Commodities offer a unique advantage in 2019 over traditional investments, considering a slowing global economy and inflation no longer on the horizon. Several commodity markets are poised for well-defined up-trends this year. I plan to write about these markets on a bi-weekly basis as the views presented here are more thematic and longer term in nature. Updates to the trading strategies published here will be provided on an ongoing basis.

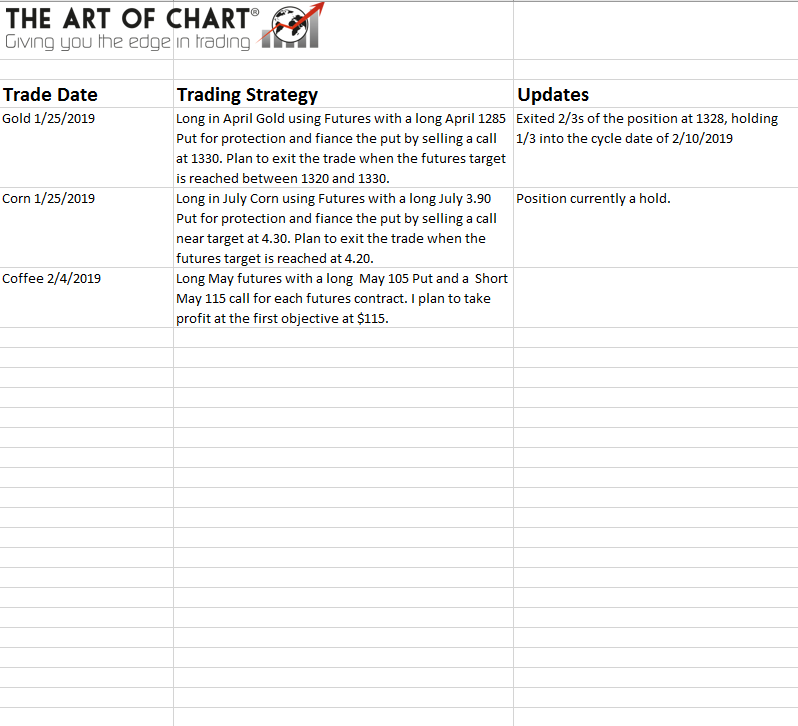

Last week I discussed starter positions in Gold and Corn. Last week I took 2/3s off in Gold for a profit and still holding the remaining 1/3 position. Corn is still a hold at this point with the USDA releasing its first report since the government shutdown. This week we will look at a Coffee trade, as record crop production last year will likely not be matched this year. Coffee is still near its low of December 2018.

COFFEE

Coffee prices declined over 20% last year, and toward the end of 2018, the government of Brazil was lobbied by farmers looking to put a floor on prices. Prices this low had not been seen since 2005. There were good reasons for the lower prices as record production occurred in the two largest producing markets, Brazil and Vietnam. This year, the story is going to be different. Vietnam is already reporting an expected harvest shortfall and Brazil is having drier than expected weather. So the major producers are likely going to have an off year. This can be bullish for prices in 2019. This does not take into account a devalued dollar or possible continued inflation, which will have implications on commodity prices.

On December 19th, a reversal on Coffee occurred, which currently targets the $115 area in February. On the weekly chart, the 15-year seasonal trend is higher into March with a target in the $130 area according to Hurst cycles. On the daily chart, the declining resistance trend line has not yet been tested and is likely to be tested this month. Money managers, according to the COT report as of December, were short a net 53,000 contracts with open interest increasing since then. The USDA will be updating the COT information every Tuesday and Friday with one week of data on each report until they are caught up. I am very interested in what they publish this Tuesday. Longer term, I am looking for high in 2019 into the 150s if in fact the producing countries have a shortfall in production.

On the four-hour chart, I am expecting a break out of a small triangle pattern in price and also on compression on RSI. This compression should resolve higher into the $115 area by the middle of February. A conversion of 108 will confirm the break out. Chances are the lower triangle trend line will hold as support.

Trading Strategy

With the possible lower production in Coffee by the largest producing nations, I am looking to be long Coffee in May with a hedge to the downside. I am looking to bracket a futures long with a Long May 105 Put and Short May 115 call for each futures contract. I plan to take profit at the first objective at $115 and may trade in and out of the short call if profit is offered lower.

Wrap Up

Keep a close eye on the weather as this will have an impact in Brazil over the next few months. Cocoa is another commodity which has potential upside this week due to weather as crop short falls are expected. The USDA report has not been issued due to the government shutdown and will be release this week which should move the commodity markets.

Next week, I’ll be covering other key commodities for 2019, which include Cocoa and Natural Gas. We may also be reviewing Gold as our first strategy may be nearing completion.

Trading Strategy Review

Disclaimer: Trading futures contracts and commodity options involves substantial risk of loss, and may not be appropriate for all investors. By reading this report, you acknowledge and accept that all trading decisions are your sole responsibility. Trading strategies referenced in this document are only suggestions, no representation is being made that they will achieve profits or losses. Past performance is no guarantee of future results.

03rd Feb 2019

03rd Feb 2019