Paragon Options is an options service that focuses exclusively on futures options. By doing so we are taking advantage of superior premiums compared to stock options and also taking advantage of the asset diversification offered by futures. Paragon Options is a directional options service that will focus on Metals, Energies, Bonds, Currencies, and Commodities. This service was launch on June 25th. Click HERE to sign up

For a few months now, we have been working on a unique new options service, providing investors with a highly diversified product, delivering superior returns that are uncorrelated with equity indices.

Our motivation is to leverage our expertise in the futures and currency markets, using a complete range of options strategies to deliver a unique service.

That service is called Paragon Options. We will be using options on asset futures and currency markets. With our methodology, we aim to generate superior returns whilst managing risk. This is a directional options service. Paragon Options will focus on Metals, Energies, Bonds, Currencies, and Commodities.

Paragon Options is different to services that focus solely on stock options because:

- We are reducing risk through diversification across multiple asset classes

- We have exposure to markets with cleaner trends and clearer market fundamentals

- Returns are uncorrelated with equity indices

- Superior premiums are available compared to stock options

The trade setups will be taken from the twenty-five global futures and forex instruments that Stan and I look at in our Chart Chat and Daily Video Services. These positions will be custom made as each trade set up develops and comprise options across multiple time frames, strikes, and of varying quantities to give a truly unique approach.

We have enlisted the help of Matt Gardiner, who has traded in options professionally since 2001 and has a long history working as a private client adviser as well as an Interdealer Broker in the City of London. He has a deep knowledge of options, options greeks, and advanced options strategies.

Paragon Options is still in the development stages, but is now in the final stage before launch. We are introducing the service today, and at this stage, we are offering posts and information free to all, but we will be converting this into a paid service on June 25th, 2018. We will be writing a blog post every week looking at trades that we have done in the development phase from late 2017 to the present, giving you an insight into the wide range of assets and strategies we are employing. There will also be at least one webinar on the service every month going forward.

The first trade that we are looking at is below:

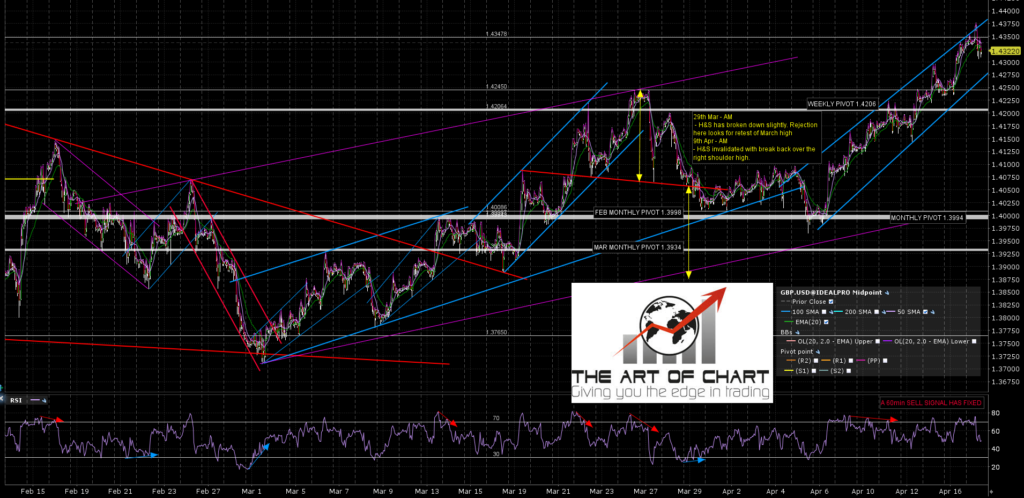

The GBPUSD Long Trade – Entered 16th March 2018

This was a very attractive long setup. The January 2018 high on GBPUSD was a possible first high of a double top and the falling wedge that formed from that high over the next two months was a very likely bull flag. The flag wedge broke up overnight on 13th – 14th March and then formed a small bull flag over the next two days into 16th March. We initiated the trade on 16th March with a risk of modest short-term downside before headed to the minimum bull flag wedge target at a retest of 1.435.

GBPUSD 60min Chart 16th March AM

Intraday on 16th April GBPUSD reached the minimum flag target at 1.435 and we exited half of the trade for a very respectable profit of 2x $3.550 = $7,100 (a 210% gain). The main scenario has another marginal higher high into 1.44 to 1.45 to the remainder has been retained against that target for now.

GBPUSD 60min Chart 17th April AM

Trade set up

As per the above trade initiation analysis, we were looking for a considerable rise in GBP against the dollar and had strong conviction that it had bottomed here. The underlying was at 139.86 and the position was opened on the 16th March 2018.

We wanted to be able to capture as much upside as possible whilst minimizing downside risk. However, we were highly confident of a turn at these levels and had a clear level at which we would stop the trade out (1.38).

2 x May 1.40 Calls

The underlying was at 139.86 as we initiated the trade. Buying 2 May 1.40 calls allowed us to have an explosive upside on the trade. They were very close to the money and so carried a combined delta of just under 100 but had potential to increase to 200 over time, effectively long 2 futures. As we were looking for a good upside move and felt a reversal was imminent, this seemed very attractive.

-1 Jun 1.38 Puts

By selling a 1.38 put in June, we were able to dramatically reduce the cost of the trade. The June option had a lot more time premium than the May and also carried less gamma. This way, if we were wrong we should be able to exit quickly without too much damage.

As you can see from the below P&L profile, a trade to around the 1.38 level would have incurred a loss of around $1220. More than acceptable considering the upside potential.

The structure

The overall structure can be seen below. The downside is unhedged and so has to be closely monitored; however, it must be noted that it would need an almost complete collapse in sterling to incur a heavy loss. The position is monitored constantly by ourselves and so we consider that the trade could get that out of hand a minimal probability.

The structure has a high opening delta of 135, and although this high delta may look risky at a glance, it is a little deceptive in that we have purchased 2 ATM calls that already carry a combined delta of nearly 100 and that delta is paid for up front, carrying no further risk. That means we only added another 35 delta from the put which also has a lower gamma as it is in June; however, as mentioned above, the higher premium from the June put enabled us to set up the whole structure for a debit of 0.0183 or $1143 in real dollar terms.

The exit of the trade

The trade was exited on the 4th of May 2018 with the underlying at 1.4375.

We can now examine the options structure as it looked on the day we exited.

2 x May 1.40 Calls

These calls had now gone into the money and their delta had increased markedly. From their opening delta of around 45, they had seen an increase to around 80. This means that from initially making us long just under 1 future (90 delta) (calls only), they now carried a delta of 160 (long 1.6 futures), a huge increase in our exposure to the upside gain.

-1 Jun 1.38 Puts

The June 1.38 put had also seen a decrease in its value, although not as large as the increase in the calls as it had less delta and gamma to begin with. This was a halving of its delta from 27 to 13.

The net effect was that our calls close to doubled in exposure and at the same time we reduced our put exposure by half, culminating in both sides of the trade moving in our favor.

Summary

We exited the entire strategy at 0.0751 or in real dollar terms $4693, from our entry at 0.0183 or $1143. This constituted a $3550 gain per 1 lot of the structure entered or 210.6%.

This trade was a completely bespoke option structure and just one example of the different approach we take to expressing our view of traded options. Over the coming weeks, we will detail more trades that we have placed, again using entirely tailored option strategies. For every instrument and view we trade, we start with just our view and a blank slate on the options side, then construct an entirely new structure to best reflect our idea. So you may find that no two trades are the same in composition. We feel this gives us a totally original approach to our trading and allows us to be entirely flexible and dynamic in our trade structures.

Consequently, there is no recognized name for this structure but it would perhaps be best described as a cross month ratioed risk reversal.

29th Apr 2018

29th Apr 2018

Hi Stan,

This service looks great! What brokerages do you recommend to trade forex options ?

Best,

Jason

Hi Jason,

Jack here. Most brokerages cover these I think. If yours doesn’t then I know IBB does all of them.