In my posts over recent weeks I have been following on from my post of 6th August 2021 when I was looking at the possibility that there would be a retracement this year to backtest a major broken resistance trendline on SPX, and the possible very bullish setup that a good retest would partially confirm.

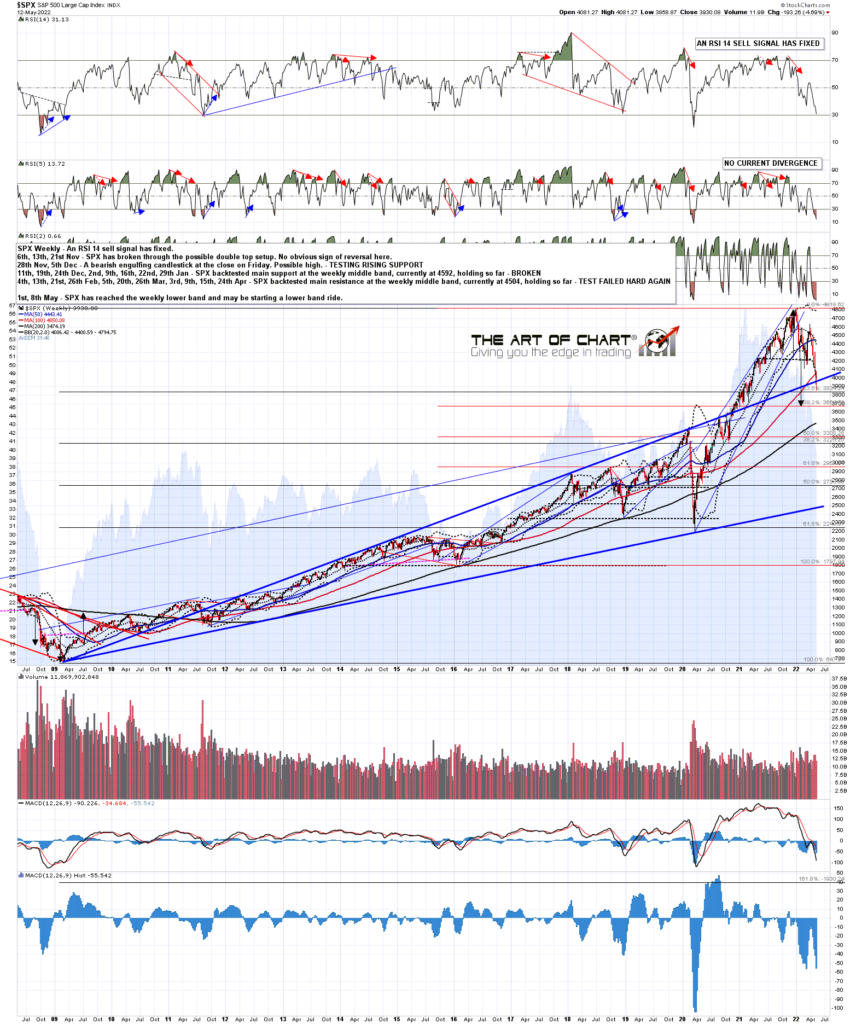

The trendline is the main resistance trendline on SPX on SPX from the low in 2009, shown on the chart below, and it was and is a really good trendline. The start was at the 2009 low, with touches at the lows in 2010, and highs in 2011, 2012, 2013, 2014, 2017, 2018 and 2020. It was so strong that I was expecting it to hold indefinitely until it broke in the wild move up after the 2020 low. This is the trendline I was looking to be backtested, and SPX delivered a visual hit of that trendline at the low early this week, and has broken below it slightly on Wednesday and Thursday, as you can see on the weekly chart below.

So where does that leave my very bullish scenario? At minimum significantly weakened and, if there is a weekly close below the trendline, broken entirely. You can’t derive a statistical universe from a single trendline of course, but on the two occasions when this trendline broke on a weekly close basis, SPX followed through on the break with force.

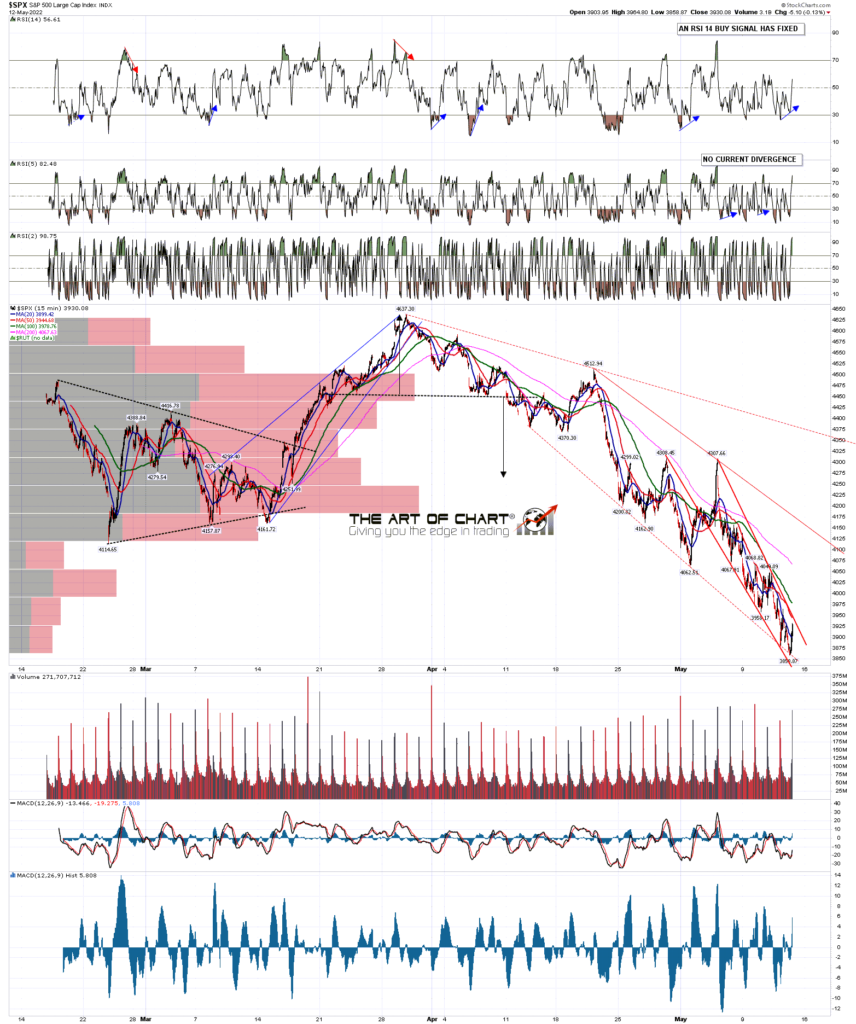

We’ll see how it goes today. Fridays tend to lean bullish and there is an hourly RSI 5 buy signal on SPX. SPX is also badly in need of a rally after the steep declines over the last few days.

SPX weekly chart:

NDX has now reached the 50% retracement level of the move up from the 2020 low, and is showing a decent bull flag. I’m not seeing as much bullish divergence on NDX stocks as I would like to see here, but this is a possible support area and is the likely inflection point area where NDX can either find support and reject back up into the high on the bull flag scenario, or continue down into the H&S target in the 9200 area, still a long way below.

NDX daily chart:

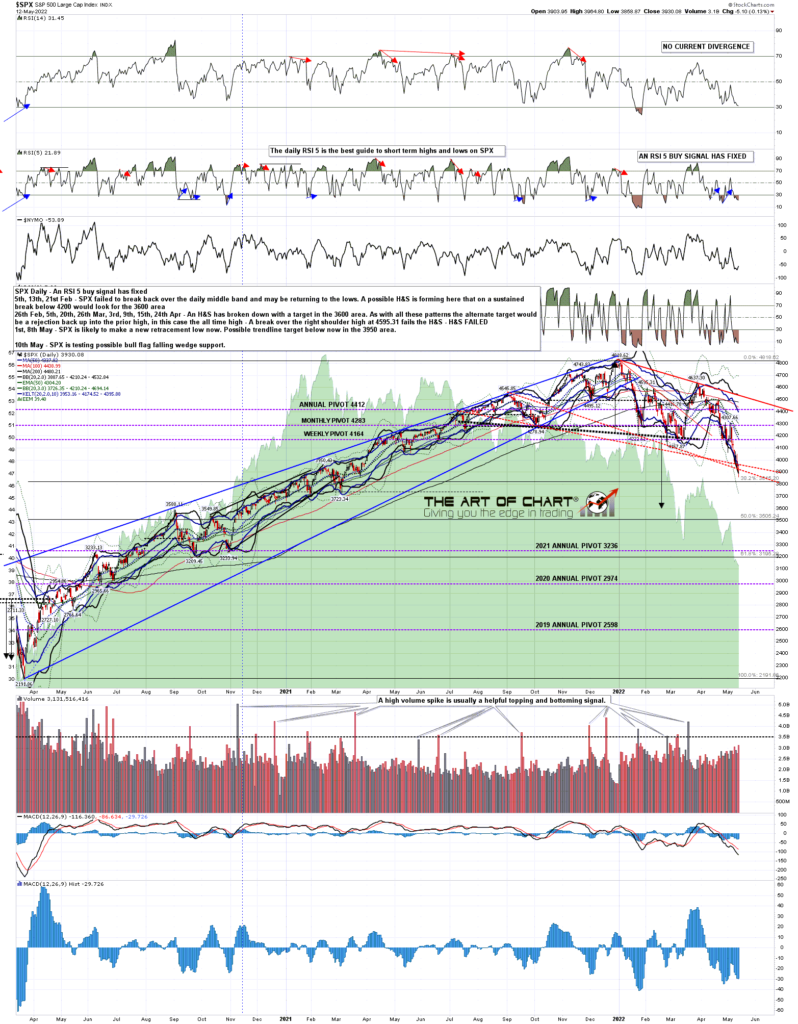

In the short term SPX has been on a daily lower band ride all week, and if that is to continue today then SPX would likely need at minimum to retest yesterday’s low at 3858.87. A break up from the band ride would set up a possible rally into a test of the daily middle band, now in the 4200 area.

SPX daily BBs chart:

If SPX closes below the main support trendline in the 3950 area today, the case for an all time high retest on SPX this year will be badly damaged. I will be watching the close today with great interest.

I haven’t recently mentioned our free to follow service ‘The Weekly Call’ at theartofchart.net. It is now up 714% since the start in October 2016 and Stan does a post every week on it at our blog. If you wanted to follow the trades you can do that automatically in a trading account at striker.com where it is in the top 10 of the trading strategies used there. I think this may be the best trading service given out for free on the internet, and if you try it and disagree, you can have a full no-quibble refund of that free subscription. Everyone have a great weekend 🙂

13th May 2022

13th May 2022