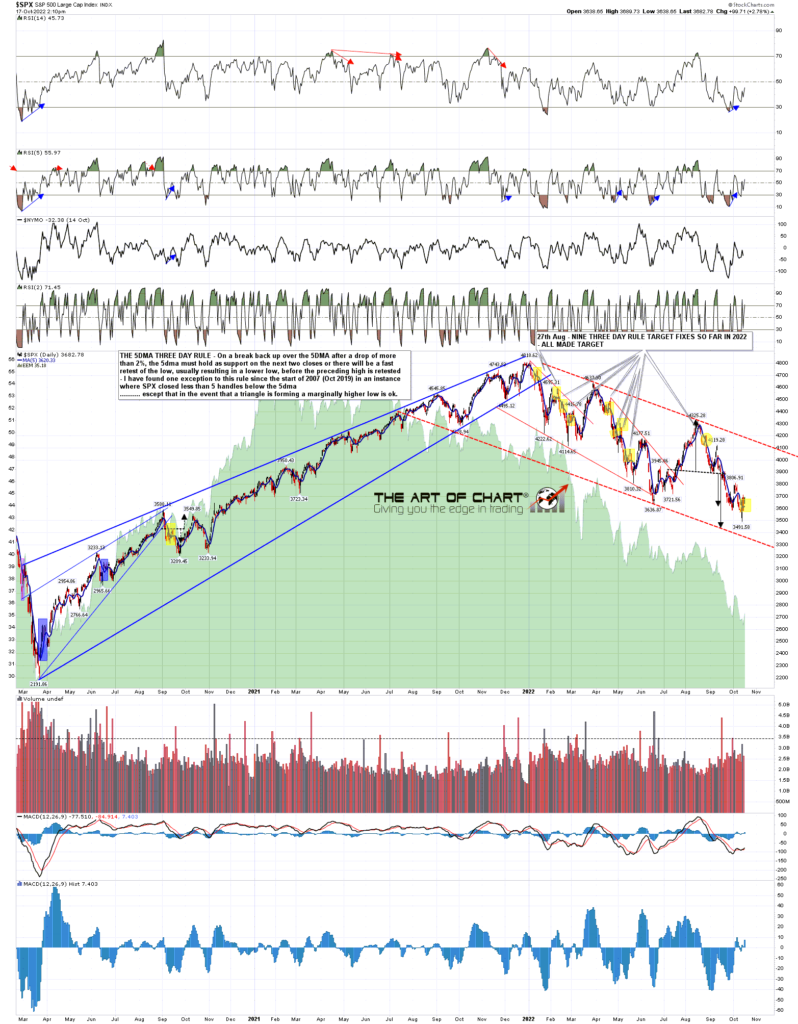

On Friday morning I was writing that SPX went back onto my Three Day Rule on the break back over the 5dma at the close on Thursday night. Under that rule, if either of the next two closes delivers a clear break back below the 5dma, then the prior low, in this case 3491.58, will be retested before the prior high, in this case 3806.91. There was a clear close back below the 5dma on Friday, so that is a fix on the rule.

Now this is the most impressive performing market stat that I have ever seen anywhere about anything. There have been nine previous fixes so far in 2022, all of which made target and I’d estimate somewhere in the region of 100 – 200 fixes since the start of 2007, which is as far back as I looked when I first investigated this in 2011/2. With a minor rule fix in 2019 requiring a clear close below the 5dma for a fix, every one of those has made target barring a couple of very near misses when a triangle has been forming at the low.

So, coming to the title, is it a certainty that 3491 is retested before 3806? No. There is no such thing as a sure thing in the market, and a perfect stat is just one where there has been no exception yet. Is that exception likely to be here? No. There is a strong likelihood that 3491 will be retested before 3806 and the closer SPX gets to 3806, the more attractive the short back to 3491 becomes.

SPX 5dma chart:

On the weekly chart there was a close 16 handles below main support at the 200 week MA. That was interesting but not the conviction close needed for a solid break. Apart from the 2020 crash though, it was the first close below it since 2011. I think a stronger break below is likely soon.

SPX weekly chart:

There is a fair amount of positive divergence looking higher here, but on the other hand the Three Day Rule tells us that 3491 should be retested before 3806. No stat can deliver every time, but the history tells us that the market will very likely be turning down again shortly.

My next post should be on Thursday or Friday before the open.

17th Oct 2022

17th Oct 2022

Fascinating study. Thank you for sharing.