I plan to cover just three cryptos every week in this post: Bitcoin, Litecoin, and Ethereum. These instruments provide trading opportunities with out sized gains. I hope the analysis presented here helps you profit in these instruments.

BTCUSD — A retest last week to the support trend line which may be tested later this week. If we convert this trend line we cam 42100 as support – If the trend line does hold this week then we should see more upside on BTC. The USD is the prime reason for the pull back here, more downside in the USD means more upside in Cryptos.

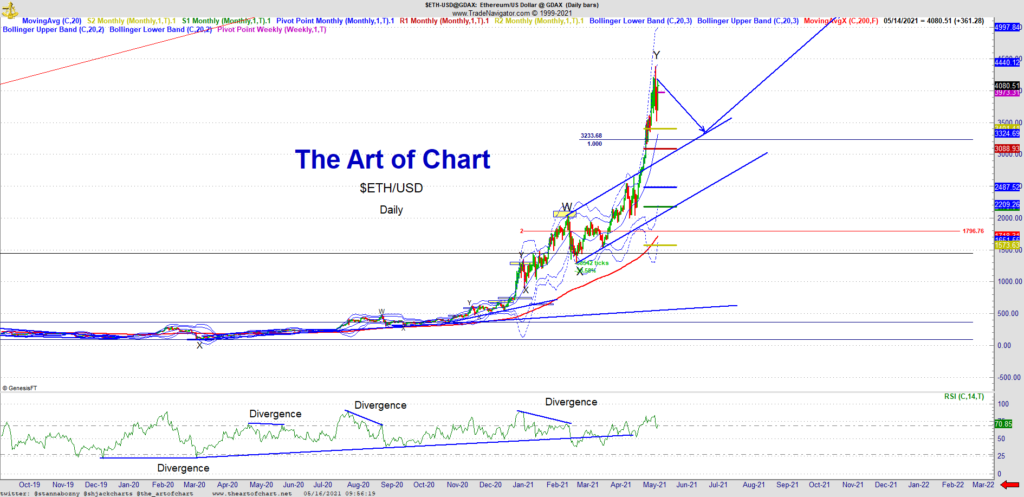

ETHUSD – A large retracement as mentioned last week and again as a result of the USD. We can see another legg lower but remember previous retracements have been quick and short in duration and over 20%. Support is at the lower trend line and we can advance directly from here. More upside is expected and I am still bullish Cryptos.

LTCUSD – As mentioned last week, we have seen this movie before. Another 20+% retracement and we could see monthly pivot as support which is at 266. LTC can rally directly and watch the USD for clues. I am looking for more upside here longer term.

Big squeezes in ETH and LTC two weeks ago and the structure of wave Y for LTC showed an expanding diagonal as discussed last week. The retrace has played out as expected, short and high volatility as before. Look to scale back into positions as we may see a lower low in Cryptos driven by the USD. The structure on LTC does call for a lower low but after a 25% retrace, this can advance directly from here. BTC is lagging and I expect it to catch up. DX will continue to be devalued for the next year or more and Cryptos will continue to climb. All retracements are a buying opportunities. More volatility to come. I remain bullish Crypto’s. Trade Smart and Trade Safe.

16th May 2021

16th May 2021