The Options Trading and Investing service provides perspective on high quality setups and option trading strategies for the coming week. We carefully select these setups due to their quality and profit potential and we report back on results. This week we review current positions and anticipate potential additions in SLV and UNG as well as potential adjustments to the current positions in AAPL, EEM and UUP.

Please refer to our education video HERE for more information in the option strategies used in this post.

A summary of the plan for the week is summarized in the video below. The entries and cost basis will be highlighted on this post on our private twitter feed.

In today’s post we will examine the benefits of using option spreads instead of simply purchasing options. First, let’s take a look at the position statement for the portfolio:

In last week’s video I discussed making an adjustment to 2 of the current positions in AAPL and EEM. I did not make those adjustments yet because we didn’t see a pull back in price of either. Why wait for a pull back? The adjustments that I will be making are adding put Ratio Spreads. The ratio spreads will be established for a credit. The credit I will receive for adding the ratio spreads will increase as the price of the underlying decreases. So, I will wait until the price declines to initiate the positions to bring in more premium. Follow the Twitter feed for more developments on these positions.

2 new positions that I may initiate this week are spreads in both SLV and UNG. We discussed SLV in last week’s video as a potential trade and we have had our eye on UNG since the 2/26 video. There is a good possibility that I may change the strikes in those spreads when I actually place the order but I won’t decide that until Stan thinks the time is right to initiate the positions. As always, patience is a virtue. We want to combine well structured option positions with Stan’s reversal calls to try to maximize our profitability.

Now let’s look at comparing the benefit of trading option spreads instead of just buying single options using the portfolio’s current RUT position as an example. This RUT position was established on 2/21. The RUT closed that day at 1410. It is currently at 1391.52. At the time, I was looking for a move to around the 1300 area by the end of March. Normally I sell the option strike that is the target price as that is where peak profitability occurs in a Broken Wing Butterfly (BWB) spread. However, there was only $2.63 of premium at that strike and that was less than half of the value that I wanted to collect in premium to reduce the overall cost of this spread. Instead, I decided to sell the 1330 puts in order to collect enough premium to meet my cost reduction objective. To understand how I structure a spread such as this I will walk you through the process.

As I said, at the time RUT was trading 1410. I wanted to own the nearest out of the money (OTM) put for the anticipated move lower. That was the 1400 strike. That put cost $24.40. To reduce that cost in order to improve my profitability I sold 2 of the 1330 puts for $7.65 each ($15.30 for both). Now, the net cost of the 1400 puts was $9.10 ($24.40-$15.30) If I stopped at that point I would have owned a 1×2 ratio spread. However, since Stan was projecting a move to as low as below 1300 I needed the position to be profitable to at least that price and lower. By buying 1 of the 1300 puts for $2.63 I was able to guarantee a profitable position no matter how low in price RUT went below my breakeven price of 1386.80. That is a characteristic of a BWB and a prime reason why I use them so often. The net effect of those 3 legs is that I own a position that has defined $1,320 in risk and will have a minimum profit of $2,680 anywhere below RUT 1360 and a maximum profit of $5,680 at RUT 1330. That is a return on risk of between 200% and 400% if RUT is below 1360 as of 3/31. I will do no worse than double my money if RUT is below 1373.

Considering that RUT has moved lower by just 1.3% since the position was established and the BWB has an 18% return on risk, you can see how option leverage can work in your favor if you allow it to.

Where is the profit coming from in this position currently? The 2 long puts have a total loss of $758 and the 2 short puts have a profit of $1,145 leaving me with a net profit of $240. If RUT were to move to 1330 by expiry, the 1330 and 1300 puts would expire worthless and the 1400 puts would be worth $70. That is how you make the maximum profit in a BWB.

So why do so many option traders just buy puts or calls without selling something against the options that they buy? Long options have unlimited profit potential and that can be very tempting. The problem is that if you don’t consistently reduce your cost basis you will find it very hard to be successful utilizing options in your portfolio. Option premiums are very expensive relative to your probability of making a profit! What if, instead of buying a Broken Wing Butterfly as in our current RUT position I had just bought some puts? Below is a comparison of the performance of long 1300 puts in 3 different expiration’s.

What are the break even prices on each of these puts? The May expiry is 1284.30, the Jun expiry is 1278.05, and the Sep expiry is 1259.55. RUT is currently trading 1391.52. If you were long those puts you would need a decline of 107.22, 113.47 and 131.97 points respectively just to get your money back by each expiry! Above RUT 1300 at expiry and you lose the entire amount of your purchase.

If you were thinking that the 1300 puts were too far out of the money (OTM) to buy, below is what your loss would be if you bought the 1350 puts instead.

And finally, how about the 1400 puts? They would currently be at a loss as well. Also, look at your risk in buying those puts. You would be risking anywhere from $4,190 to $7,420 to buy just 1 contract.

One final point. Even if I disregard the anticipated price move I still want to have a positive reward to risk ratio. Below is the reward to risk on a plus/minus 2% move from the current price of RUT as of the 3/31 expiration.

When I finally add the SLV and UNG positions we will have 11 underlying instruments in the option portfolio and we will be using approximately 35% of the $50,000 margin. I will then be focused on adding to the portfolio’s potential profits while, in many cases, reducing the directional risk of the current positions. For instance, we are short the dollar in the current bearish position. It is a longer-term position. When Stan sees a shorter-term price reversal coming I may add a short-term bullish position which actually reduces the directional risk in the position while still maintaining a bearish long term outlook. Another instance can occur when a position doesn’t move as quickly as anticipated or has plenty of profit room to work with and I can add risk in a new, shorter-term position that is covered by the original position. That will be the case in both AAPL and EEM. What I just described is a difficult concept to comprehend without seeing it develop so stay tuned and I will be sure to explain how this all works as I place the actual trades in the coming week(s).

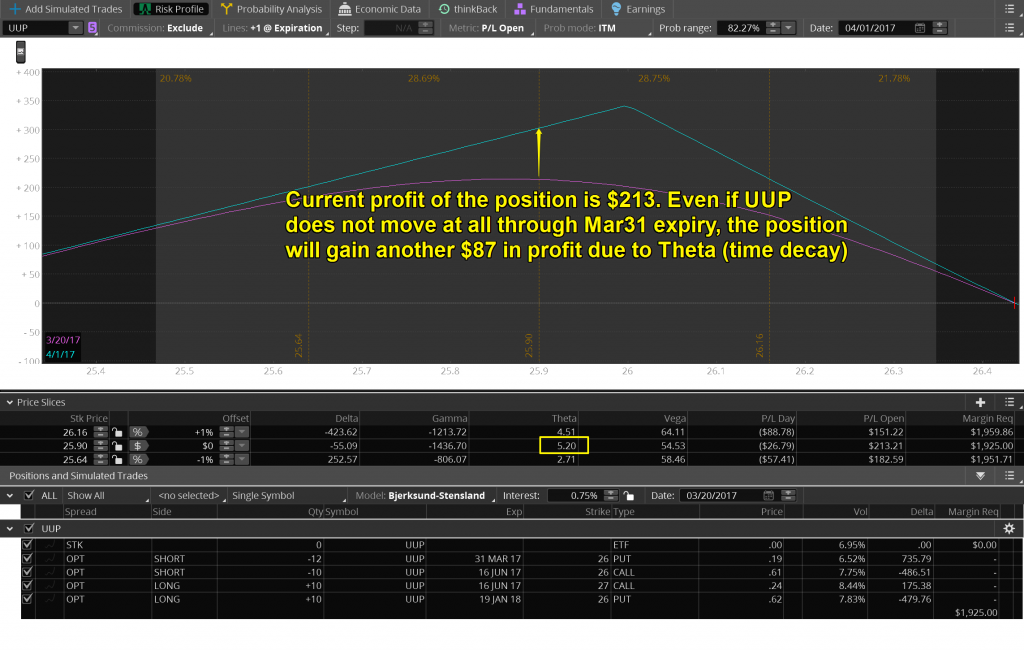

3/20 Update: Today I sold 12 Mar31 UUP 26 Puts for $.19. That means I brought in $228 (less commission) and reduced the short Deltas on the primary position. Stan is expecting a 1% move higher in UUP into the end of the month and the primary position is short UUP so this is a short-term hedge for the projected move higher. UUP closed at $25.90 today so another $.10 move (or more) higher in UUP by Mar31 and the puts would expire worthless allowing me to keep the $228 as a short term profit.

19th Mar 2017

19th Mar 2017