I was making the argument before the open this morning that equity indices were so close to obvious resistance on NQ, RTY, DAX and ESTX50, that ES might well deliver a lower high this morning and fail hard there. So far that has delivered though this morning’s high might need a retest.

Premarket Video from theartofchart.net – Update on ES, NQ, RTY, DAX, ESTX50, SPX, NDX, RUT, CL, NG, GC, SI, HG, ZB, DX:

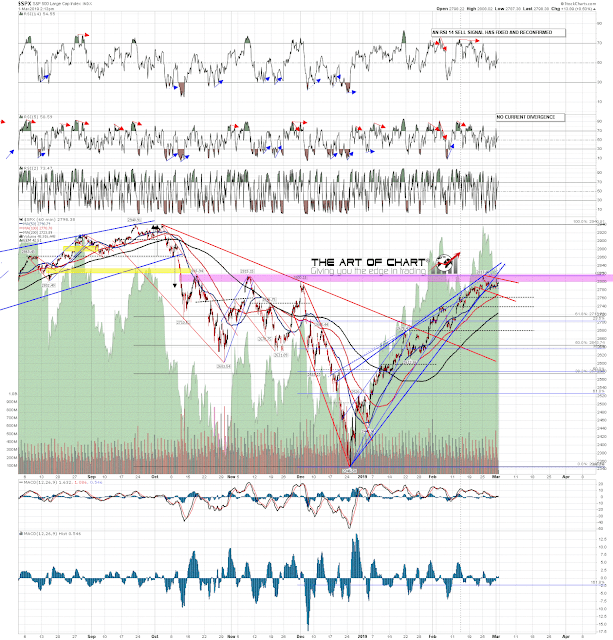

If this morning’s high area holds, where might SPX be headed next? Well if a bull flag is forming here to set up a high retest before a larger retracement, then the obvious next target would be the 2760s, with some established support in the 2760 area and a possible flag support trendline in that area.

SPX 60min:

Could the retracement go further? Yes, I’m looking particularly at the H&S on RUT, with a target in the 1540 area on a break down. That could be a match with the ES/SPX target area though. Bigger picture the setups, particularly on DAX and ESTX50 are suggesting lower than these levels soon.

RUT 60min:

Stan and I are doing our monthly free public Chart Chat on Sunday, looking at the usual wide range of equity indices, forex, bonds, metals and commodities. If you’d like to attend you can register for that on our March Free Webinars page. Be there or be unaware! 🙂

01st Mar 2019

01st Mar 2019