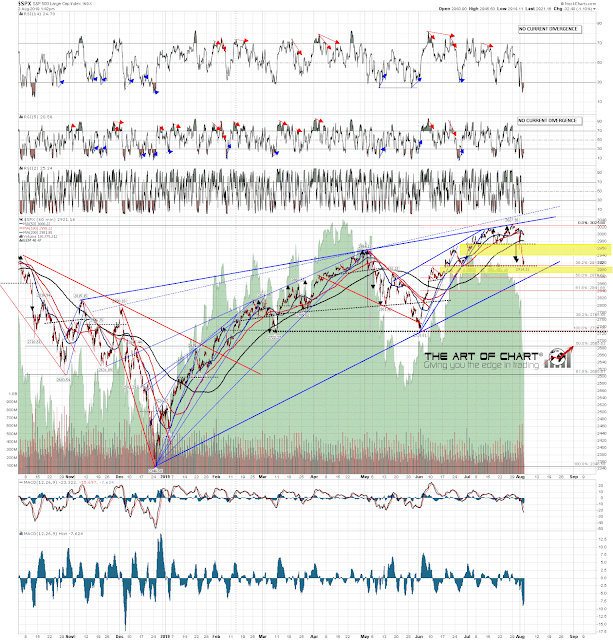

SPX 60min chart:

Everyone have a great weekend. 🙂

02nd Aug 2019

02nd Aug 2019