It has been a few weeks since my last post, as I’ve had a lot of stuff to sort out. That’s pretty much done & I have returned.

As it happens, this doesn’t look like a bad time to be coming back. My speciality is patterns and reversals and we have some nice patterns and potential reversals forming on NDX and SPX here. They might just deliver yet another break up, but for now we have a decent looking inflection point, and what might be a pretty decent reversal brewing here.

On the bigger picture I was saying at the start of the year that presidential election years in the US tend to lean bullish, and that has certainly been delivering so far in 2024. I’m not really expecting that to change, and if we do see a retracement here, I’d be leaning towards that being a bullish retracement, with at minimum likely all time high retests to come after that completes.

For the last few weeks this move up has been very narrow. The Russell 2000 high in 2024 was made in late March, and there has been no new all time high (ATH) since 2021. The Dow Industrials have made new all time highs this year but the last was a marginal new high in mid May retesting the new all time high also made in late March 2024. That has left a large and very nicely formed potential double top on Dow that might deliver a very nice move in the event that NDX and SPX reverse and deliver a frankly overdue retracement.

In terms of what has been driving US markets higher since RUT and INDU both stalled out in mid-May, that has essentially all been Tech, with NDX leading and SPX, which also includes a lot of Tech, being dragged up behind it.

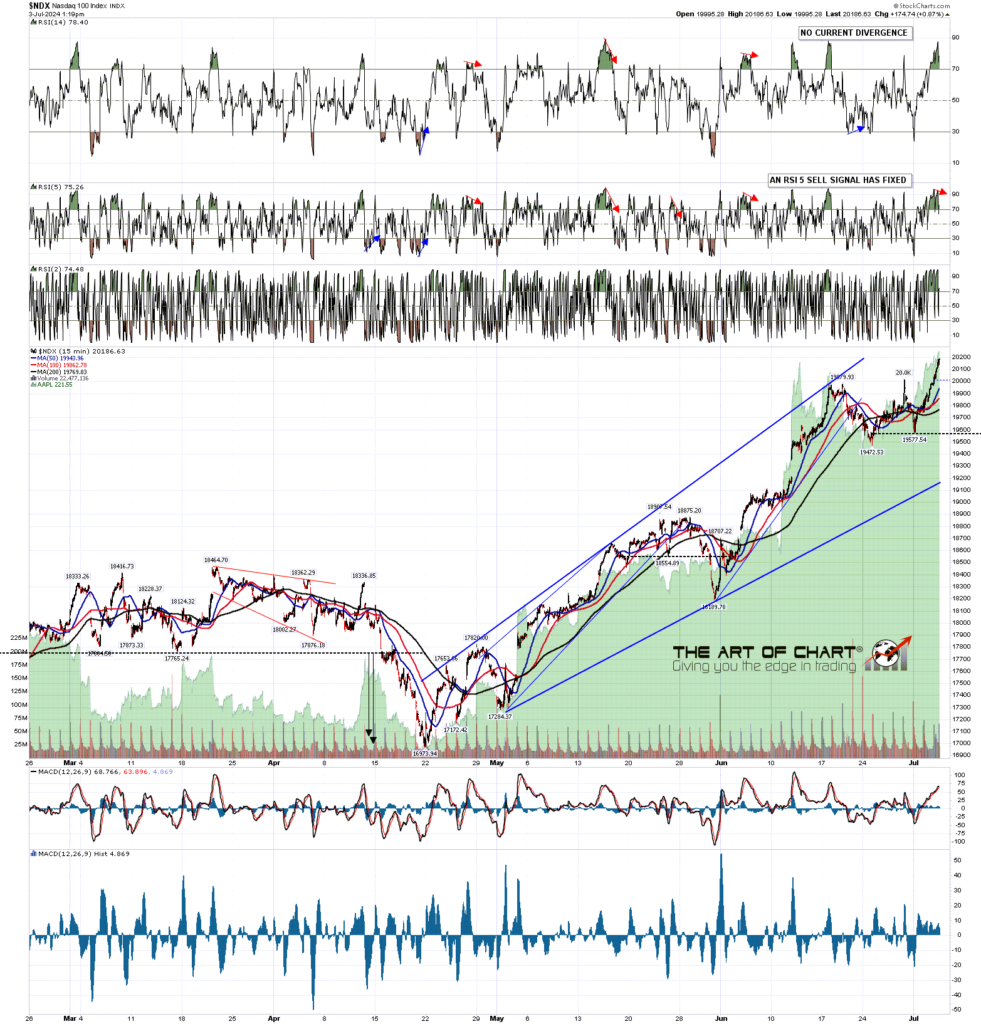

Looking at NDX there is a very nice looking pattern setup here from the Oct 2022 low, with a very high quality rising megaphone resistance trendline that was tested and then retested at the last two new all time highs. If we see a high here, then the next obvious target would be a test of that rising megaphone support, currently in the 16750 area, though obviously that is a moving target currently rising at about 400 handles per month. I would also note that after the last marginal new ATH there is also a possible daily RSI 14 sell signal brewing on NDX, and a small a very high quality possible double top to go with that.

NDX daily BBs chart:

The last short term low was in April, and within the main rising megaphone on NDX from October 2022 is a smaller rising megaphone from April this year that has also tested resistance and has then formed a high quality nice double top. With the new all time high on NQ this morning, there are now possible daily RSI 14 sell signals brewing on both NDX and NQ.

NDX 15min chart:

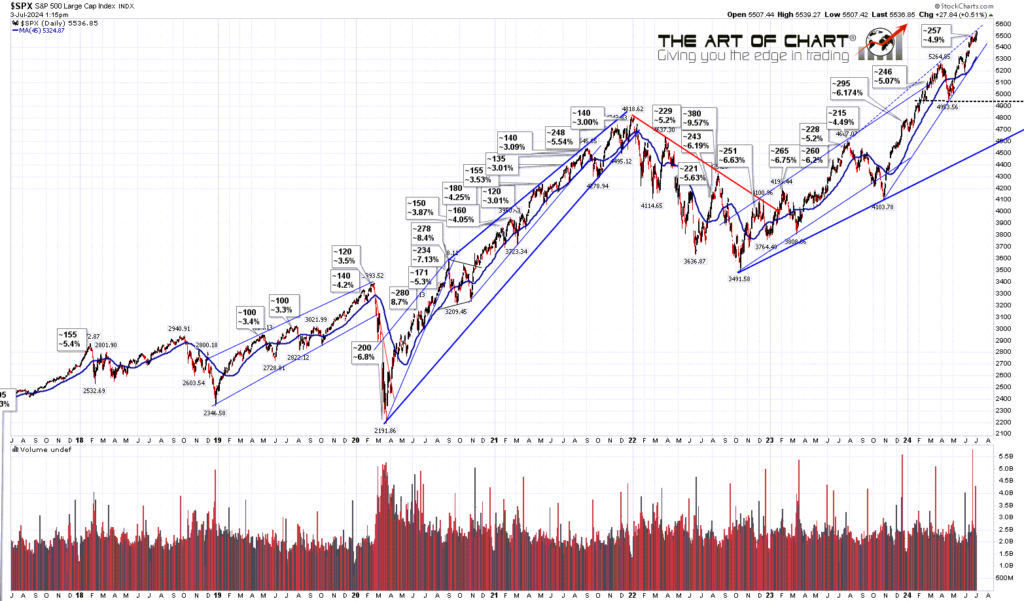

The pattern setup is also nice on SPX, though not quite as nice as NDX, which has very much been the leader since the Oct 2022 low, and even more so since the Oct 2023 low. One thing I watch on SPX is the distance from the 45dma, as I tend to be looking for a possible short term high to form in the 4% to 5% range over the 45dma. That was hit a few weeks ago, along with the largest daily volume spike on the chart below dating back to summer 2017. That’s far from a sure sign of reversal, but is often seen close to a significant high or low.

SPX daily 45dma chart:

On the daily SPX chart there is a very high quality rising wedge from the low in Oct 2023. Nothing solid from the low in Oct 2022, though there is a possible rising channel resistance trendline that has been hit and might hold.

in terms of the rising wedge from Oct 2023 though that is now being tested for the fifth time, so it is a high quality trendline and while this is an inflection point, and we could very much see a break up, this an increasingly nice looking setup for a high here. Daily sell signals have already fixed on the SPX daily RSI 14 and RSI 5, and with the new all time high on ES today, there is also now a possible daily RSI 14 sell signal brewing on ES. If wedge resistance holds, then the next obvious target is wedge support, currently in the 5310 area.

SPX daily BBs chart:

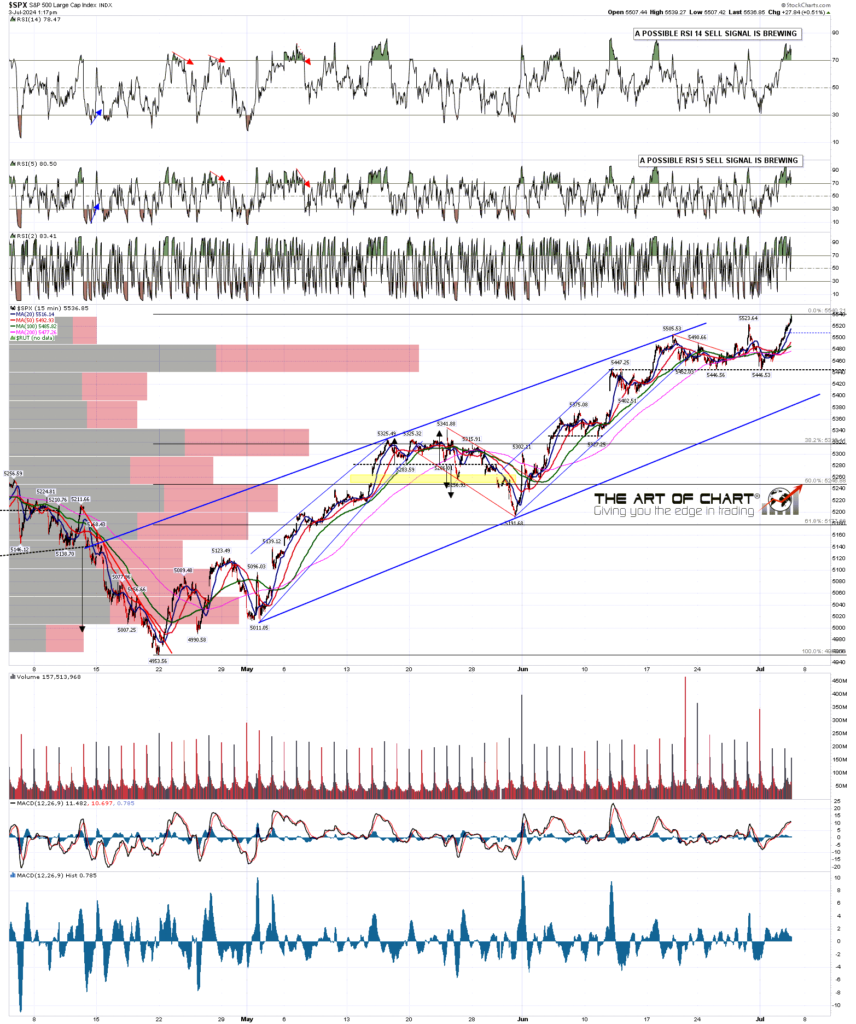

On the SPX chart there is a decent quality rising wedge formed from the April low, and, if these highs can hold through another trading day of holiday tape this week, there is again a nice looking short term double top formed. If we see that play out next week, then that could get the downside ball rolling, and deliver a break below this shorter term rising support currently in the 5385 area.

SPX 15min chart:

I’m planning to start posting three or four times a week again, but with a difference as I’m planning to start covering a much wider range of instruments. Expect posts on bonds, precious metals, energy, currencies and on occasion, the minor commodities. One of the main additions though will be crypto, which I’ve been covering in detail on my premarket videos for a while now, and is surprisingly classical chart friendly. With the launch of crypto ETF coming in the next few months, cryptos are moving into the trading mainstream.

If you are enjoying my analysis and would like to see it every day (including a daily premarket video) at theartofchart.net, you can register for a 30 day free trial here. It is included in the Daily Video Service, which in turn is included in the Triple Play Service.

03rd Jul 2024

03rd Jul 2024