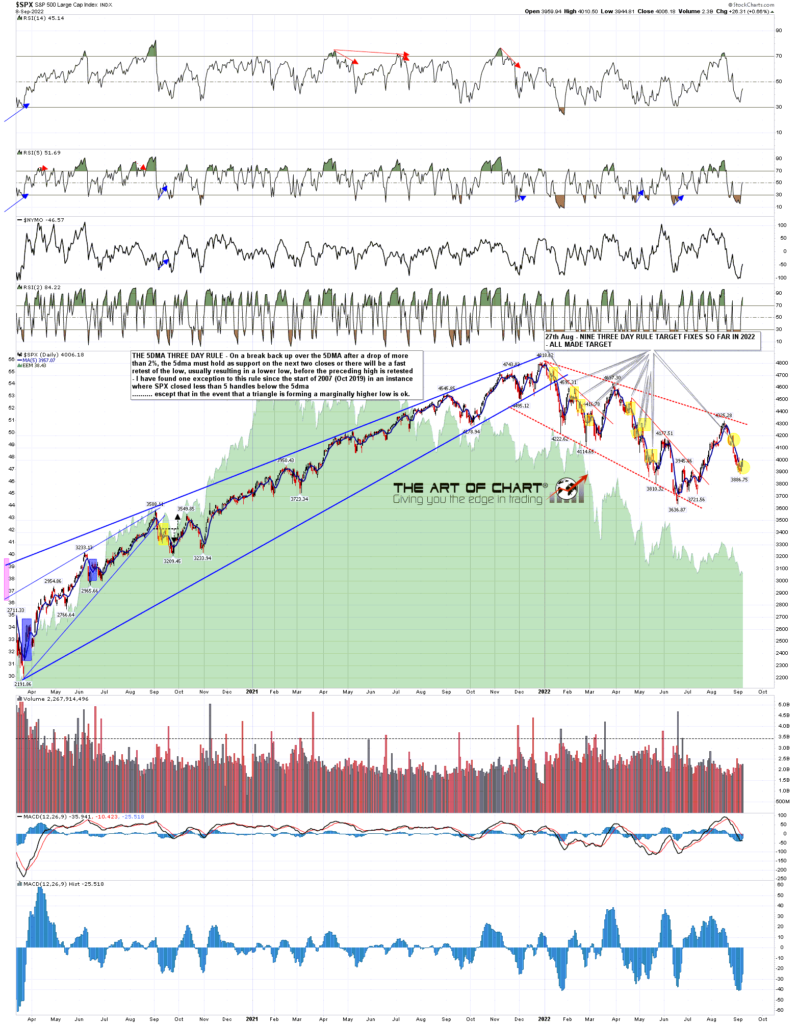

I was saying on Wednesday morning that the most important short term resistance was the 5dma, and we saw a break back over the 5dma at the close on Wednesday, so that put SPX back on the Three Day Rule. That means that in the event of a clear visual break (3 to 5 handles) back below the 5dma on either of the next two trading days, in this case yesterday or today, then SPX should retest the last low at 3886.75 before any retest of the prior high at 4325.28.

I was asked about this stat this week and I was looking back at it. The stat goes back to the start of 2007, I think because I first looked at it in 2012 and went back five years. After a fail and small tweak of the rules in 2019, on the revised basis this has delivered every time over the last almost thirteen years apart from two very marginal higher lows when triangles were forming that broke up to deliver significant lows. This stat is going to fail sometime but that must be somewhere between 150 and 200 Three Day Rule fixes over the period that all made target. I have never seen a market stat as reliable as this one has been.

The 5dma closed at 3957 yesterday and will likely close a bit higher today. A clear break back below it today would very likely deliver a retest of the last low at 3886.75.

SPX daily 5dma chart:

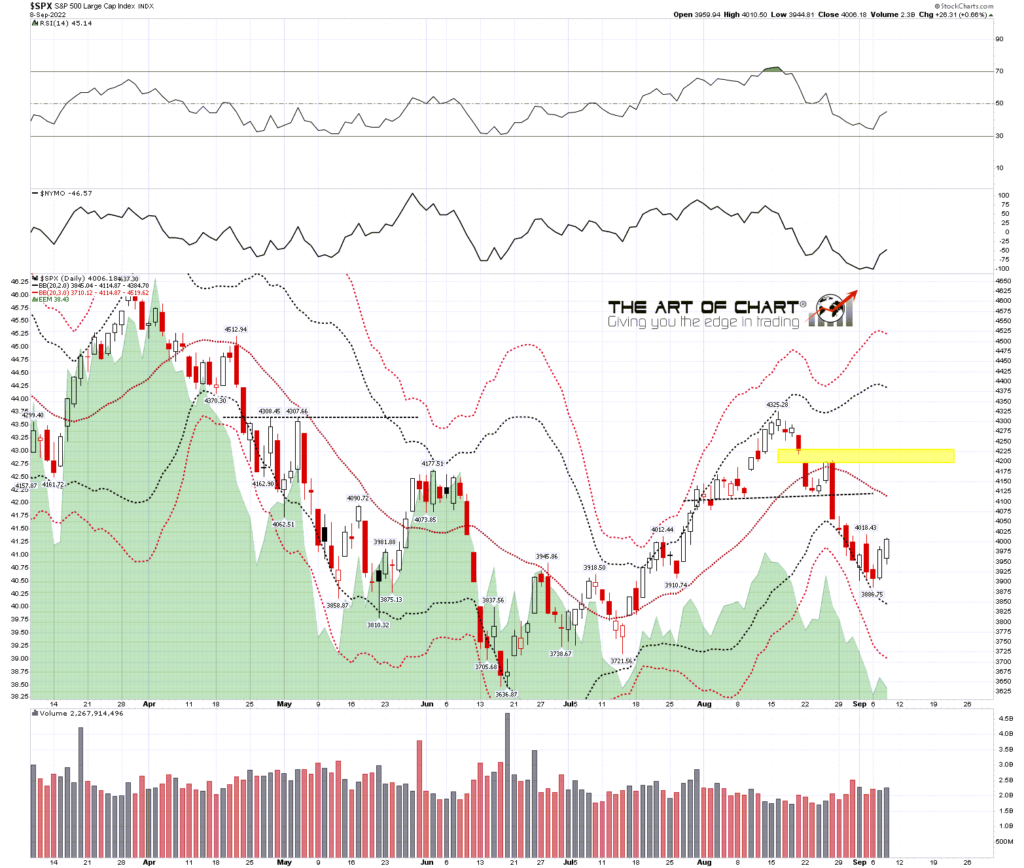

SPX has now clearly come off the daily lower band and may be heading back up to the the daily middle band, currently at 4115. Short term resistance for today is a break and conversion of short term double bottom resistance at 4018.43, the 45dma at 4048, and declining resistance now in the 4055 area. A break and conversion of 4018.43 looks for a target in the 4133-50 area.

SPX daily BBs chart:

The economic news has been pretty dire, and despite all the decent looking bull flags that have formed since the all time highs on equities I obviously have serious doubts about whether those retests are doable, but if SPX can break and convert the daily middle band back to support then they are at least still the table as a possibility and, so far at least, that important support in the 3900 area is still holding.

Rather than show you the updated short term double bottoms that are starting to break up here, as they are mostly on my last post in any case, I thought I’d close today showing you some of the most bullish looking charts on the sector indices that I cover at theartofchart.net.

The most bullish is at IBB (biotech), where the obvious interpretation for this latest retracement is that the right shoulder on a larger IHS is forming. A sustained break up over the neckline in the 135 area would look for a target in the 165 area, effectively opening a retest of the all time high at 176.99. This may not deliver but it is a beautiful setup and pattern.

IBB daily chart:

On IYR (real estate) the setup is more ambiguous, but there is a lovely bull flag from the all time high with the obvious next target within the flag in the 108.8 area. A short term H&S has broken down but may be failing, and if it fails that should deliver a retest of the rally high at 103.36. If seen we may well see that test of main bull flag resistance and IYR would already have rallied most of the way back to the all time high retest.

IYR daily chart:

XLE (energy) has an IHS that has already broken up towards a retest of the 2022 high at 92.28, and a smaller H&S that has since formed and broken down. I’m expecting the small H&S to fail back to the recent high at 85.18 and after that I think there is a very good chance of a retest of the all time high.

XLE daily chart:

Historical stats for the next few days are 61.9% bullish today, with Monday, Tuesday and Friday next week also all leaning 71.4% bullish into Opex. As a group these are one of the most bullish leaning six trading day periods of the year. In a strong trend down that wouldn’t matter much but in the absence of that we could see a decent move up into the end of next week.

In the short term we have solid looking double bottom setups breaking up on SPX, NDX, IWM and Dow so we’ll see how those far today. As I didn’t manage to finish this post before the open I can now see a possible breakaway gap up over double bottom resistance on SPX. If we are going to see a reversal back down today then a fill of the gap from yesterday’s close at 4006.18 would be the first serious crack in this short term bullish looking setup.

We are doing our monthly free public Chart Chat at 4pm on Sunday. It should be interesting with equities bonds and USD all at or coming into interesting inflection points here. If you’d like to attend you can register for that here or on our September Free Webinars page.

My next post should be on Monday or Tuesday before the open. Everyone have a great weekend 🙂

09th Sep 2022

09th Sep 2022