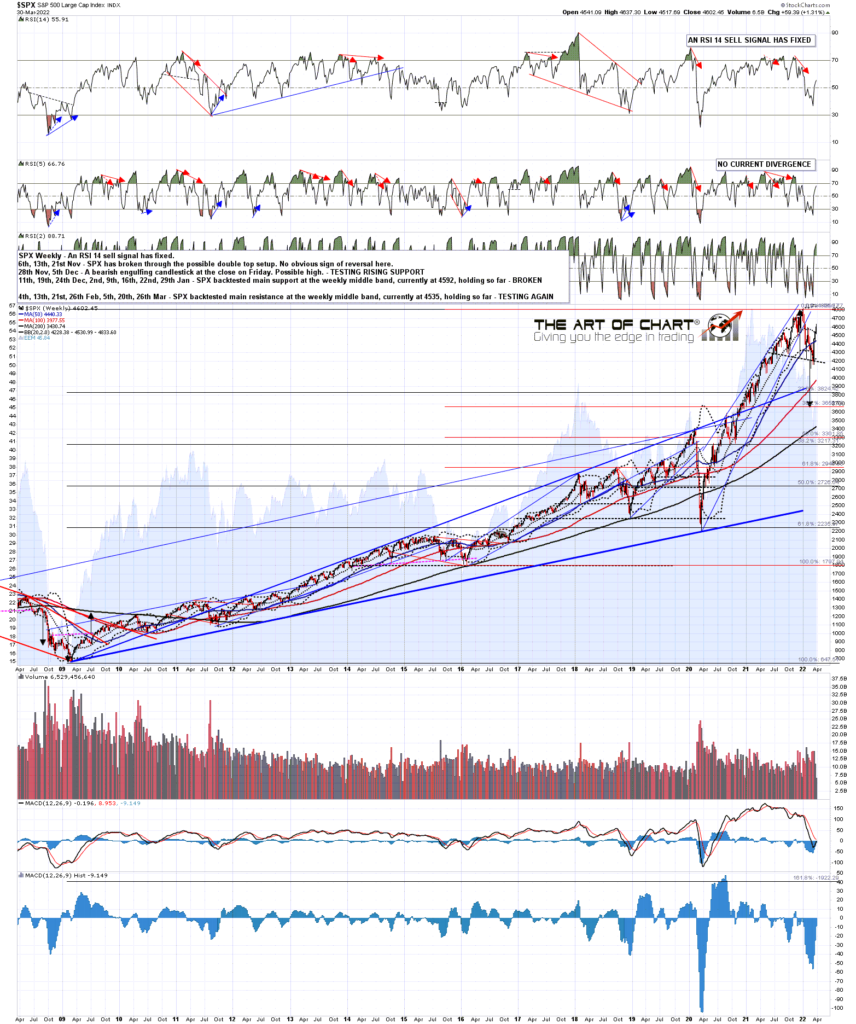

I was looking at resistance at the weekly middle band in my post on Tuesday, and SPX has broken up through that convincingly, though SPX still needs to close the week significantly above the weekly middle band, currently at 4531 to fix that resistance break. If seen SPX will then need to close next week above the break to confirm it.

I was also saying that a break on SPX over the H&S right shoulder high at 4595.31 would fail the H&S and fix a target at a retest of the all time high at 4818.62, and that has now definitely broken, so that is a very significant bullish break.

SPX weekly chart:

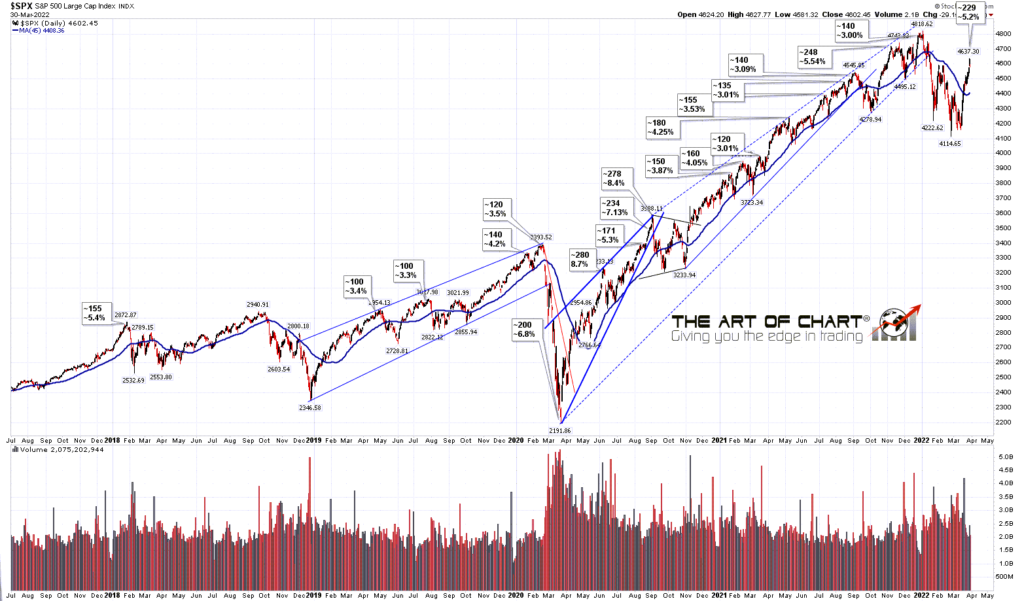

The negative divergence on the daily RSI 5 was lost on this latest move up, but what really draws my eye is the 5.2% above the 45dma that SPX reached at the high on Tuesday. Apart from the recovery from the 2020 crash low this is the third highest reading against the 45dma achieved since the start of 2018, with the two higher readings at 5.4% in January 2018 and 5.54% in November 2021. SPX is overdue for a backtest of the 45dma, currently at 4408. The other key target would be the SPX daily middle band, currently at 4388 and rising faster than the 45dma, so they are becoming in effect a single backtest target over the next three or four trading days.

I’m expecting to see this backtest next, and what happens at the backtest is likely very important for direction. On a break and conversion of those levels, in effect likely to be in the 4400-20 range, then SPX can still retest the lows before retesting the all time high. If that support holds and SPX returns to the current level and higher, then there are decent odds that the next target will be the retest of the all time high on SPX.

SPX daily vs 45dma chart:

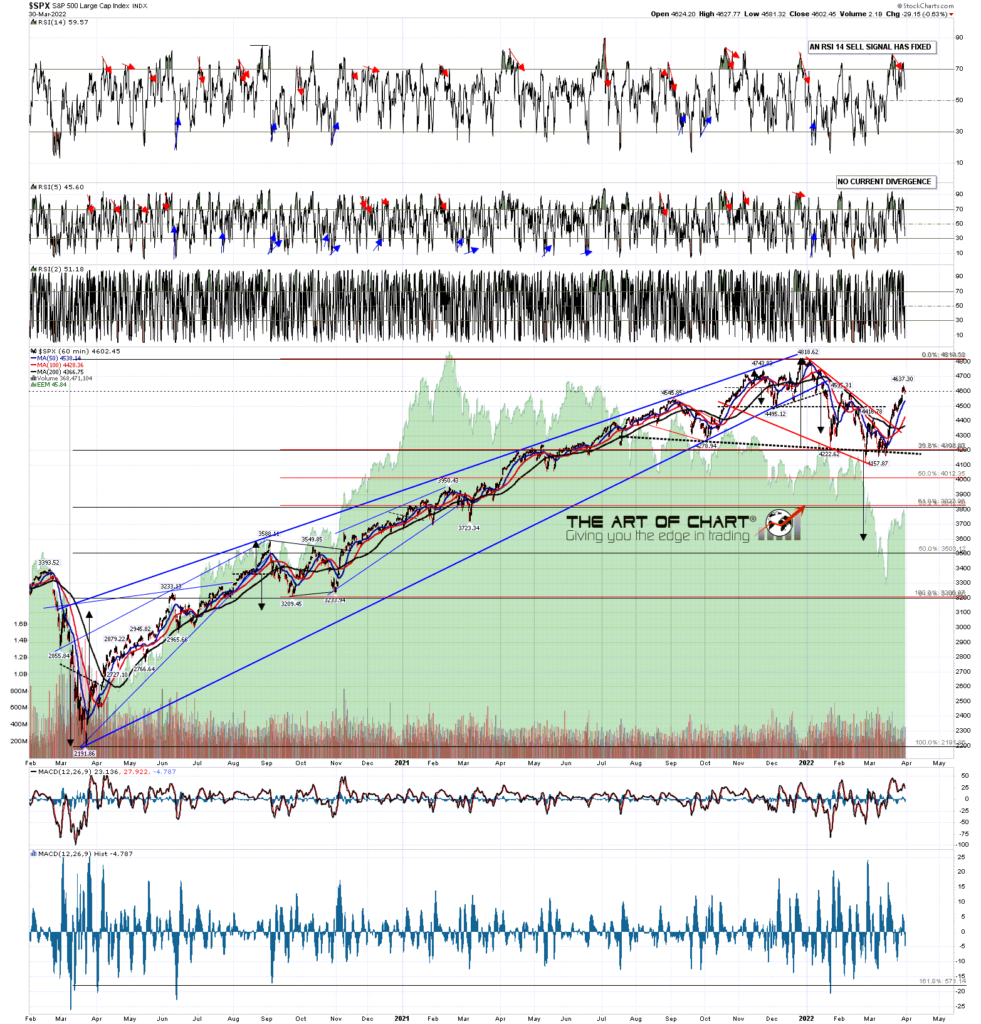

On the SPX hourly chart the RSI 14 sell signal survived this latest move up, and I’m expecting that to deliver over the next few days.

I would note that the retracement this year formed a falling wedge that is an obvious bull flag pattern, and that has also broken up with a target at the retest of the all time high, so we now have two setups targeting that retest, though we still have the Three Day Rule looking for a low retest first. It is still possible that SPX could do both while forming a larger bull flag, though if that is the case then the trendlines for that larger flag are not yet obvious.

SPX 60min chart:

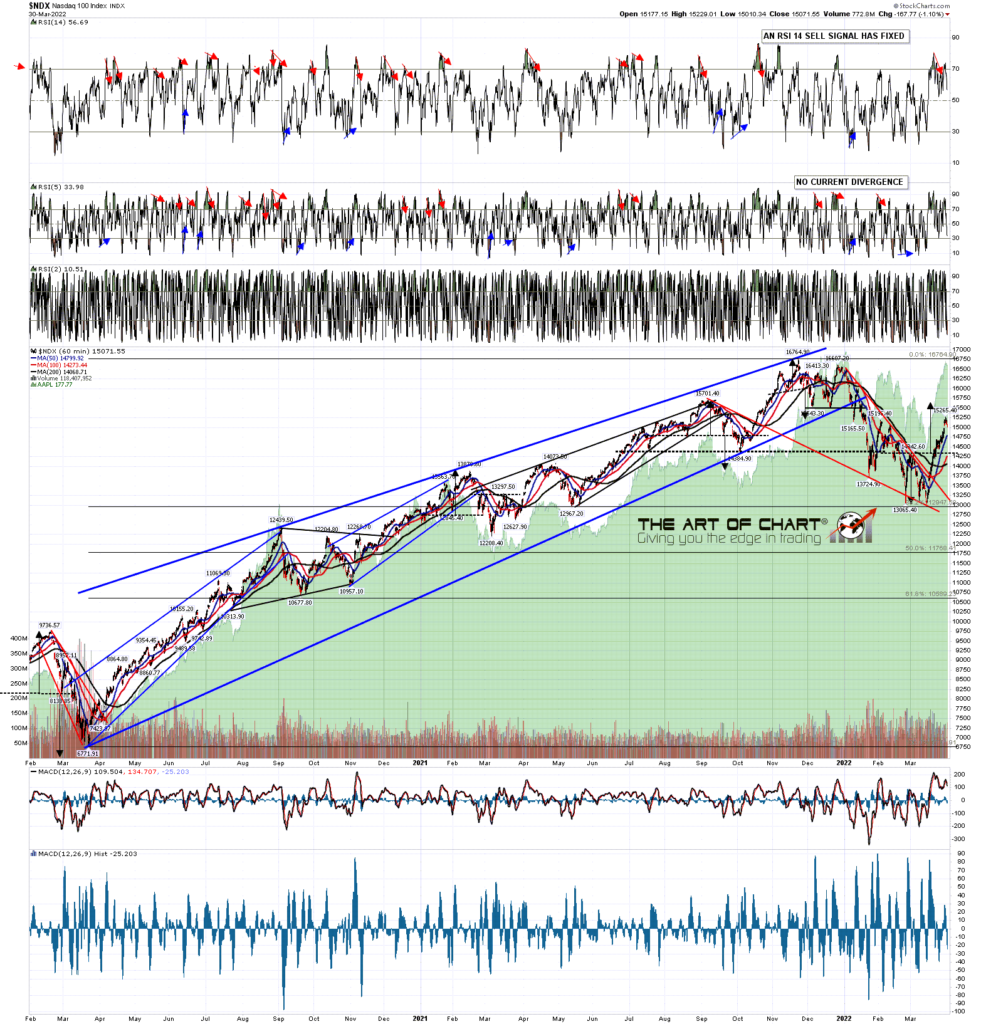

On NDX the hourly RSI 14 sell signal also survived and I’d add that NDX is close enough to a possible IHS neckline that a pullback here may for the right shoulder on an IHS that on a subsequent break up would look for a retest of the all time high on NDX.

We’ll see how this develops over the next few days, but without doubt the overall setup now looks a lot more bullish than it did on Tuesday morning. What happens next will be key.

NDX 60min chart:

Unusually we are doing two free webinars at theartofchart.net tonight, as they were delayed by my COVID this month. They are starting an hour after the close today. The first is starting an hour after the RTH close at 5.00pm EDT and is on the ‘FAANG Stocks & Key Sectors’. If you’d like to attend you can register for that here. The second is starting half an hour later at 5.30pm EDT and is looking at ‘Trading Commodities – Setups and Approaches’, where we’ll be looking at opportunities in commodities and designing three options trades to trade them. If you’d like to attend you can register for that here. As always you can alternatively register for those on our monthly free webinars page.

31st Mar 2022

31st Mar 2022