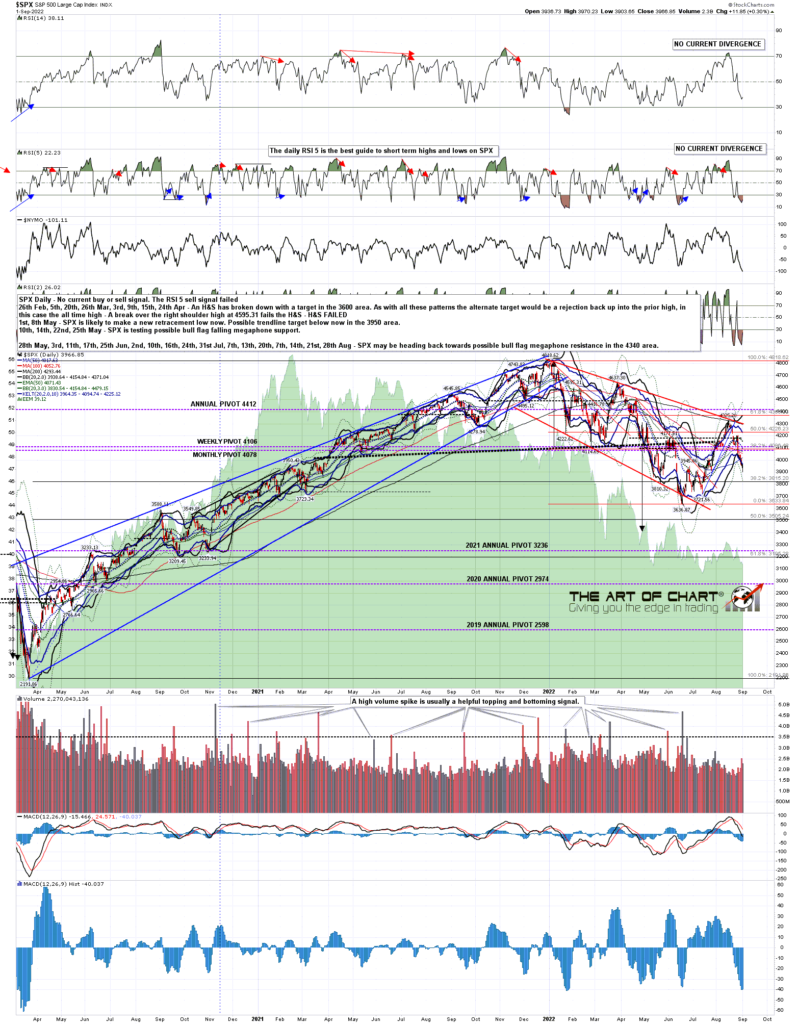

The H&S patterns from the rally highs that I was looking at a week ago all made their target areas yesterday and SPX is now testing important support at 3900. This area was significant on the way up in early 2021, and was then key support in May, resistance in June, and was broken as resistance and backtested as support in July. Bulls need to hold this area if they want to go higher, and bears need to break it hard if they want to retest the 2022 low at 3636.87 and go lower.

Either way I’m expecting to see at least a rally attempt here, and I think that rally started yesterday. On the bull scenario I would be leaning towards a 50% (approximately) retracement back towards the new SPX monthly pivot at 4078, possibly failing at the 50 hour MA, currently at 4053, then a retest of yesterday’s low to set up positive divergence on the daily chart and a double bottom setup to retest the rally high, and then the move back to that high at 4325.28, setting up a possible move back to retest the all time highs.

On the bear scenario SPX would retest yesterday’s lows, breaking through and converting 3900 to resistance before a move to retest the 2022 low, probably then breaking lower. We will see.

SPX daily chart:

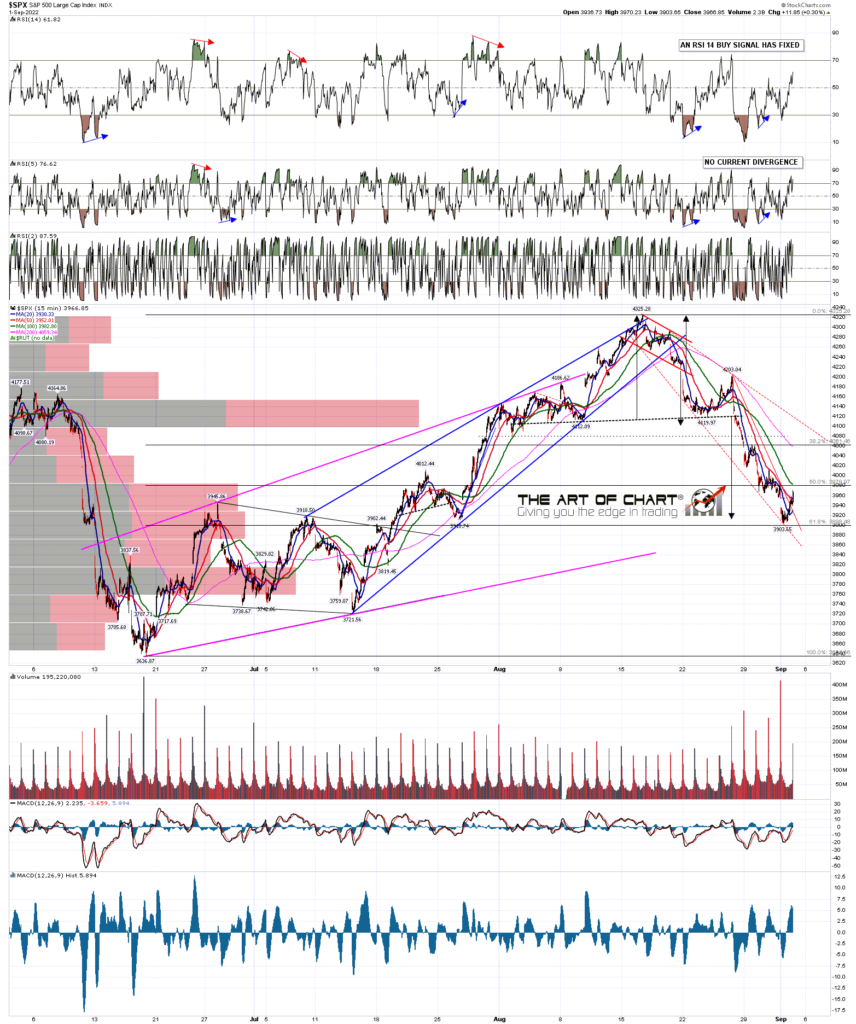

On the NDX chart the full H&S target was almost made yesterday, reaching the 61.8% retracement area. A decent looking falling wedge has formed on the way down and broke up yesterday afternoon. A possible declining resistance trendline target is now in the 12820 area and declining rapidly.

NDX 15min chart:

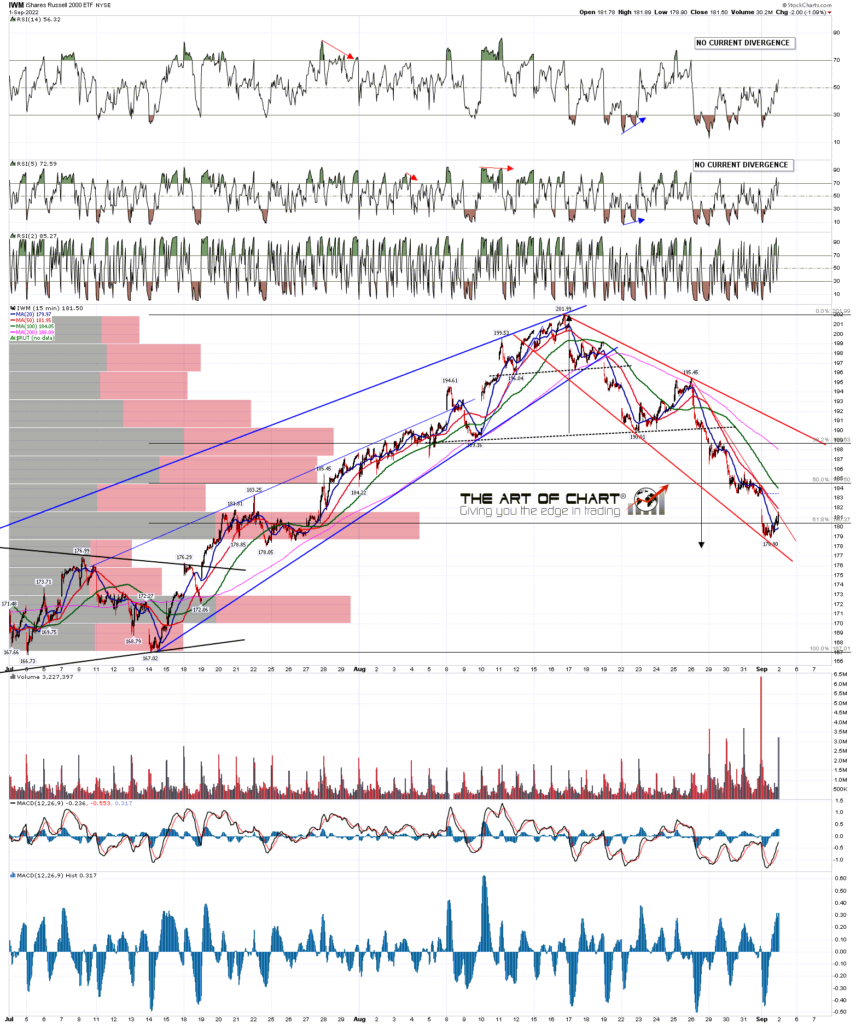

On the IWM chart the full H&S target was almost made yesterday, reaching the 61.8% retracement area. A decent looking falling wedge has formed on the way down and broke up yesterday afternoon. A possible declining resistance trendline target is now in the 191 area and declining rapidly.

IWM 15min chart:

What are the prospects of seeing the stock markets retesting the all time highs here? Well the economic news doesn’t seem at all encouraging, and the Fed now seems to be remembering that keeping inflation low is an important part of their job. Do I think that a major new bull market started at the current 2022 low as some are saying? No, I think that is very doubtful, and if we do see a retest of the all time highs my lean will be that would likely be the second high of a large double top, preceding another test of the 2022 low and another big inflection point there. SPX does like those high retests though, and the decent looking bull flag setups across the board from the all time highs are saying that those high retests are possible until demonstrated otherwise.

Historical stats for the next few days are neutral until Friday 9th September, which leans 61.9% bullish with Monday, Tuesday and Friday the following week also all leaning 71.4% bullish into Opex.

My next post should be on Monday or Tuesday before the open. Everyone have a great weekend. 🙂

02nd Sep 2022

02nd Sep 2022