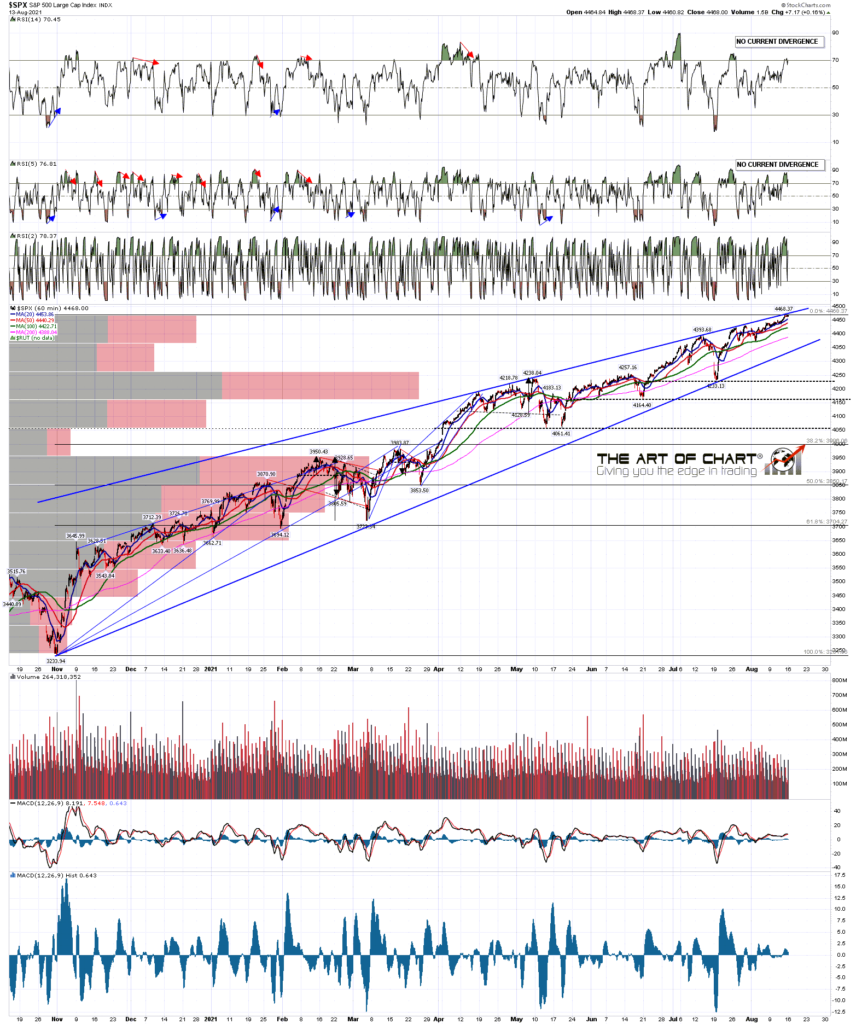

I was looking at the resistance trendlines on SPX and NDX last week and while I was off on Friday SPX tested the resistance trendline there. Of those four signals, only ES hasn’t yet made the possible near miss target, though it isn’t far away, and may well reach that this morning without declining much further.

SPX 60min chart:

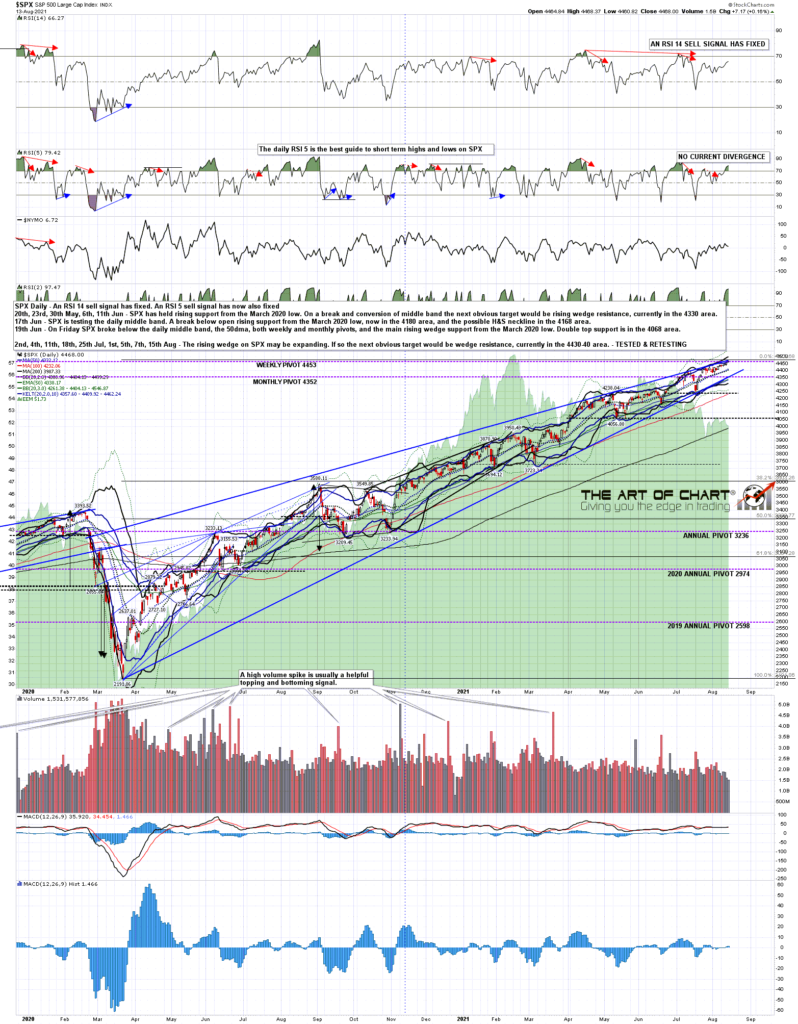

On the daily chart the RSI 14 sell signal is still open, but the RSI 5 sell signal failed last week. This high would be improved by a retracement here and then a retest of Friday’s highs to set up the RSI 5 negative divergence again.

If SPX drops directly from here then key support is at the daily middle band, currently at 4404. A sustained break below opens the downside.

SPX daily chart:

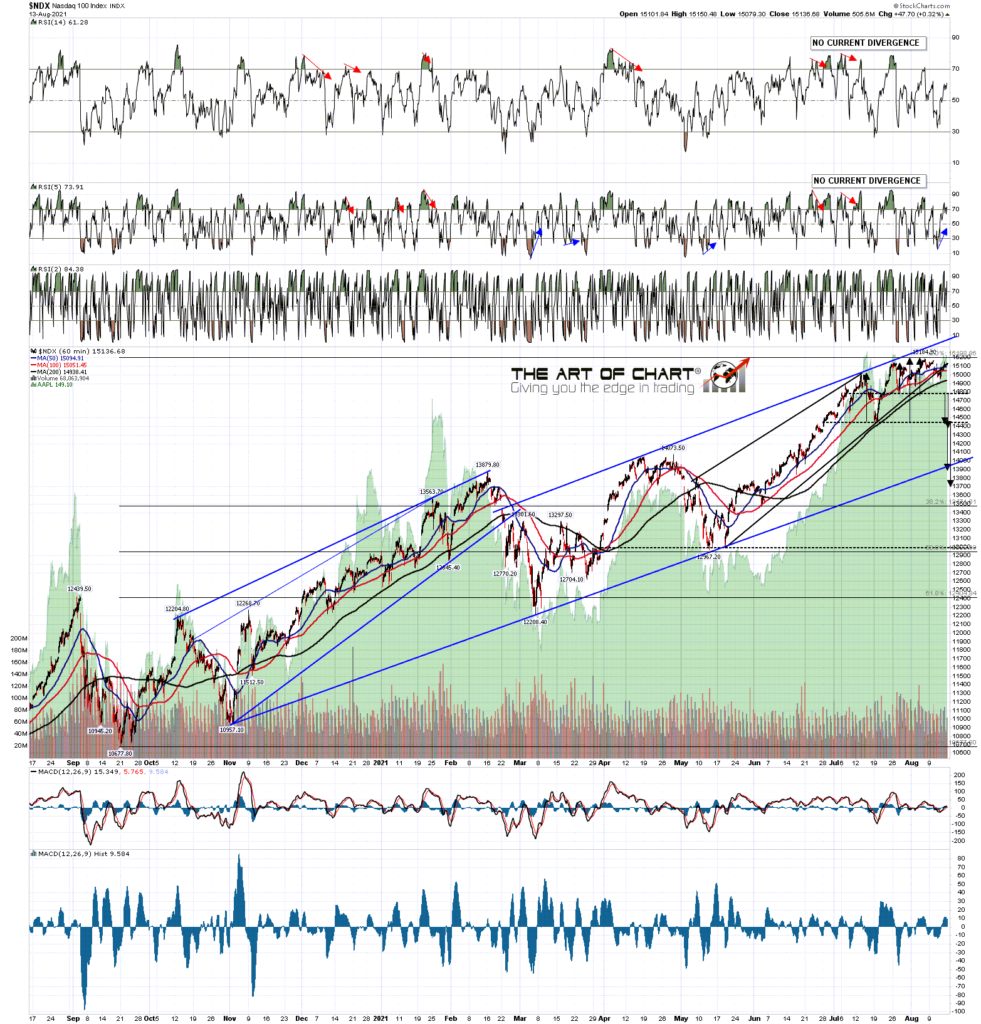

NDX didn’t reach the resistance trendline, which isn’t needed, and didn’t retest the current all time high, which might be needed, though not for negative divergence.

As the setup already stands though there is a very decent looking nested double top setup on NDX that on a sustained break below 14800 would look for the 14400 area, and then on the larger patter on a sustained break below 14465 would look for the the 13700 to 13900 area. That would be a modest retracement of the move up from the November low, and could play out directly from here.

NDX 60min chart:

On the NDX daily chart RSI 14 and RSI 5 sell signals are already fixed. Key support is at the daily middle band, currently at 15006. A sustained break below opens the downside.

NDX daily chart:

I would love to see a retracement start here that would deliver the 3800 area retest scenario that I was looking at in my post on Friday 6th August. If not though I would be looking for a minimum reversion to mean backtest into the 45dma, currently in the 4343 area.

An hour after the close on Thursday we are holding a free public webinar on trading commodities at theartofchart.net and will be outlining the usual three possible option trades on interesting looking commodities there. If you’d like to attend you can register for that here, or on our August Free Webinars page.

16th Aug 2021

16th Aug 2021