The research I am doing on the 45dma over the last 25 years is a bigger job than I expected so I should have the post out on that next week.

In the short term though, equity indices have been looking pretty interesting and and are at a significant short term inflection point here. The first part of that is that the daily middle band was tested on SPX at the current low today, and that is the key short term support level. There have been a couple of breaks below that in the last few weeks but there has been no daily close below it since SPX broke back over it in early November. If seen, a clear daily close below it would be a significant technical break. Without that break, a retest of the current all time high would be the obvious next target.

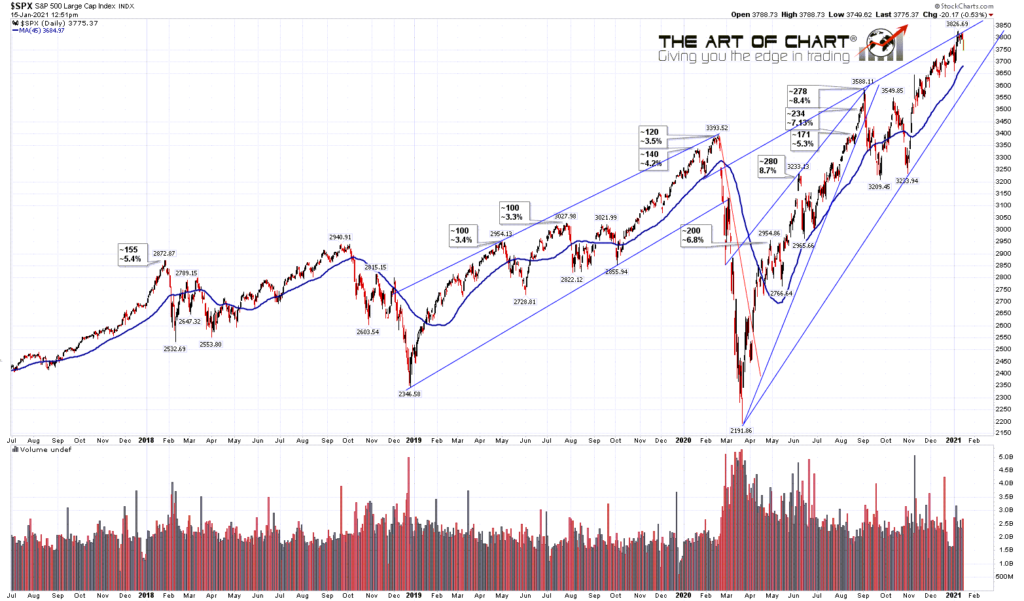

SPX daily chart:

If we were to see a break below the daily middle band then the obvious next target would be the mean reversion to the 45dma, currently at 3684. That is a significant level for other reasons that I will be coming to further down.

SPX daily 45dma chart:

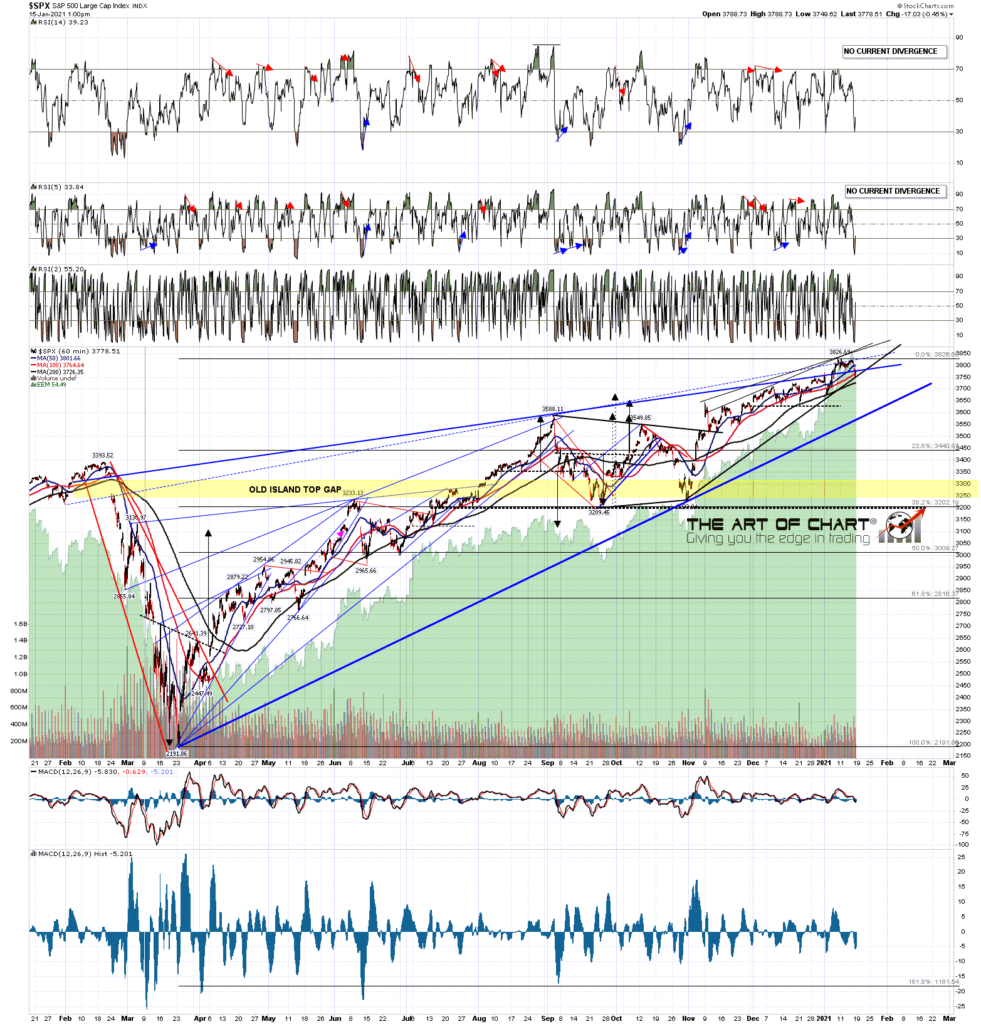

On the SPX hourly chart we are seeing a test of short term rising support, which I’ll be looking at in more detail on the 15min chart below, and a break below would open a possible test of rising wedge support from the March low, currently in the 3570 area, and that would be the obvious next target on a break and conversion of the 45dma to resistance.

SPX 60min chart:

The SPX 15min chart shows the short term pattern setup here very well. You can see that the low today delivered a perfect test of the smaller rising wedge support from the early November low. You can also see that there is a part formed H&S that on a sustained break below 3750 would look for the 3670 area, not far below the 45dma level. If SPX continues back up here then an obvious target would be wedge resistance, now in the 3845 area.

Shoutout to my friend Suz Buckles who spotted the part formed H&S. Many trained eyes make light work. 🙂

SPX 15min chart:

Looking at the NDX 15min chart there is a strong pointer towards a break up from this inflection point as while that wedge from the early November low has broken down, the pattern from the current high is a very well formed bull flag falling wedge, so I think the short term odds favor a break up into all time high retests.

NDX 15min chart:

If we do see that break up into all time high retests, what then?

Well there’s a very interesting analog that I spotted on the SPX 1min chart on Wednesday and have been following since. I was noting on my premarket video at theartofchart.net yesterday morning that the rising wedge there was very similar in form to the rising wedge from the March low, and that patterns on every timeframe are the same, just obviously playing out a lot faster on shorter timeframes. I also noted that the wedge had overthrown so in exactly the same way as the hourly wedge, with a break over wedge resistance, a backtest of broken wedge resistance and then a lower high, and wondered if we might see the same on SPX on the larger wedge yesterday, which we did.

The 1min wedge then broke wedge support, retested the high, formed an H&S, made the H&S target and retraced the full rising wedge and more. That may or may not happen on the larger wedge but this is a good example of how a decent quality rising wedge behaves, with the proviso that these deliver fibonacci retracements in the 38.2% to 61.8% range when these form as continuation rather than termination patterns, and it is not yet clear which of those the larger rising wedge from the March low is, though it is very likely to be either one or the other.

SPX 1min chart:

The jobs and retail data this week was grim, which was not unexpected, and Joe Biden announced his intention to add $1.9 trillion of stimulus after his inauguration, which didn’t have any significant impact on SPX, which was both unexpected and very interesting. Perhaps the flood of liquidity and stimulus is no longer having the impact that it has been having to date. If so, we could finally be topping out for at least a decent retracement here, which is certainly what the pattern setup is strongly suggesting.

In the short term though, on this pattern setup I’d give 60% odds of a retest of the all time highs from this inflection point on SPX and NDX. If we see a break down instead then the obvious main target below would be in the 3570-3600 area. If seen we might well still see a retest of the all time high from there as part of a larger topping process.

We are running our next Trader Boot Camp at theartofchart.net starting 18th January and this is extremely competitively priced and covers a lot of territory. If you’re interested you can read more about that here.

Stan and I did two public webinars at the end of December looking at prospects across a wide range of markets and you can see both of those posted on our December Free Webinars page. We also did our free monthly Chart Chart on Sunday and if you would like to see that, it is posted on our January Free Webinars page.

Stan and I are doing a free webinar tonight at theartofchart.net and that is looking at interesting trades on commodities using (mainly) options strategies. If you’d like to attend you can register for that here, or on our January Free Webinars page, where it is listed for 5pm EDT yesterday, as we had to delay the webinar a day due to a conflict.

15th Jan 2021

15th Jan 2021