It is the first day of May today and ES, NQ, & TF started the day testing the new monthly pivots at 2639, 6596 and 1540 respectively. This is an important inflection point and the historical stats for the first day of May lean bullish.

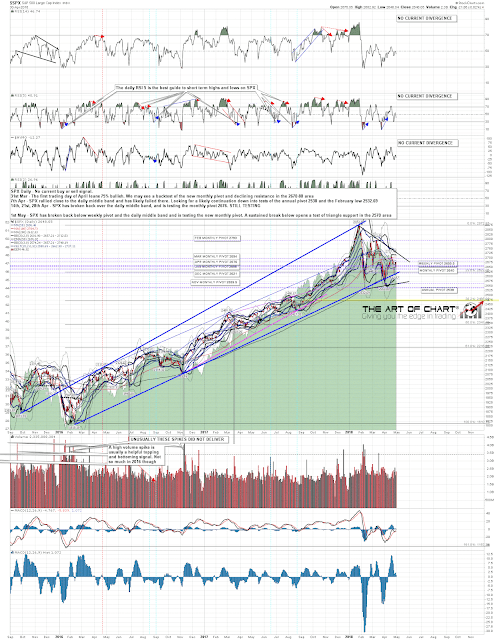

On a conviction break of these monthly pivots, the next obvious target on SPX is triangle support in the 2570 area, with a possible shot at the open Three Day Rule target at the retest of the April low at 2553.

On a failure to break down with conviction through the new monthly pivots the triangle forming since the start of February may be complete. The obvious next moves would be a thrust up through triangle resistance, currently in the 2725 area, then a backtest from that high back into the triangle, and then a thrust up that at minimum retests the all-time high.

The better odds move should be 2570 next, and the bears are starting the day strong so we will see how that goes. Premarket Video from theartofchart.net – Update on ES, NQ, and TF:

Here is the bullish triangle shown on the SPX daily chart. SPX daily chart:

Tomorrow will be the middle of a low window on SPX and we are expecting some kind of significant low within a couple of days of that. The window for that low is, therefore, this week and this could be that low forming today. If not we will be looking again in the 2570 area, which we would expect to see tested this week.

01st May 2018

01st May 2018