In my posts last week I was talking about my post of 6th August 2021 when I was looking at the possibility that there would be a retracement this year to backtest a major broken resistance trendline on SPX, and the possible very bullish setup that a good retest would partially confirm, and I looked at that in more detail in my last post.

The trendline is the main resistance trendline on SPX on SPX from the low in 2009, shown on the chart below, and it was and is a really good trendline. The start was at the 2009 low, with touches at the lows in 2010, and highs in 2011, 2012, 2013, 2014, 2017, 2018 and 2020. It was so strong that I was expecting it to hold indefinitely until it broke in the wild move up after the 2020 low. This is the trendline I was looking to be backtested, and SPX delivered a visual hit of that trendline at the low yesterday, as you can see on the monthly chart below.

SPX could still go a little lower on my possible very bullish scenario from here, but not much. Anything under 3930 would likely weaken that bull scenario, and a break below 3900 would likely kill it, though it wouldn’t weaken the case that a bull flag has been forming so far this year that should naturally resolve into a retest of the all time high.

SPX monthly chart:

In my last post I was looking at the pattern setup here but I want to take a few minutes today to look at the trendline that is currently being backtested, which in my view must be a strong contender for the most remarkable trendline ever formed on SPX. Regardless of that I think this is likely the strongest trendline that I have ever drawn or seen on any trading instrument on any timeframe, and I have drawn tens of thousands of trendlines on hundreds of indices, bonds, commodities, currencies and stocks over the years. So what makes this particular trendline so special?

Well you see a lot of trendlines posted, and most of them aren’t drawn that well in my view. If you are looking for a rough channel or just assessing wave structures then drawing rough trendlines can be ok, but when it comes to patterns I have always taken the firm view that the trendlines need to start at logical locations for the start of a move, and to be precise to avoid an an unacceptable risk that the chartist will draw what he/she wants to see, at the risk of missing what is actually there. I draw all my trendlines to be as precise as possible.

On that basis a three touch trendline is confirmed, a four touch trendline is strong, and a five touch trendline is a rarity. This trendline however starts at the 2009 low, was tested three times as rising wedge support for the first wave up from that low, broke down in 2011 and became the main resistance trendline from there through to late 2020, being tested nine times as resistance in that time, with a small intra-week spike through the trendline on the eighth test and a break up on the tenth. This current test is the first test since then, and will be the fourteenth test since the 2009 low, with two of those tests breaking through and converting the trendline first from support to resistance, and then from resistance to support (if it holds here on this test).

If this backtest is precise, then the bullish scenario I laid out last week is firmly on the table, with the next big inflection point after the retest of the all time high, at which point either the old all time high is converted to support, and the bullish scenario into 6560 becomes my main scenario, or the move up fails, in which case we may well be looking at a double top setup on SPX that on a subsequent break of this low would be looking for a target in the 3100 area.

Either way it should be fun to chart and trade on the way.

SPX weekly chart:

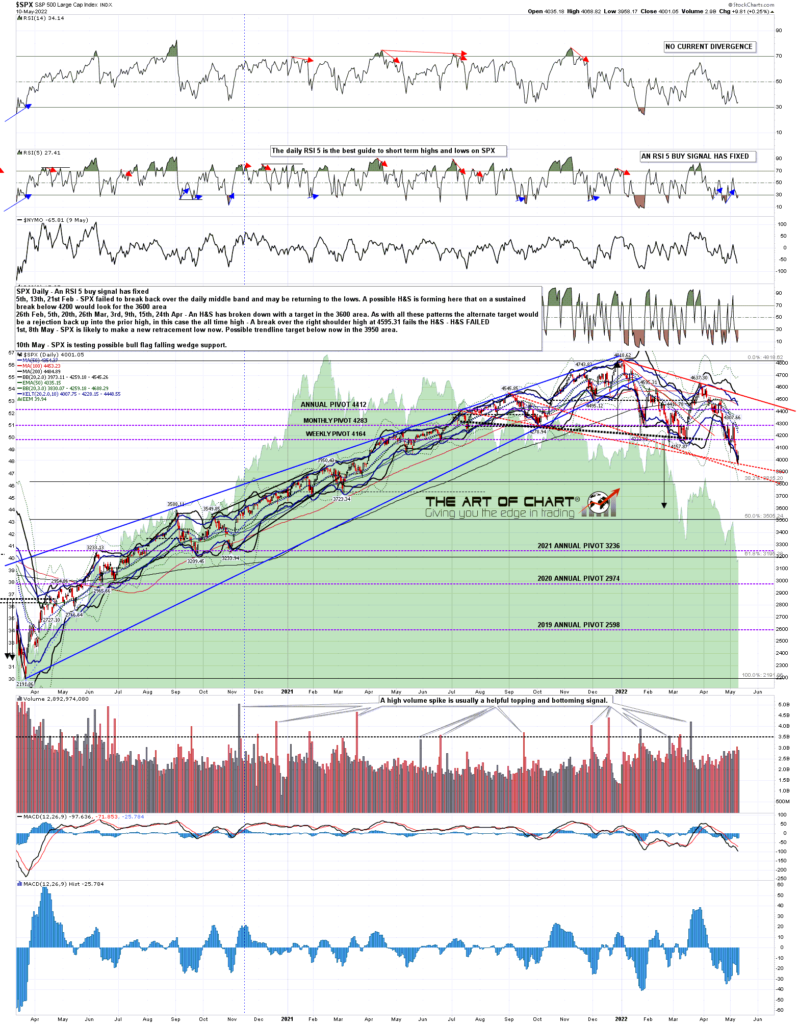

On the daily chart I have drawn in a very decent possible bull flag falling wedge support trendline that may hold for a start of the move back into the highs. One way or the other this is a likely bull flag setup from the high, so regardless of whether the main SPX trendline holds on this retracement, a retest of the all time highs in due course is likely. Not all bull flags break up of course, but some 70% of highs and lows on SPX involve a double top or bottom, so even if a major high or low is forming here, a retest after a large retracement would be normal.

SPX daily chart:

In terms of the shorter term resistance the obvious first resistance levels are the 5dma, currently at 4112, currently a good match with the hourly 50 MA at 4116. A daily close would put SPX back on the Three Day Rule, so the next two daily closes would then need to hold above that, or SPX would likely need another low retest.

SPX 5dma chart:

SPX is making a possible low here at my target trendline, and if the low is at a precise test of that trendline then the very attractive bull scenario I laid out last week will still be in play. Regardless of that though the overall likely bull flag forming on SPX here favors a retest of the all time high in due course.

We are did our usual monthly free public Chart Chat at theartofchart.net on Sunday 8th May looking the usual wide range of instruments and markets. If you missed that you can see the recording here, or on our current free monthly webinars page.

11th May 2022

11th May 2022