We did our monthly free public Chart Chat at theartofchart.net looking at equity indices and the usual wide range of other markets yesterday and if you missed that you can see the recording here or on our March Free Webinars page.

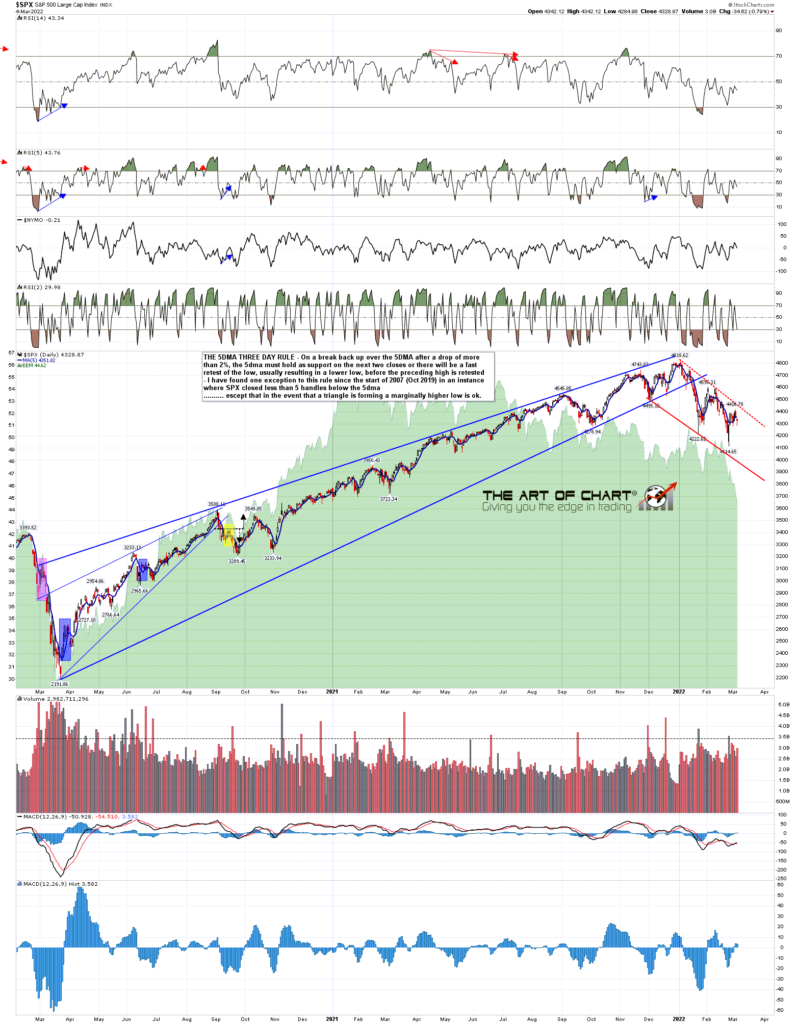

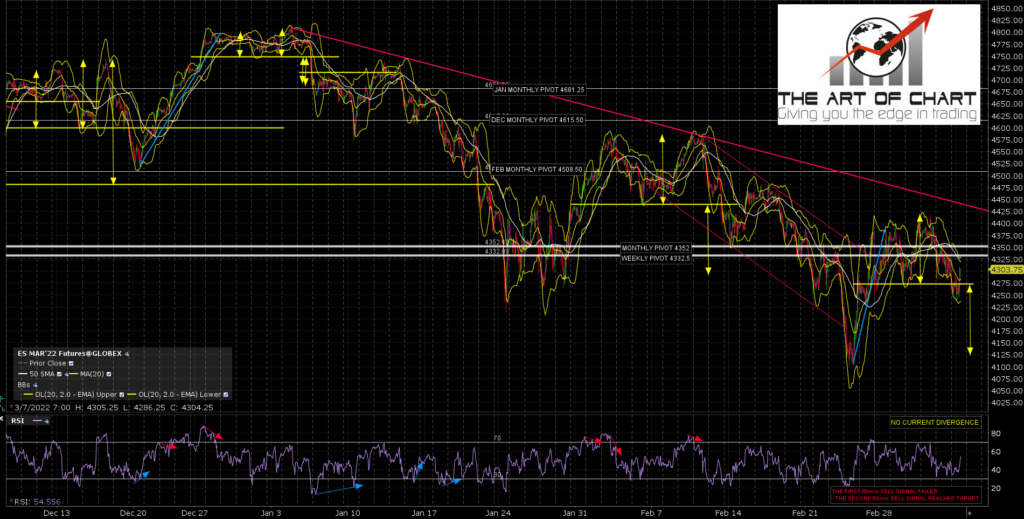

Awaiting SPX Low Retest

Written by:

Richard Chappell

Jack is a 20 year retail trading veteran and co-founder of The Art Of Chart. He started his blog at channelsandpatterns.net in 2010 and since has published tens of thousands of charts looking at hundreds of trading instruments across most tradeable markets, doing original work mainly in the areas of trendlines, patterns and divergences. At The Art Of Chart Jack has taught trading skills, technical analysis, and the discipline and trader psychology that allow those to be used effectively in trading.

07th Mar 2022

07th Mar 2022