Well, it’s been a while, but something interesting finally happened on equities today with an AM high that died into a halfway decent decline. Rising support for SPX from the late December low was broken and we may well now be in the topping process for a larger retracement before subsequent higher highs.

This one is mainly interesting because if seen this should deliver a decent buyable dip, but that would be interesting to see. The high after this one might be more interesting for a swing trade. Intraday Video – Update on ES, NQ, and TF + others:

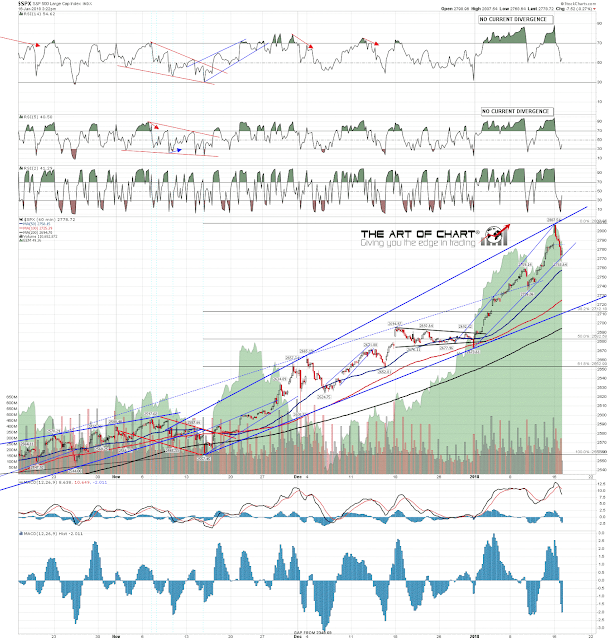

It’s a measure of how strong this move up has been that a 40 handle pullback failed to reach the 50 hour MA on SPX, now at 2756. If this move is topping out, the obvious topping sequence would be a retest of the high and marginal new ATH before a move to test rising support from the November low, currently in the 2712 area. SPX 60min chart:

I’ve posted my full intraday video as I aim to do that once a week. Normally I’ll just be posting the equity index section.

16th Jan 2018

16th Jan 2018