On 5th July last year I was updating my SPX monthly chart and added a scenario for a retracement that I thought might take place in the next few months, and talked about that in webinars at theartofchart.net. On 6th August I then wrote a post about that scenario looking for a backtest of a trendline on the monthly chart that was in the 3800 area at the time. That trendline is now in the 3930-50 area, and that is my main target for the retracement we have been seeing so far this year.

I’ll be writing more about this scenario, and the potentially very bullish next move that this retracement may be setting up, in another post later this week, but I’m going to focus on the short term setup this morning. On the monthly chart below though, X marks the spot where I would like this retracement to reach, and end.

SPX monthly chart:

In terms of short term targets, I had two open targets below yesterday morning, and they we both reached in the morning so I have no open targets below.

The first target was the Three Day Rule target at the retest of the 2022 low on SPX, and we saw a new low made for 2022 this morning. The 5dma is currently at 4186/7 and, now the target is cleared, that is now important resistance on a daily close basis.

The second target was the double top target on Dow, and that was also reached and is shown on the last chart on this post.

SPX daily 5dma chart:

After the strong rejection at the test of the weekly and daily middle bands on SPX a few days ago, SPX has been on a daily lower band ride for seven trading days. The lower band is now at 4112 and declining fast, so if SPX is to remain on the lower band ride, that will need a test again today. If we don’t see that SPX may be starting a bottoming process for another backtest of the daily middle band, now in the 4372 area.

SPX daily BBs chart:

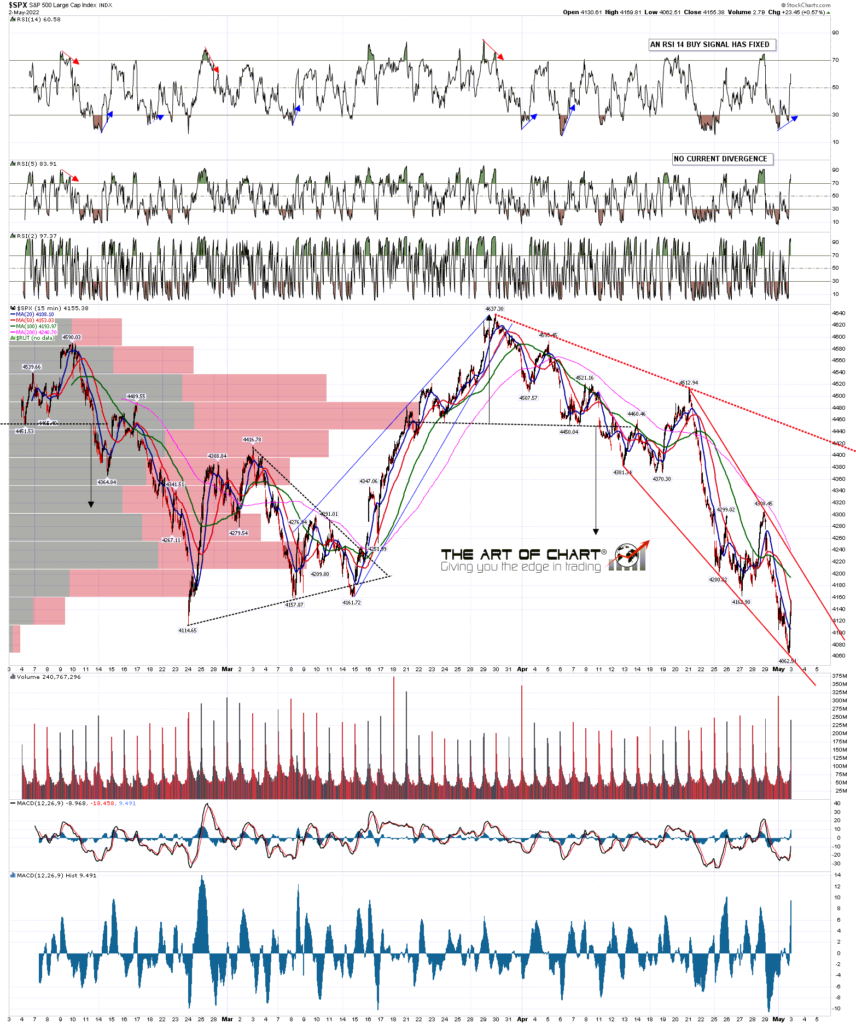

Looking across the indices after the close yesterday there are two decent quality decline patterns from the last test of the daily middle band on SPX. The pattern on SPX is a decent quality falling wedge, with wedge resistance now in the 4230 area, and with the rally supported by an RSI 14 buy signal on the 15min chart, and a 60min buy signal on ES.

SPX 15min chart:

Both of these rally setups look good, and the odds of seeing the indices rally today look decent. That might be short lived though and I’d note that the historical stats for tomorrow are 67% bearish on SPX.

There are two webinars at theartofchart.net this week. The first is Trading Commodities – Setup and Approaches an hour after the close on Thursday. We’ll be looking at the usual three prospective instruments and will be designing and outlining three options trades for those. If you’d like to attend you can register for that here.

The second webinar is our usual monthly free public Chart Chat which will be at 4pm on Sunday 8th May. I’ll be looking in more details at my SPX retracement scenario from the top of this post, and we’ll be covering the usual wide range of instruments and markets. If you’d like to attend you can register for that here.

As always you can also register for either or both of these on our current free monthly webinars page.

03rd May 2022

03rd May 2022