In my post on Friday I was looking for a fail at the backtest of the 4200 SPX area, and a break down from the H&S patterns forming on the US equity indices and we saw that fail and all the H&S patterns broke down. None of those have yet made target.

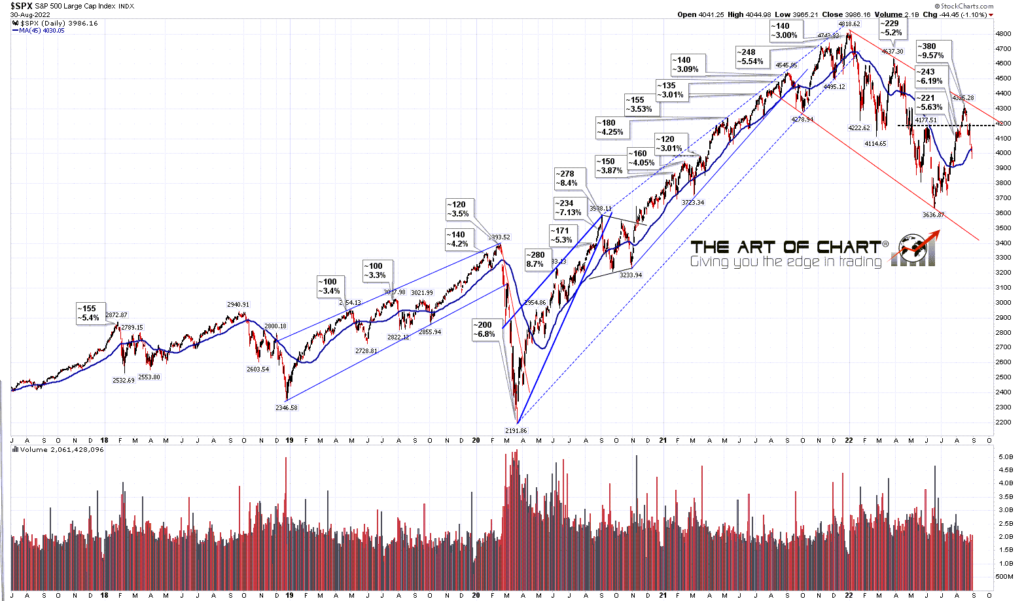

SPX has broken back below the 45dma, now at 4030.05, so the reversion to the mean move has been completed and I won’t be posting this chart again for a while.

SPX daily 45dma chart:

Normally at the end of the month the last day of the month leans bearish and the first day of the month leans bullish. That’s not the case at the end of August though, with the last day of the month leaning 61.9% bullish and Thursday and Friday this week leaning mildly bearish. I am definitely wondering about a possible rally attempt today so we’ll see how that goes.

My next post should be on Friday before the open.

31st Aug 2022

31st Aug 2022