I was looking at the equity indices on Sunday, and there were decent looking short term bull flags across the equity indices. These were a good indicator for a rally high retest next but they only break up about 70% of the time. The rest of the time they break down or evolve into larger flags and these broke down.

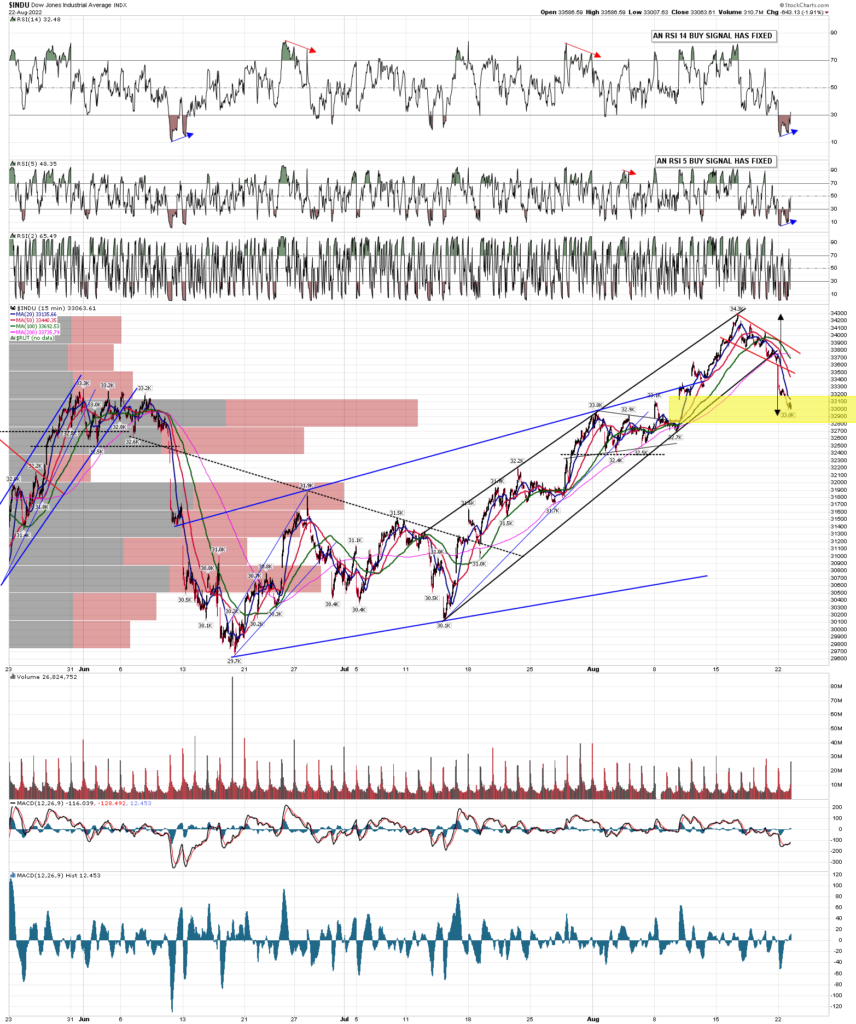

I’m showing the SPX 15min chart below and I have marked the flag target in at about 4100. That wasn’t quite reached yesterday but there is a lot of positive divergence established here and there are fixed 15min RSI 14 and RSI 5 buy signals on all of SPX, NDX, IWM and Dow. There are also hourly buy signals fixed on ES, NQ, RTY, YM, DAX and ESTX50. The odds of seeing a decent rally attempt starting in this area are high. We might see a test of the 4100-20 area on SPX first.

The rally target should either be the ideal H&S right shoulder area around 4186 SPX or, if we see a really strong rally, a possible retest of the rally high. A fill of yesterday morning’s opening gap at 4218.70 would make a rally high retest at 4325.28 considerably more likely.

SPX 15min chart:

Looking at the SPX 45dma, this retracement is very unlikely to be finished, so if we do see rally high retests then I’d be expecting those to be the second highs of small double tops. The 45dma is now at 3991 and I’m expecting it to be in the 4025-50 area by the end of this week. This move should deliver at least a near miss backtest of the 45dma and usually a full test or break below.

SPX daily 45dma chart:

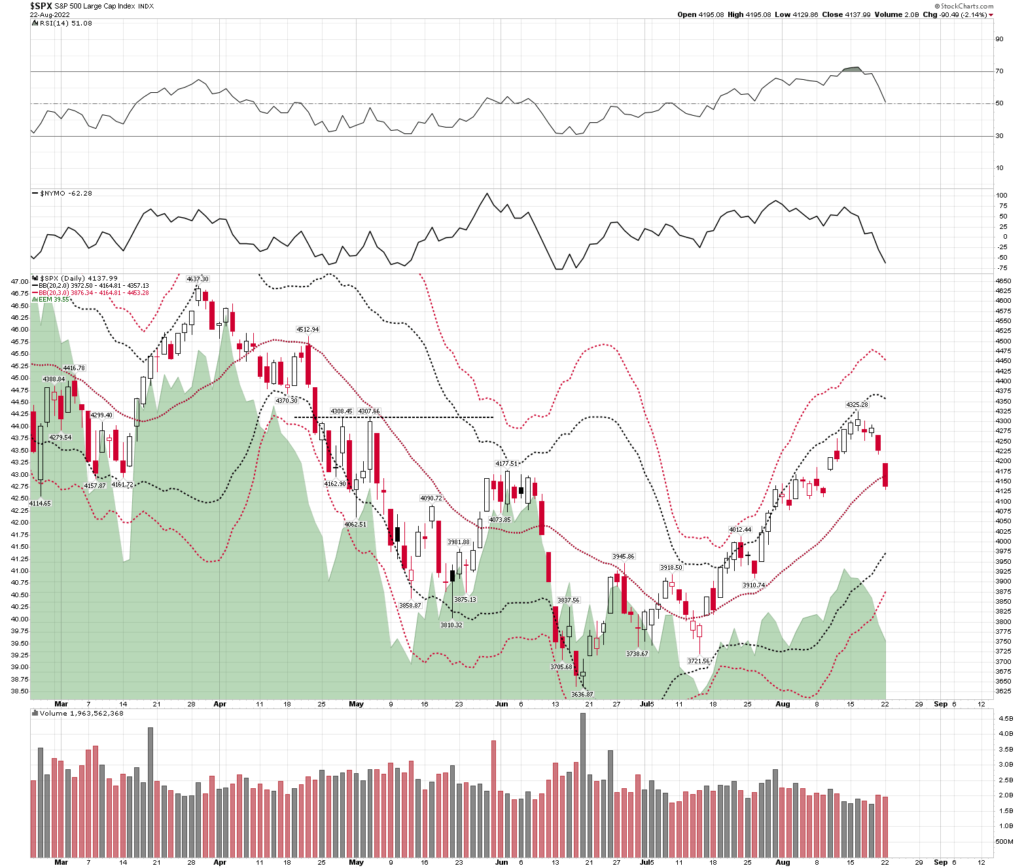

Looking at the SPX daily bands, the middle band, currently at 4164, was broken with some conviction yesterday. Obviously there is a decent chance of seeing a rally today. If we were to see a reversal candle today, ideally closing in the 4200 area or higher, that would be a rejection candle, and would greatly increase the chances of a rally high retest. If we see a confirming close below the middle band today, that would favor continuation directly downwards.

SPX daily BBs chart:

The retracement I was looking for has started and is unlikely to have finished. If we see a break and conversion of the 45dma on SPX, then it may just be getting started.

I am looking for at least a decent attempt at a rally today, and will be watching the close today with great interest as it may tell us a lot about what we should expect to see next.

We are doing our monthly free public Big Five & Key Sectors webinar at theartofchart.net at 5pm EDT on Thursday 25th August. I will be looking at the bull flag setups on most of these as well so that should be interesting. If you’d like to attend you can register for that here or on our August Free Webinars page.

My final divorce hearing is on Wednesday and Thursday this week, so I will try to do a post on Friday morning before the open if I can. If not my next post will likely be on Monday before the open.

23rd Aug 2022

23rd Aug 2022