I was looking yesterday morning at the daily upper band ride on SPX which had been going for six days. That’s not that long for one of these, the last three lasted six, seven and eleven days. Eleven days would be getting long in the tooth for one of these and I think I can only recall one offhand lasting as many as fifteen days, but this this one could potentially run another week. The close yesterday was on the upper band at 4929, and if we see this run again through today, then the upper band will likely rise about fifteen handles into the 4944/5 area.

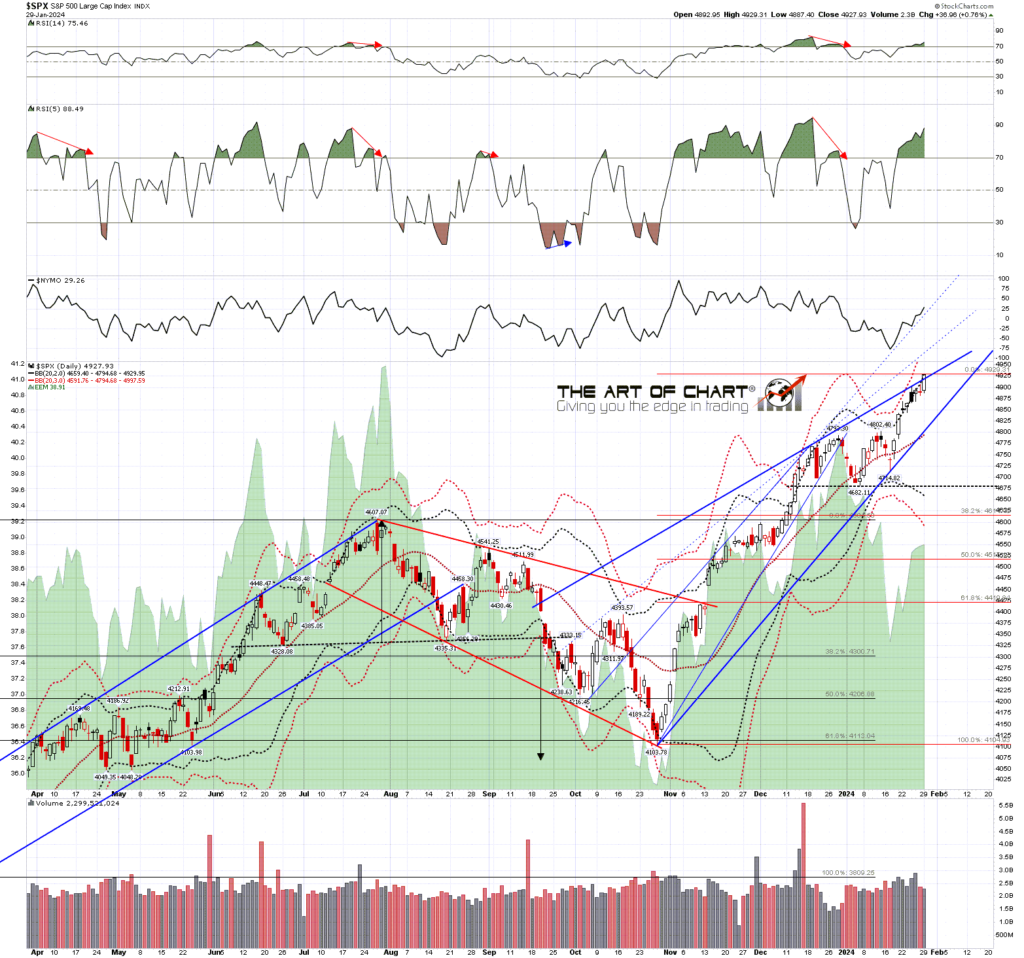

SPX daily BBs chart:

On the hourly chart there is a possible RSI 14 sell signal brewing now and the high yesterday broke up slightly through the obvious rising wedge resistance trendline. If that trendline holds then that break above was a bearish overthrow, and then next move would be to reverse towards wedge support, currently in the 4815 area, and then to break down from it into a retracement of the move up from the October low at 4103.78 which would ideally deliver a 50% retracement of the move back into the 4500s, where I’d be watching the backtest of the July high at 4607 or the support/resistance level in the 4540-50 area.

This pattern scenario could take another day of the daily upper band ride, but any more than that and I would be looking at the two high quality alternative trendlines that I have marked in above in dotted trendline, and the first (wedge) of those is currently in the 4965-70 area, and the second (channel) is currently in the 5050-50 area.

SPX wouldn’t have to respect either of those higher trendlines of course, but those are the three high quality resistance trendline options, and the odds are that one of the three is the right one.

SPX hourly chart:

I don’t often mention past calls that did well, as it seems like boasting, but I understand that’s called marketing nowadays, and some of those are pretty cool, so here is one today.

As the COVID crash was playing out I posted the NIKKEI chart below on 15th March 2020 talking about the possibility that the next big move would be to the IHS target in the 35000 area……..

NIKKEI monthly chart (15th March 2020):

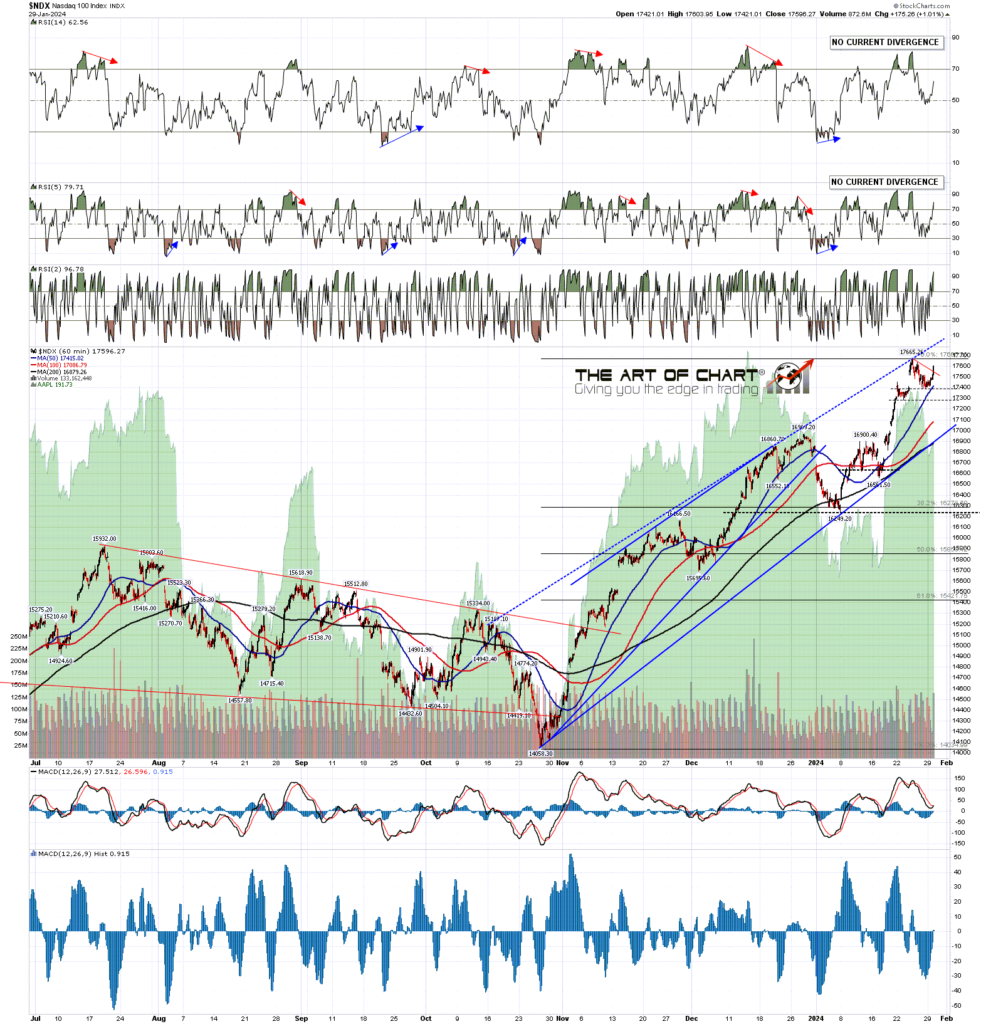

I’m keeping an open mind on direction here, and this really has been a strong trending move up, and it has been the kind of move that can just run over divergences, sell signals, trendlines and so on. These moves are hard to call and will find a high. There is decent trendline resistance and negative divergence here though, and it could end here. If so, the daily upper band ride would likely end today or tomorrow.

I’ve stopped using a custom domain for my blogger posts so the address for those has reverted back to https://channelsandpatterns.blogspot.com/

If you are enjoying my analysis and would like to see it every day (including a daily premarket video) at theartofchart.net, which I co-founded in 2015, you can register for a 30 day free trial here. It is included in the Daily Video Service, which in turn is included in the Triple Play Service.

30th Jan 2024

30th Jan 2024