Stan and I are doing our monthly free public webinar on the Big Five and Sectors after the close tonight and we’ll be looking at AMZN, AAPL, FB, NFLX, TSLA, IBB, IYR, XLE, XLF, XLK, and XRT. If you’d like to attend, you can register for that on our April Free Webinars page. We are also, of course, doing our monthly free public Chart Chat on Sunday and you can register for that on the same page.

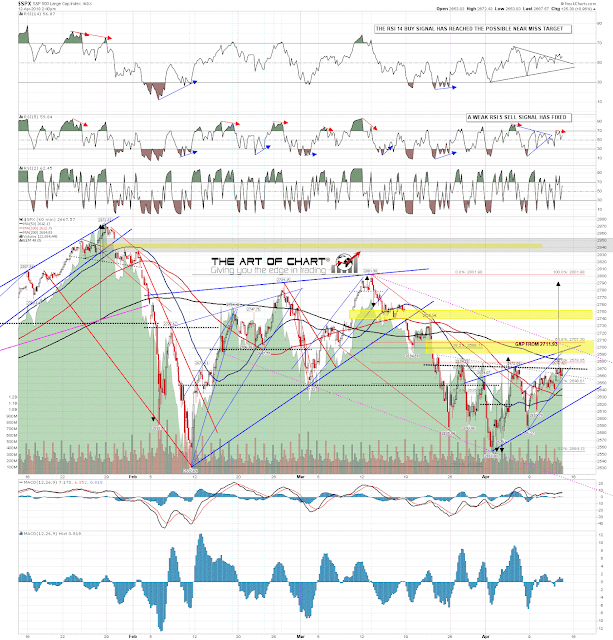

The possible triangle resistance on SPX broke and ES and SPX have both broken their respective IHS trendlines at the highs today, so all of ES/SPX, NQ/NDX, and TF/RUT have now broken up from their IHS necklines. This is the inflection point I was looking at in Chart Chat on Sunday and if this is going to be a Janus bear flag reversal, then I’d expect a failure here or not too much higher. If the IHSes are for real, then the respective targets on SPX/NDX and RUT would be in the 2792, 6920, and 108 areas respectively. I’ll be taking the bull targets seriously if SPX reaches 2712. Intraday Video from theartofchart.net – Update on ES, NQ, and TF:

SPX 60min chart:

12th Apr 2018

12th Apr 2018