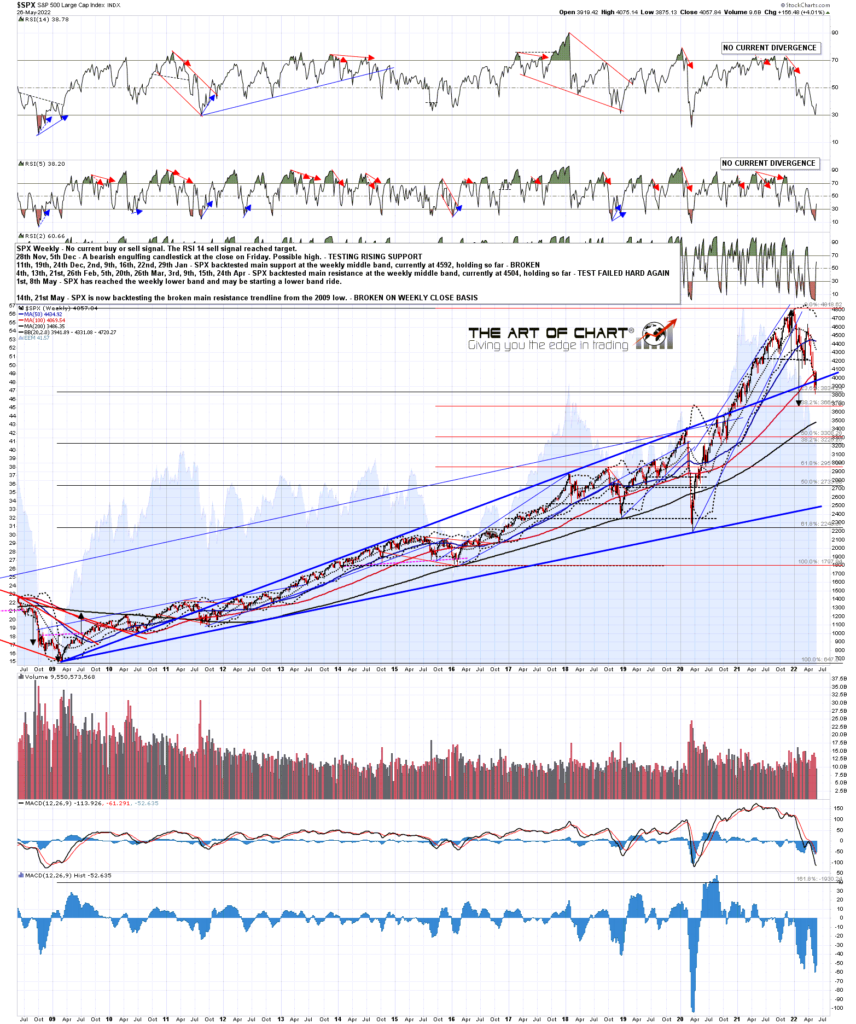

SPX closed below the main SPX support/resistance trendline at the end of last week. This trendline has broken twice since 2009, and both times SPX followed through hard. In 2011 SPX broke very hard through it and never broke back over it until until 2020. In 2020 SPX broke over it, then closed the next week back below, and then didn’t close back below it again until last week. This is too limited a sample to extrapolate much from but there is precedent for failing to confirm the break the following week and then following through the break and so the likely weekly close back above today has precedent from 2020 and is not an obviously bullish development.

I was asked yesterday whether it is significant that SPX is back over the trendline and I replied that the importance of the trendline is mainly that the break below it effectively killed off the very bullish scenario that I was talking about in my post of 6th August 2021 as that required a more precise backtest to confirm the pattern setup. It may still hold on a less precise basis and the bull flag setups here on many indices and stocks still look good.

I added though that last week’s low provisionally killed it off as support, and that a clear conversion of that trendline to resistance next would look very bearish indeed, and open both considerably lower targets, and the possibility that the trendline may become strong resistance for the next few years, as it was between 2011 and 2020.

SPX weekly chart:

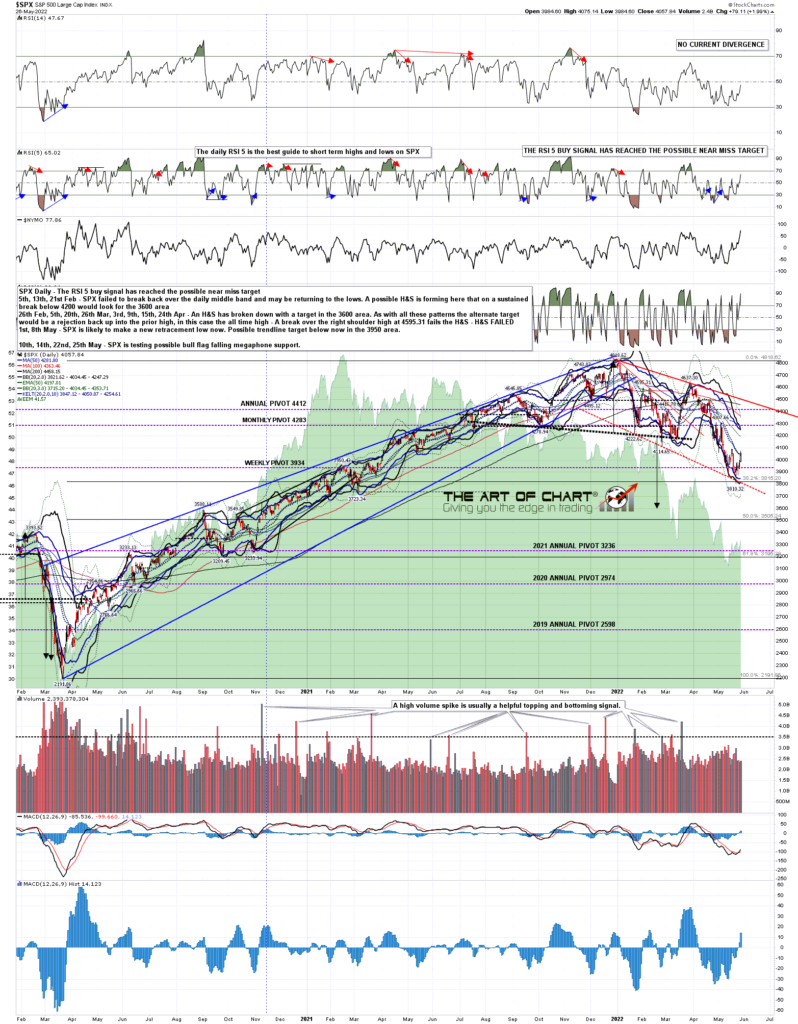

On Monday I was talking about the possibility that there might be a significant rally this week and then on the bullish tape around the holiday on Monday and so far that has delivered a test and daily close break over the SPX daily middle band. That’s promising for this rally to extend into next week.

As I mentioned on Monday the stats for this week were decently bullish, with historical stats of 61.9% for a green close today, and strong bullish stats of 71.4% and 76.2% respectively for the first two trading days of June on Wednesday and Thursday next week. Tuesday and Friday next week both lean very slightly bearish at 47.6% green closes historically but overall the week leans significantly bullish, as you’d expect for a holiday week that includes the first trading days of the month.

In that time I’m thinking that SPX may convert the daily middle band, now at 4034, to support, and head up to test main resistance at the weekly middle band, now at 4331. I would note that, after the clear break back above the daily middle band at the close yesterday, if we were to see a clear close back below it today then that would be a bearish rejection.

SPX daily chart:

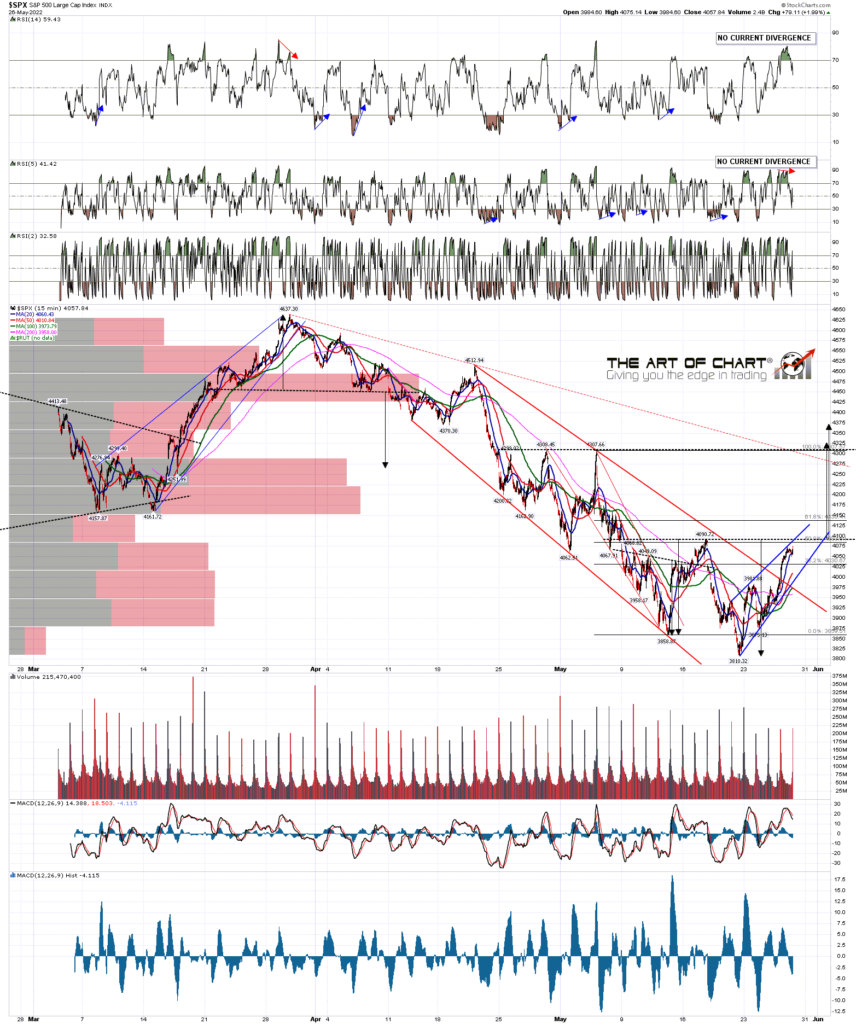

In terms of the short term pattern setup there is a clear inflection point here. On the bull side there is the break over the daily middle band yesterday and a clear double bottom setup on SPX that on a break and conversion of double bottom resistance at 4090.72 would look for a target area 4325-75, taking SPX back into the weekly middle band test.

On the bear side on SPX there is a clear rising wedge from the retracement low that may be a bear flag, and on the break through the resistance or neckline on any double top/bottom or H&S there is an inflection point where SPX or the instrument that broke through may either reject back into the previous high or low, or head to the pattern target.

There is also a lot of negative divergence here. On the six equity index futures charts that I watch every day there are possible 60min sell signals brewing on four of them, and with a little rally further up this morning there would be possible 60min sell signals brewing on all six of them. This is a very much a possible point of failure for equity indices, and while delivering a break down is harder to deliver on historically bullish days and around holidays, we have seen strong declines start from similar circumstance before this year so far and might see that again now.

In the meantime there are good bull and bear scenarios here and equity indices have a decision to make.

SPX 15min chart:

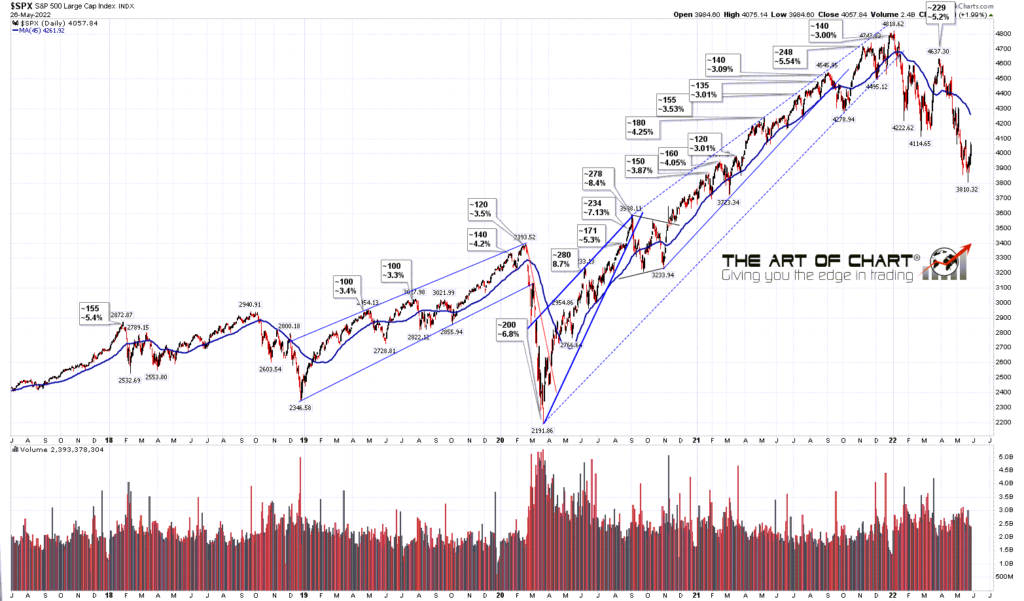

I’ve been asked about reversion to the mean from here and if we see a return to the 45dma then that is now at 4261. I explained though that the distance from the 45dma is more important when SPX is above it, simply because except for a period like the bullish spike up after the 2020 low, bearish moves tend to be more violent that bullish ones, which tend to mature into a grind upwards.

That is the reason that every bubble showing the distance from the 45dma on the SPX daily chart below is above the 45dma. The moves below the 45dma are too variable for this to be a meaningful indicator on bearish moves.

SPX daily vs 45dma chart:

My last chart today is for TSLA, where the possible bull flag falling wedge setup has overthrown bullishly and a strong daily RSI 5 buy signal has fixed. That too is an inflection point testing the shorter term falling wedge resistance and a break up from that would be bullish.

I know that TSLA is a controversial stock with much impassioned debate about it, and Elon Musk’s social media posts add a large slug of randomness to the TSLA tape, but I just look at the charts, and this is a bullish looking setup. There are many others like it suggesting that even if equity markets have much lower to go, there is a decent chance that we might see some all time high retests before that happens.

TSLA daily chart:

This is a holiday weekend and on SPX the historical stats lean 61.9% bullish today, 47.6% bullish on Tuesday which is the last trading day of May, 71.4% and 76.2% on Wednesday and Thursday which are the first two trading days of June. The next historically significantly bearish trading days are on Thursday 9th and Friday 10th June. There is a natural window here where we could see SPX test main resistance at the weekly middle band so we’ll see if that happens.

In the event that the SPX daily middle band is broken and converted to resistance now, that would be bearish and suggest that SPX may proceed directly to a new retracement low, though there would still be a possibility that an IHS right shoulder might be forming, with an ideal low target in the 3858 area.

We had to delay yesterday’s webinar so we are now doing our monthly free webinar at theartofchart.net on Big Five stocks and (eleven) Key Sectors an hour after the close on Thursday 2nd June, and if you’d like to attend you can sign up for that here.

I also want to mention again that our Follow The Leader service at theartofchart.net is up 100% so far this year. The technology to support this service is provided by our partner, GFF Brokers. GFF Brokers is an authorized broker for the World Cup Trading Championships Advisor programs. The profits on that so far this year on the nominal account of size at $25k would be enough to pay the Triple Play subscription for ten years. If you’d like to have a free trial of the Triple Play service you can find that here.

27th May 2022

27th May 2022