I’ve been ill or recovering much of the new year so far, as has Stan, and much of the western world as far as I can tell, and I’ve managed to keep up with my main work at theartofchart.net but this is an unusually late first post for the year.

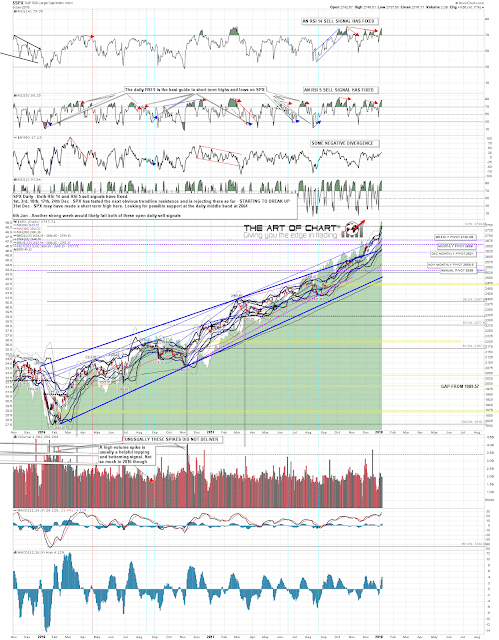

That’s not the polite cough that I’m referring to in the title though. SPX and ES have been on both daily RSI 14 and RSI 5 sell signals since the end of 2017 and a polite cough to the upside would at this stage will be all that is required to kill the underlying RSI divergences and fail those signals. We may well see that happen today, though there is at least some reason to think that bears might be able to pull off a last-minute decline to save them from that failure today.

I look at that in my premarket video this morning, though with the observation that it’s not a trade I’m taking. I’ve included the whole video today so if you’re interested you can see which other trades I do think are interesting, notably CL and KC today, and managing existing trades in ZB and NG. The part on equity indices is covered in the first five minutes. Premarket Video – Update on ES, NQ, and TF:

To fail the daily sell signals requires the respective RSIs to close the day above the initial RSI spike used in the signal. As you can see, SPX is very close to managing that. SPX daily chart:

I won’t be holding my breath waiting for a decline in equity indices today but you never know. If we do see a decline Stan and I are still looking higher afterward.

09th Jan 2018

09th Jan 2018