I was talking on yesterday morning’s video about the triangle breaking down on NQ, saying that the classic triangle sequence would be for the initial break to find a low, then reverse back up into the NQ triangle, and then do the main triangle thrust down. So far NQ is following that sequence and should now be topping out on the backtest into the triangle to start the main triangle thrust down.

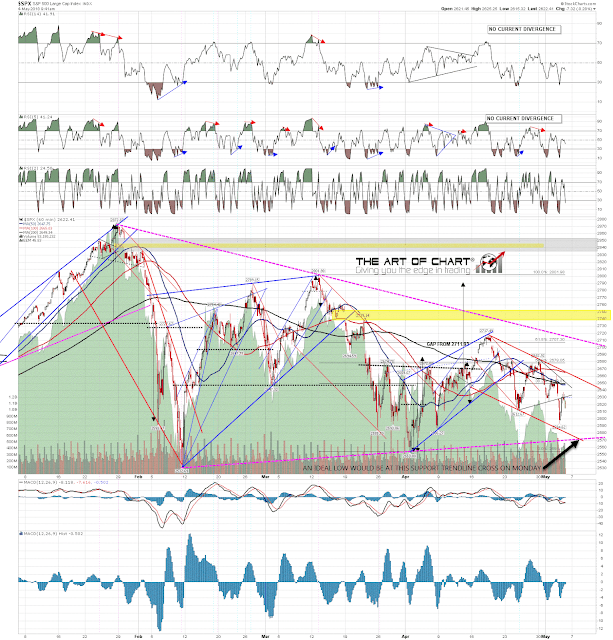

In the short term there is a case for ES to test a short term resistance trendline in the 2636 area before moving down towards double trendline support in the 2570-5 area, which ideally would be hit on Monday. We’ll see how that goes.

On this scenario ES should not break over the monthly pivot at 2639 and the key bull/bear line is falling channel resistance now in the 2662 area. Partial Premarket Video from theartofchart.net – Update on ES, NQ and TF:

The double support hit on SPX that would ideally be hit on Monday is shown on the chart below. On the video I talk about the possible alternate scenario where that support is broken with conviction. SPX 60min chart:

Stan and I are doing our monthly free public Chart Chat on Sunday looking at the usual wide range of tickers over world equity, bond, commodity and forex markets. If you’d like to attend you can register for that on our May Free Webinars page. If you are following our new Paragon Options project then I do another post late yesterday which you can see here.

04th May 2018

04th May 2018