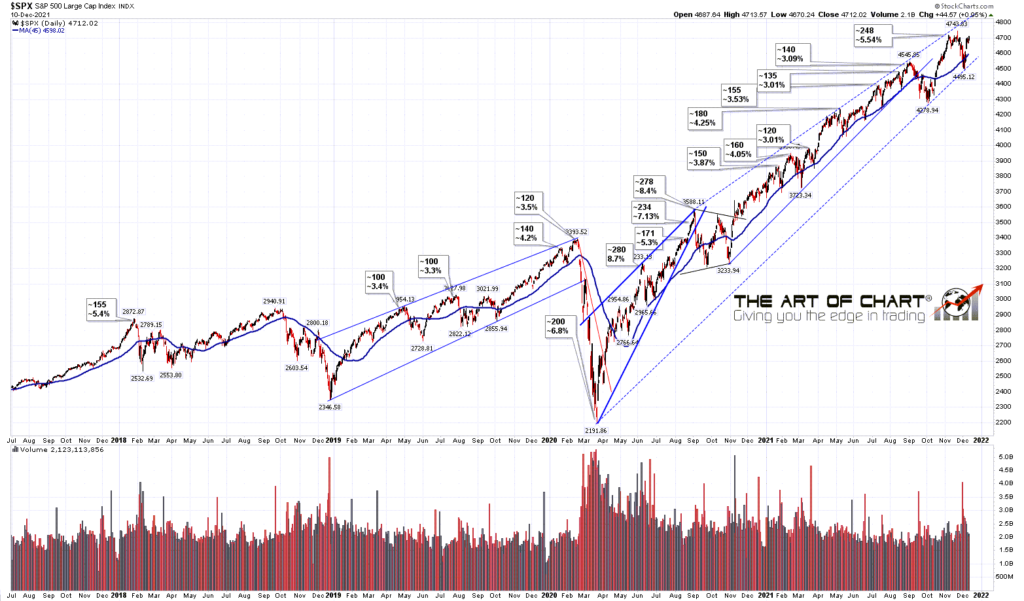

SPX did the lower low I was expecting in my last post and found support at the rising support trendline from the March 2020 low, as I had suggested it might.

The strong rally since then is now within striking distance of a retest of the all time high, and if seen, the normal range for the next high of 3% to 4.5% above the 45dma, now at 4598, would now be in the 4736 to 4805 range. That is particularly interesting as that range includes the retest of the all time high at the lower end and I have the main resistance trendline on SPX at the upper end in the 4800 area.

SPX daily vs 45dma chart:

The SPX 60min chart is the most interesting here though. In terms of support the retracement low was a slight break of the rising support trendline from the March 2020 low, leaving a possibility in the mix that a topping pattern is forming here to follow through on that slight break.

On the resistance side I redrew the SPX resistance trendline to include the last high, and that trendline is a very strong four touch resistance trendline. That is wedge resistance, and if we see SPX continue higher after a retest of the all time high then it is there that I would be expecting strong resistance. As I mentioned higher, the upper end of the normal topping range against the 45dma is currently in the 4804 area, and that resistance trendline is now in the 4800 area. If we see a test of that trendline then that will reconfirm that the wedge is still forming, and we should see a high form there to take SPX back towards that rising wedge support, currently in the 4500 area.

SPX 60min chart:

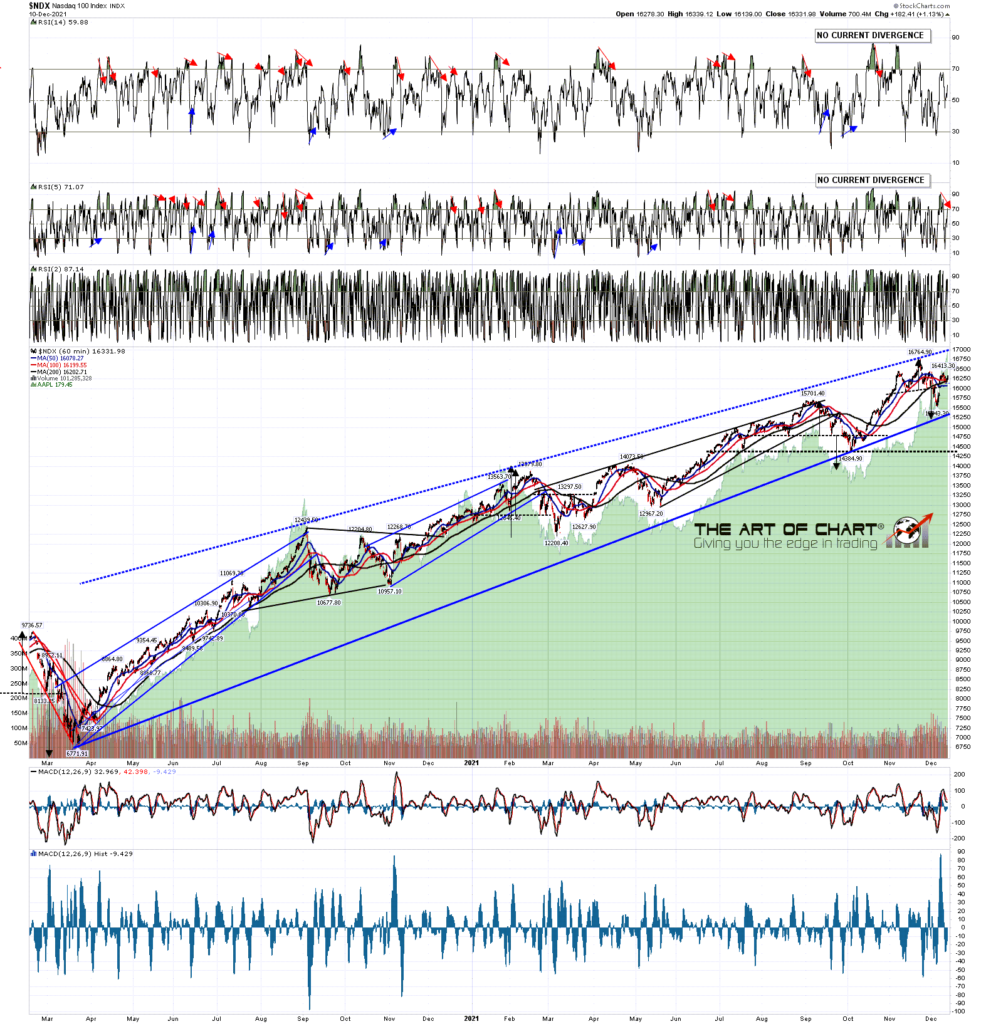

NDX is also looking interesting here, mainly because the H&S that broke down there never made the target in the 15,200 area,, and that target is therefore still open unless and until the H&S fails, which would be on a break back up over the right shoulder high at 16,454.60. If we see that break, then the target from that break would be a retest of the all time high on NDX, so I’m watching that with particular interest.

NDX 60min chart:

In the short term there are three main options on SPX here, and decent arguments for all of them, though for obvious trading reasons I would prefer to see the test of the main SPX resistance trendline in the 4800 area.

The first option is that SPX has been doing wave B of an ABC bull flag sequence and is about to start a C wave down to a lower retracement low, before a likely all time high retest after that. If SPX is going with this option I would expect the B wave high very shortly.

The second option is that SPX is going to retest the all time high, and that is the second high of a double top that on a sustained break below 4495 would look for a target in the 4250 area. If SPX takes this option I’d be looking for a likely high before Xmas.

The third option is that SPX heads for that resistance trendline currently in the 4800 area, but rising of course. That would be the best fit with seasonality here and, if seen, I’d be looking for the sharp retracement in early January that is seen two or three times in most decades. This would be my preferred option as it would likely be the easiest and most profitable to trade.

A larger high may be forming here, and I’d refer back again to the backtest scenario that I was looking at in my post on Friday 6th August. This could be setting up for that backtest here and I’m watching for a possible larger topping pattern to form that could deliver that target.

We are doing a free public webinar at theartofchart.net an hour after the RTH close on Thursday on the Big Five and Key Sectors and if you’d like to attend you can register for that here, or on our December Free Webinars Page.

12th Dec 2021

12th Dec 2021