There has been a remarkable similarity on the patterns from last Friday’s low on all of ES, NQ, and TF, with rising wedges forming then breaking down. I was expecting consolidation to establish less steep support trendlines and in a remarkable convergence, all three of those initial rising wedges evolved into the perfect rising channel with the channel support trendlines established at the premarket spike down lows this morning. Will these make it back to channel resistance? Maybe yes; I look at options in the video below. Intraday Video from theartofchart.net – Update on ES, NQ, and TF:

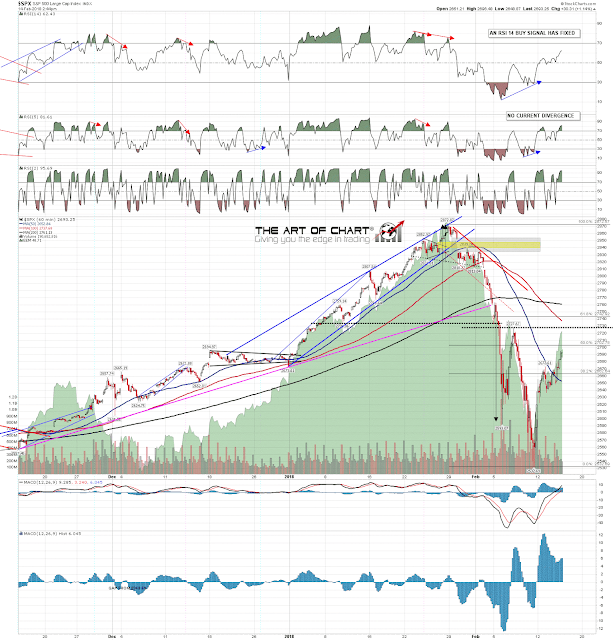

On the bigger picture, there is a possible double bottom setup on SPX here, but we aren’t expecting that to make target, as we don’t think that the retracement is done yet. What I think is more likely on all three indices is that they are rallying to establish the declining resistance trendlines that should then hold until the retracement on each is finished. That may well need to go higher than today’s highs first. SPX 60min chart:

14th Feb 2018

14th Feb 2018