I haven’t written a post since 1st September as I’ve been immersed in divorce paperwork again. That should all be finished within a few days, and that should be the last serious work that needs to be done in my quest to be single again, which will be a relief. This should therefore be the last long gap in my posts.

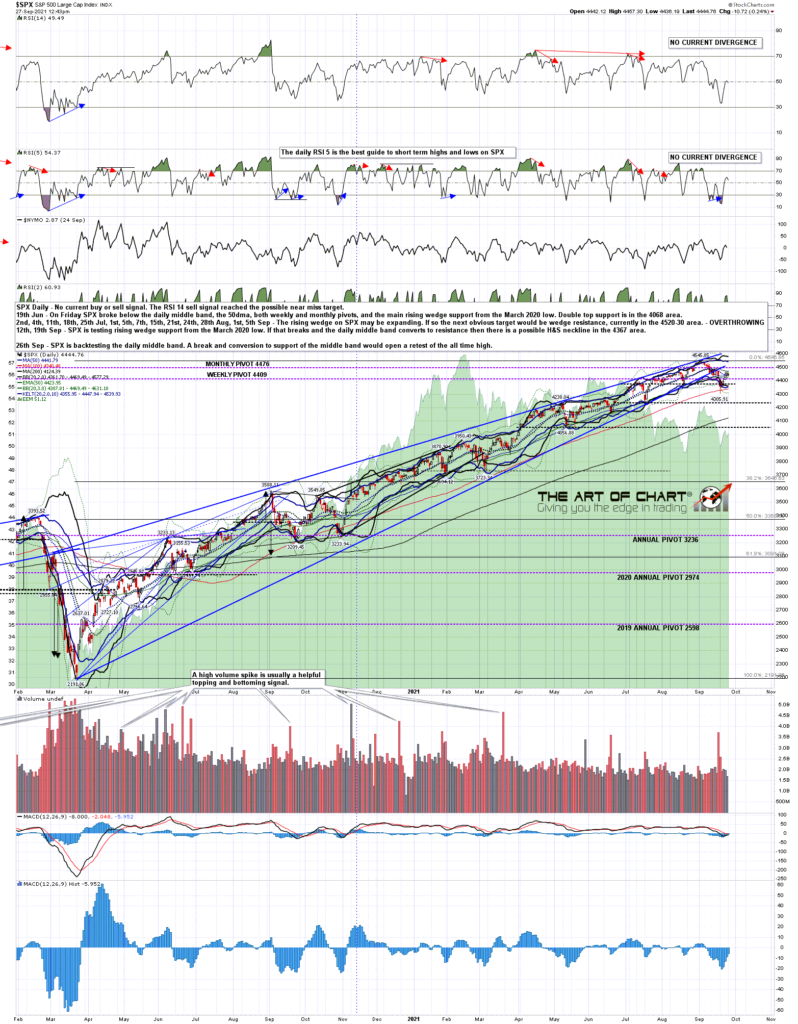

In my last post I was talking about the likely retracement to the mean move that I was expecting to see soon, and we have seen that move. The level I am using for that, the 45dma, is currently at 4462 and SPX is backtesting that from below at the moment, having delivered one of the only four retracements in the last eighteen months to deliver a retracement significantly below that.

Is there more coming and could this be the first really significant retracement since the March 2020 low? Maybe, but bears will need to jump through a few more hoops to really open the downside. There is a decent possibility here though that what we have seen in the last three weeks may be the start of a larger retracement that could deliver a move back to the 3800 area that I was looking at in my post on Friday 6th August.

In the short term SPX has rallied back to test the daily middle band as resistance and there is a decision to make there. A break and conversion to support of the daily middle band, currently at 4469, opens a retest of the all time high. A break and conversion of 4400 to resistance opens a possible next leg down into the next big support level at the July low and possible H&S neckline in the 4233 area.

SPX daily chart:

It has been a while since I’ve mentioned the SPX 5DMA Three Day Rule, and that is because retracements in the last eighteen months have been infrequent and muted, but SPX broke back over the 5DMA on Thursday and today is the third and last day on the rule. A clear close back below the 5DMA (currently 4421) by the close today signals a very high probability that the current retracement low at 4305.91 would then be retested soon afterwards.

SPX daily 5DMA chart:

I would say though that one reason that this retracement looks so promising to deliver the first decent retracement since March 2020 is that NDX has, after a slow start, been leading the way down. On the hourly chart below you can see that NDX may be making a right shoulder on a large H&S pattern. A break down below the neckline could therefore trigger a much larger retracement than we have seen so far.

I would note though that the retracement low was a high quality test of rising support on NDX from the March 2020 low. If that support holds then the obvious next target on NDX would be that rising wedge resistance, currently in the 15,950 area.

NDX 60min chart:

Looking at the structure of the rally on NDX from the current retracement low, there is a second, smaller possible H&S forming that may also currently be forming a right shoulder. A sustained break below the H&S neckline in the 15215 area would look for a retest of the current retracement low, which would in turn complete the larger H&S pattern and test the neckline on it.

NDX 5min chart:

As I was saying in my last post, the ideal time period for that larger retracement is into the end of October . That is only five weeks ago now, so if equity indices are heading lower, I would expect that to start soon.

An hour after the close on Thursday we are holding our monthly free public webinar on on the big five and key sectors at theartofchart.net and will looking at the usual six big tech stocks and eleven sector ETFs, many of which are looking particularly interesting here. If you’d like to attend you can register for that here, or on our September Free Webinars page.

27th Sep 2021

27th Sep 2021