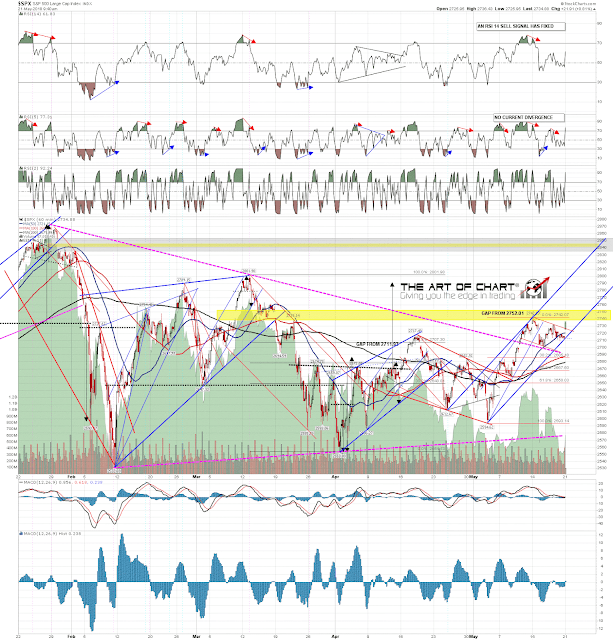

I was concerned on Thursday that SPX would fail to do the obvious second leg down on the likely overall bull flag forming here, and in all likelihood SPX has now broken up from that bull flag. Confirmation that SPX is going up directly comes on a fill of the open island top gap from the mid-March high at 2752.01.

I’m leaning against another leg down here but if the bears are going to have (yet) another try at that, then first support is at the ES weekly pivot 2718.25 (same area on SPX), then a break of rising support from the mid-May low, now in the 2712 ES area.

I uploaded the full premarket video this morning by mistake, so this is going to be the full version that I post this week, as I try to only post one of those each week. Full Premarket Video from theartofchart.net – Update on ES, NQ and TF, and CL, NG, GC, HG, ZB, KC, SB, CC, ZW, DX, EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCAD:

One thing I look for in a situation like this, when a break up or down is happening earlier than expected, is whether a high quality pattern might be forming, and indeed a high quality rising channel has now been established from the 2594 low. Channel support is now in the 2714/5 area, and if that holds then I’d note that channel resistance is now in the 2790 area. SPX 60min chart:

We are starting our second Academy Trader Boot Camp tonight in a webinar an hour after the close. The feedback from the last one was very positive and if you’d like to see that then scroll down to the bottom of our Testimonials page to find those. If you’d like to take this very reasonably priced and high quality four week course on TA, risk management and trading methods, there are still places available and you can sign up for that here until the RTH close today.

21st May 2018

21st May 2018