The Art Of Chart is proud to introduce the Options Trading and Investing Service to our subscribers. This is the first of many blog posts where we will describe in detail the various option strategies that we will utilize to help you profit. There will also be a regular schedule of video updates covering new opening positions as well as updates and adjustments to current positions. So let’s get started. Here is a brief video introducing the service:

This first post is an introduction to the service and how we approach options trading and investing. The service will initially be initiate and manage positions via this blog and invite you to ask questions in the comments section. You can also ask questions on the twitter feed as needed. The starting point for the service will be using the following instruments:

We will expand into other stocks and instruments as the setups instruct us. Please note that each setup we will offer two instruments, one for larger accounts and the other for smaller accounts.

We will be using this service for investing and trading. Now most of you are not accustomed to hearing ‘options’ and ‘investing’ in the same sentence. Options are only for trades of a maximum duration of 30-60 days, right? While there are some legitimate reasons for trading options in that 30-60 day time frame, position duration is the first (of several) major differences between us and them (them being most option education and advisory services). So what benefit do you get from extending the duration of an options position? Instead of a very long description to explain this concept, lets look at an example using a risk profile from ThinkorSwim’s trading platform.

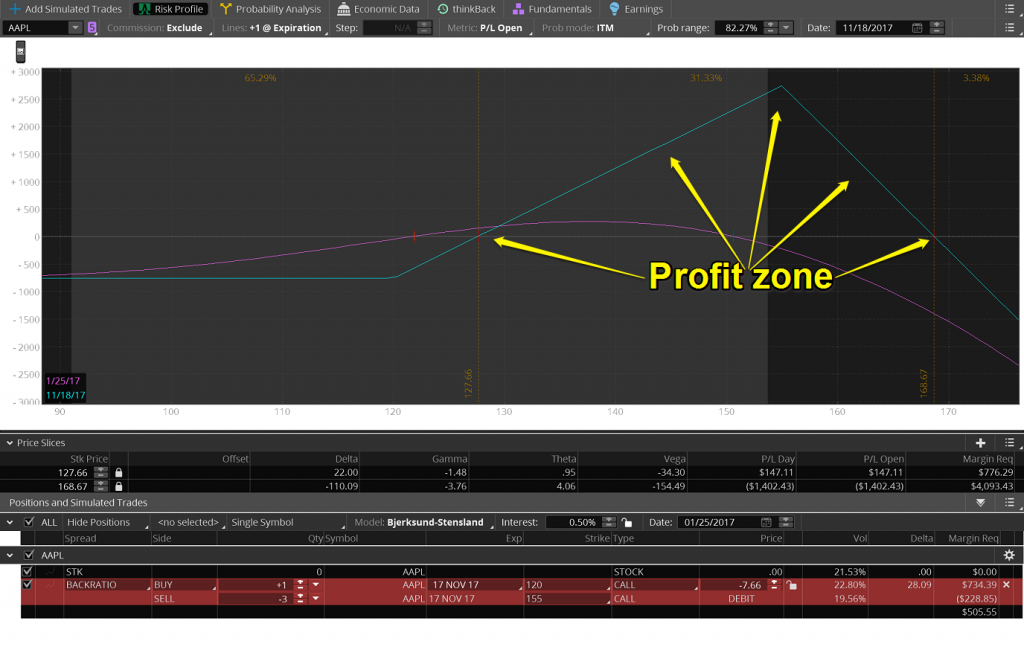

First, let’s assume that Stan and Jack have identified a projected price range in AAPL of $150-$160/share in the October/November time frame. (This is just an hypothetical example, the price targets and dates are not from their charts.) So how would you position yourself to profit from that projection? Do you use a series of 30-60 day trades or do you just go out and buy some November calls. Our most preferred long-term option position is the Ratio Spread. It can be used as a stock replacement strategy with limited risk to one side of the position. Unlike a shorter term position we have a huge profitability range and unlike simply buying calls we have lowered the cost basis of the position by 25%. We will cover the strategy much more in depth in the near future but for now lets focus on the benefit we can get by extending the duration of the position. In the risk profile below, you can see that the position is a bullish spread in Apple (AAPL). The position will be profitable at expiration on November 17th if the price of AAPL is between $127.66 and $168.67. That profitability range is over $40 wide. The position has a maximum loss of $766 if the stock is below $120/share at expiry and a maximum gain of $2,734 if the stock closes at $155/share at expiry. (It is not a coincidence that the maximum profitability happens to match the price projection from the chart analysis). The maximum upside reward to downside risk is 3.5 to 1. And, oh by the way, you could reduce some of or all of that $766 downside loss by selling a couple of out of the money puts if you didn’t mind some additional downside risk. For instance, selling 3 of the Nov 100 puts would generate $837 in premium which means the profitability zone would then be between $99.91 and $172.85 (a profitability range almost $73 wide) and the maximum profit on the spread would become $3,571. You could also sell put spreads instead of naked puts to limit downside risk and the margin required to hold the position. All call ratio spreads structured like is are net-short calls so they have undefined risks to the upside. That is why we never use this strategy on underlying stocks that are in play for a potential takeover. There are no guarantees in life but AAPL probably falls into the category of stocks that are ‘unlikely to be bought out’! However, in order to reach the undefined risk side of the position above $168.67 the stock price has to first pass through the profit zone. If the stock moves too quickly higher in price we would adjust the position to push that upside break-even higher or exit the trade at a profit, which isn’t all that bad, is it? If AAPL moves higher in the manner that most stocks do, higher and then consolidate, higher and then consolidate, etc., this position will be adding to it’s profitability every day that passes due to an option trader’s/investor’s best friend, Theta.

So that is probably enough for this post. Stay tuned for more posts coming soon covering much more material! We’ll talk all kinds of strategies such as Ratio Spreads and their lower margin brother, the Broken Wing Butterfly, as well as Calendar and Diagonal Spreads. We will even talk about how we turn the plain old time spread into a Ratio Time Spread. We’ll cover short term trades in the future as well. They make a great compliment to the long-term positions or can be done as standalone positions. Stay, tuned, exciting things are coming for all you option traders and investors!

31st Jan 2017

31st Jan 2017

I am a novice when it comes to trading options and I don’t fully understand some of the strategies presented here. But options trading and investing appeals to me. Can a novice use this service? and is this a stand alone service?

Michael, this new option education service will be appropriate for all levels of option traders, including novices. The intro video that Stan and I recorded was a very cursory introduction to the service and not really designed to provide an in-depth understanding of option strategies. Stan and I will be posting a new video very shortly with a complete description of the various strategies that the service will be discussing in the future. As time progresses I will post additional videos and make frequent blog posts discussing all aspects of strategy selection, specific position establishment and adjustments as well as position risk management. I will be also be available to answer questions from the subscribers along the way to further their understanding of what option trading is all about. I look forward to your comments and feedback over the course of the free trial period to help you begin the journey towards profitable option trading!

Paul or Stan you say two instruments for larger and smaller accounts can you give me those two sizes? Nice work so far guys thank you.

David, labeling an account ‘large’ or ‘small’ is obviously extremely subjective. For purposes of the options education service, Stan and I are roughly defining a large account as $100,000+ and a small account as $30,000-. In the Art of Chart sample options portfolio we started the paper money portfolio with a value of $50,000. In each of the option trades I have placed so far, I have kept the maximum potential loss to around 2.5% of that $50,0000 amount or around $1,250 per trade. In one of the positions, TSLA, I have allowed a maximum potential loss of $1,720 but have positioned that loss with about a 3% chance of occurring based on the options pricing. Options trading can be appropriate for any account size as long as prudent, defined-risk strategies are employed and position sizing limits potential losses to a small percentage of the account size such as the 2.5% limit per trade that we employ.