Welcome to this week’s Crypto Market Weekly Outlook, post #349, where we provide a comprehensive analysis of the latest developments and price movements across major cryptocurrencies. Stay ahead of the market trends with our expert insights on what to watch for in the coming days. This week, we continue to leverage our proprietary trading algorithm embedded in the charts, designed to enhance your trading strategies and increase the odds of capturing significant gains in the volatile crypto mark

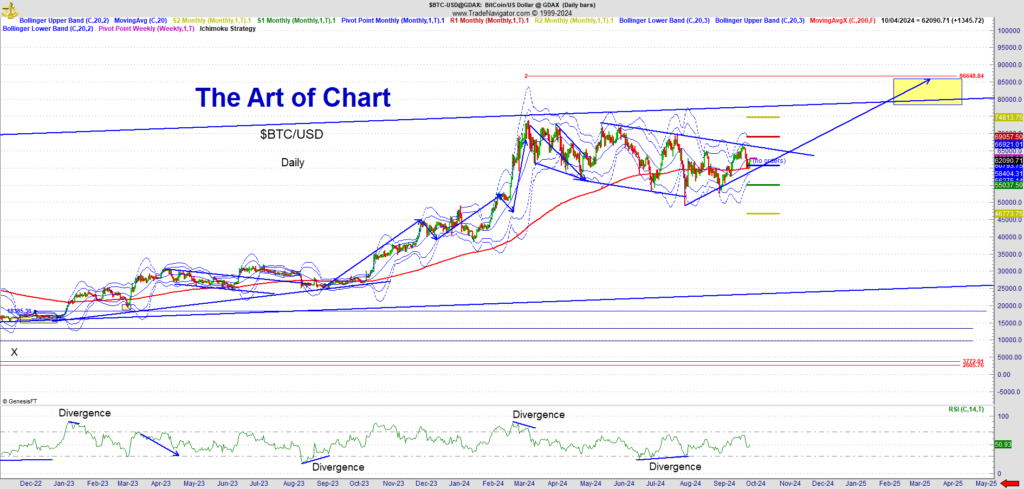

Bitcoin (BTCUSD)

Recent Developments:

Bitcoin has shown resilience in recent weeks, hovering above critical support levels. While volatility has persisted, particularly with the influence of global macroeconomic trends, Bitcoin remains firmly in a consolidation phase. Institutional interest in Bitcoin has remained steady, driven by anticipation over ETF approvals in the U.S. The SEC has recently shown more openness to spot Bitcoin ETFs, with speculation that a decision could come before year-end, potentially leading to increased institutional inflows.

Outlook:

Bitcoin’s price is likely to remain closely tied to regulatory decisions regarding ETF approvals. With the ongoing narrative of Bitcoin’s role as a store of value amidst economic uncertainty, a break above key resistance levels could drive renewed bullish momentum, potentially setting a path toward its previous highs. However, if the SEC continues to delay, Bitcoin could continue trading within its current range with downside risk.

Ethereum (ETHUSD)

Recent Developments:

Ethereum continues to benefit from robust activity in the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems. The rollout of Ethereum 2.0 upgrades, including the final stages of the transition to proof-of-stake, has been a critical driver for the network. Additionally, layer-2 scaling solutions like Optimism and Arbitrum are seeing strong adoption, reducing transaction costs and increasing processing speeds, which has sparked renewed interest from developers and users alike.

Outlook:

Ethereum’s price is likely to benefit from continued ecosystem growth, particularly with layer-2 scaling solutions playing a pivotal role in reducing congestion on the main Ethereum chain. As the network prepares for additional upgrades, including potential DeFi regulation clarity, Ethereum could break key resistance levels, leading to a potential rally. Key risks include regulatory developments and macroeconomic factors that could influence market sentiment.

Solana (SOLUSD)

Recent Developments:

Solana has continued to expand its role in the blockchain ecosystem, especially in DeFi and NFT applications. Despite past concerns about network stability, Solana has made strides in improving its infrastructure and addressing scalability issues. Institutional interest in Solana has also grown, particularly as its transaction speeds and low costs continue to attract developers. The launch of new blockchain projects, including decentralized exchanges and lending platforms on Solana, has further solidified its position in the space.

Outlook:

Solana is positioned for potential growth as it continues to strengthen its network and onboard new projects. However, caution is warranted, given Solana’s historical susceptibility to network outages. If Solana can maintain its stability and continue growing its ecosystem, the price could break out from recent consolidation patterns. Watch for upcoming network upgrades and key partnerships that could drive investor confidence higher.

Litecoin (LTCUSD)

Recent Developments:

Litecoin has experienced relatively lower volatility compared to other major cryptocurrencies but remains a solid player for long-term holders. Recent upgrades to the Litecoin network, including the MimbleWimble protocol, have improved privacy and transaction efficiency. This has led to renewed interest in the coin, particularly from users looking for faster transactions with lower fees. However, Litecoin’s price action remains largely influenced by broader market movements and Bitcoin’s performance.

Outlook:

Litecoin is likely to see continued stability, with potential upside if Bitcoin experiences a breakout. While not as volatile or innovative as some other coins, Litecoin remains a reliable option for risk-averse traders and long-term holders. The network’s improved privacy features and continued development provide additional reasons for optimism.

Regulatory Landscape and Market Sentiment

News from the Past Week:

The crypto market remains on edge regarding regulatory updates. The U.S. SEC’s stance on Bitcoin ETFs continues to shape market sentiment, with traders hopeful that a decision will arrive before the end of the year. Globally, regulators have increased focus on stablecoins and decentralized finance (DeFi), with the G20 nations recently pushing for a more coordinated global approach to crypto regulation. While uncertainty remains, many within the crypto space view these regulatory efforts as a sign of maturation, potentially leading to wider institutional adoption.

Blockchain Ecosystem Developments

The last week has seen several new projects and partnerships across multiple blockchain networks. Ethereum-based DeFi protocols continue to expand, with several new decentralized exchanges (DEXs) launching to provide users with more options for trading and lending. Solana, too, has seen new decentralized finance and NFT projects go live, boosting its activity and keeping developer interest strong.

Meanwhile, Polygon has been in the spotlight due to partnerships with major global brands exploring blockchain-based solutions for supply chain management and tokenized loyalty programs. These developments highlight the growing use cases of blockchain technology beyond traditional finance and crypto applications.

What to Watch This Week

- SEC ETF Decisions: The crypto market will be closely watching any announcements or updates from the U.S. SEC regarding Bitcoin and Ethereum ETFs. Approval could provide a significant boost to market sentiment.

- Global Economic Data: Key U.S. inflation and jobs reports are set to be released, which could influence broader market trends, including cryptocurrencies.

- Technological Developments: Keep an eye on progress related to Ethereum’s layer-2 scaling solutions and any major network updates from Solana, which could influence price movements.

The crypto market remains in a cautiously optimistic state, with traders awaiting key regulatory decisions and watching for the next major technological breakthrough to drive prices higher. Stay tuned for more updates, and as always, Trade Smart and Trade Safe!

BTCUSD (Bitcoin)

ETHUSD (Ethereum)

LTCUSD (Litecoin)

Advanced Blockchain Investments

The previous post have included Advanced Blockchain Investments. The blockchain space has rapidly evolved beyond simple cryptocurrency trading, offering investors various innovative ways to maximize returns.

06th Oct 2024

06th Oct 2024