Welcome to this week’s Crypto Market Weekly Outlook, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we’re excited to announce that our charts now feature a proprietary trading algorithm, designed to increase the odds of capturing big gains in the volatile crypto market.

Bitcoin and Ethereum Performance

The past week has been relatively stable for Bitcoin and Ethereum compared to the sharp declines witnessed recently. The market is currently in a consolidation phase, with traders closely monitoring macroeconomic indicators and potential regulatory announcements that could influence price direction.

Ethereum has also shown signs of stabilization. The network continues to see robust activity, particularly in the DeFi sector, which has helped support its price. However, the broader market sentiment remains cautious, and any significant movement in Bitcoin is likely to have a ripple effect on Ethereum and other altcoins.

Regulatory Landscape and Market Sentiment

The regulatory environment continues to be a major focus for the crypto market. The U.S. Securities and Exchange Commission (SEC) has delayed its decision on several spot Bitcoin ETF applications, leading to uncertainty in the market. This delay has tempered some of the bullish sentiment that had been building in anticipation of the ETF approvals. However, many market participants remain optimistic that approval could eventually come, potentially bringing a wave of institutional investment into the market.

In addition, the ongoing discussions around global crypto regulation, including potential guidelines from the G20 nations, are being closely watched. These regulatory developments could play a crucial role in shaping the market’s medium to long-term trajectory.

Blockchain Ecosystem Developments

The blockchain ecosystem continues to evolve, with notable progress in both modular and monolithic blockchain designs. Ethereum’s layer-2 solutions, such as Optimism and Arbitrum, have seen increased adoption, offering users lower transaction costs and faster processing times. These advancements are critical for scaling the Ethereum network and maintaining its dominance in the DeFi and NFT spaces.

Meanwhile, Solana remains a strong contender, with continued growth in its ecosystem. The network has been expanding its developer base and enhancing its infrastructure, which could lead to further adoption and potentially higher prices. However, Solana’s volatility remains a concern, and traders should be cautious of rapid price movements.

Market Dynamics and Trading Volumes

Trading volumes have seen fluctuations across both centralized and decentralized exchanges. Centralized exchanges have reported a slight uptick in spot trading volumes, likely driven by traders taking advantage of the recent market stability. However, decentralized exchanges continue to gain traction, especially with the ongoing popularity of meme coins and new project launches that often debut on these platforms.

Interestingly, the crypto derivatives market has also been active, with an increase in open interest in Bitcoin futures and options. This suggests that traders are positioning themselves for potential future price movements, either to hedge against risks or to speculate on price directions.

What to Watch This Week

As we move into the new week, several key factors could influence the crypto market:

- Economic Data Releases: Keep an eye on U.S. inflation data and Federal Reserve announcements, as these could impact investor sentiment and risk appetite.

- Regulatory News: Any updates on the SEC’s stance on crypto ETFs or global regulatory developments could trigger market movements.

- Technological Developments: Watch for any major updates or launches in the blockchain space, particularly related to Ethereum’s layer-2 solutions or Solana’s ecosystem, which could drive price action.

The crypto market remains in a state of cautious optimism, with the potential for both upward momentum and downside risks. Traders should stay informed and be prepared to adapt to the rapidly changing market environment.

Price Movements

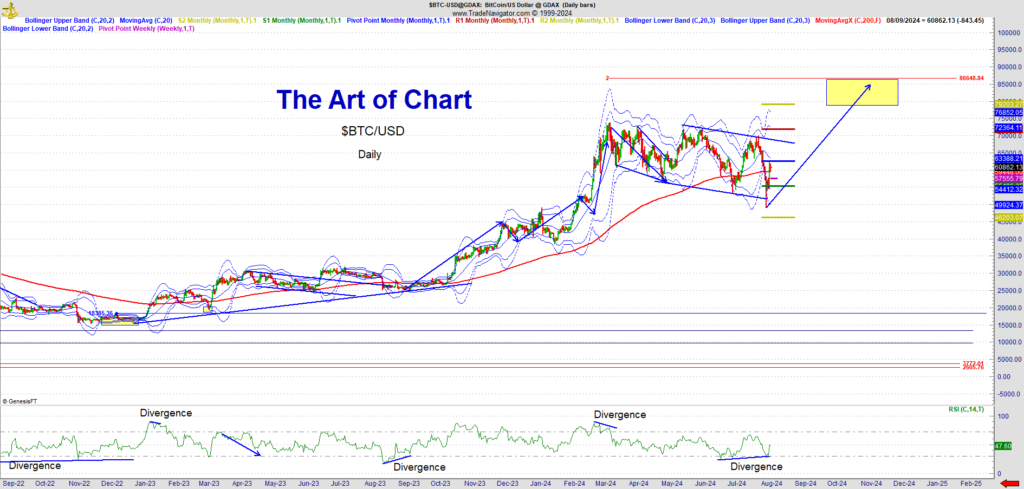

BTCUSD — The turn is confirmed in for the next legg higher, looking for 80,000 next and we can overthrow to 84,000. Bitcoin has demonstrated strong resilience, currently trading around $61,000 after recovering from recent lows. This surge follows a broader market recovery and reflects renewed investor confidence amidst ongoing regulatory challenges and global economic uncertainties. Despite these hurdles, Bitcoin’s dominance in the cryptocurrency market remains robust, with analysts optimistic that it could continue its upward trajectory, especially if macroeconomic conditions stay favorable. The next key resistance levels to watch are $65,000 and $67,000, which, if breached, could signal further gains and potentially lead to a retest of previous highs around $70,000.

ETHUSD – The turn is in and looking for higher into 4600 as the next upside move. Ethereum has continued to experience volatility, with recent prices fluctuating around $2,664. The market sentiment remains cautiously optimistic, with analysts suggesting that if Ethereum can break above the $2,800 mark, it could pave the way for a significant rally. There is a potential for Ethereum to reach new all-time highs, possibly around $4,000 to $5,000 later this year, driven by ongoing developments in its ecosystem, particularly in decentralized finance (DeFi) and non-fungible tokens (NFTs). Additionally, the anticipation of a spot Ethereum ETF has generated considerable interest, although it has also led to short-term market corrections as investors react to regulatory updates and market conditions. If Ethereum maintains its momentum and overcomes key resistance levels, it could see substantial growth in the coming months.

LTCUSD – Lean is still long into $125. Litecoin continues to lag behind the broader crypto market, currently trading around $61. Despite its quieter profile compared to major cryptocurrencies like Bitcoin and Ethereum, Litecoin remains a strong contender in the market. It continues to be adopted under the narrative of being the “silver to Bitcoin’s gold,” with a focus on offering faster transaction times and lower fees. While Litecoin hasn’t seen the dramatic price action of its larger counterparts, it remains a staple for many crypto investors, particularly those looking for a more stable and less volatile asset. As the market evolves, Litecoin’s steady presence and utility make it a reliable option for long-term holders who appreciate its resilience and consistent performance within the crypto ecosystem.

Solana (SOL): Solana has continued to capture attention with its strong performance and growing adoption. Recently, Solana surpassed Ethereum in weekly total transaction fees, underscoring its increasing usage and cementing its position as a serious competitor in the blockchain space. This achievement is a significant milestone, reflecting Solana’s efficiency and appeal in handling high transaction volumes, which is particularly attractive for decentralized finance (DeFi) and non-fungible token (NFT) projects.

Solana also received a major boost when the SEC reclassified it as not being a security, a move that could alleviate regulatory pressures and potentially open the door for more institutional adoption. This reclassification has enhanced investor confidence, contributing to the bullish outlook for Solana.

Despite a slight dip in price recently, Solana remains resilient, with its price stabilizing around $156. Analysts remain optimistic, predicting a significant rally later this year as the network continues to grow and attract new projects. With its strong technical foundation and increasing adoption, Solana is well-positioned for continued success in the evolving cryptocurrency landscape.

Outlook:

The cryptocurrency market has shown a robust recovery this week, with major coins like Bitcoin and Ethereum leading the charge. Traders should keep an eye on upcoming economic indicators and regulatory news, which could influence market sentiment. The overall trend is cautiously optimistic, with opportunities for further gains if the current momentum holds.

Trade Smart and Trade Safe.

11th Aug 2024

11th Aug 2024